Verfahrensdokumentation für Onlinehändler und ihre Steuerberater

Wer als Steuerberater Onlinehändler betreut, wird seinen Mandanten regelmäßig damit in den Ohren liegen, doch bitte eine Verfahrensdokumentation anzufertigen.

Onlinehändler, die in den letzten Monaten durch das Finanzamt geprüft wurden – z.B. im Rahmen einer Umsatzsteuer-Sonderprüfung oder Betriebsprüfung – werden sehr wahrscheinlich nach ihrer Verfahrensdokumentation gefragt worden sein.

Was verbirgt sich dahinter?

Verfahrensdokumentation: Was ist das?

Eine der wesentlichen Aufgaben einer Verfahrensdokumentation ist es, die Prozesse hinsichtlich aller steuerrelevanten Daten und Datenströme abzubilden – für einen fachkundigen Dritten, also z.B. eine Betriebsprüferin.

Hinweis: Diese Dokumentation ist im Onlinehandel umso wichtiger, da eine Betriebsprüferin hier kaum noch physische Belege und andere greifbare Infrastruktur vorfindet, welche sie prüfen kann.

Eine Verfahrensdokumentation gibt somit einen Überblick, wie beispielsweise in einem Unternehmen Belege bzw. Transaktionen gebucht und im Anschluss dauerhaft archiviert werden. Es muss einer Betriebsprüferin in angemessener Zeit möglich sein, die Geschäftsprozesse des geprüften Unternehmens zu verstehen. Des Weiteren muss gezeigt werden, dass das geprüfte Unternehmen die sogenannten GoBD einhält.

GoBD steht für: Grundsätze zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff.

Die GoBD fordern beispielsweise, dass eine einmal erstellte Buchung nicht dauerhaft gelöscht werden kann. Lediglich eine Stornierung darf möglich sein, wodurch die ursprüngliche Buchung noch feststellbar ist, selbst wenn diese fehlerhaft war oder versehentlich angestoßen wurde.

Eine Verfahrensdokumentation verfolgt somit u.a. die folgenden Zwecke:

- Darstellung der Geschäftsprozesse des Unternehmens

- Darstellung der Einhaltung der GoBD durch das Unternehmen

Zu berücksichtigen ist, dass der Inhalt der Verfahrensdokumentation nicht nur niedergeschrieben, sondern auch im Unternehmen gelebt werden muss.

Verfahrensdokumentation: Brauche ich das?

Nach den GoBD sind alle Unternehmen verpflichtet, eine Verfahrensdokumentation bereitzustellen. Eine Ausnahme für kleinere Unternehmen gibt es nicht.

Die GoBD stellen kein unmittelbar geltendes Recht dar, sondern es handelt sich zunächst nur um eine verwaltungsinterne Anweisung. Zu berücksichtigen ist jedoch, dass jede Finanzbeamtin – also auch jede Betriebsprüferin – an die GoBD gebunden ist. Wenn keine Verfahrensdokumentation vorliegt, kann es somit zu langen Auseinandersetzungen mit der Finanzverwaltung kommen.

Praktisch gesehen kommt man somit kaum umhin, eine Verfahrensdokumentation anzufertigen und bereitzustellen.

Hinweis: In dem Gastbeitrag unseres Partners Ecovis könnt ihr euch gerne nochmals vertieft ansehen, welche Chancen und Risiken das Thema Verfahrensdokumentation mit sich bringt.

Verfahrensdokumentation: Wie muss diese aussehen?

Eine Verfahrensdokumentation soll nach den GoBD den folgenden Aufbau vorweisen.

- Allgemeiner Teil: Der allgemeine Teil beschreibt insbesondere die betriebliche Organisation und den betrieblichen Aufbau des Unternehmens

- Anwenderdokumentation: Die Anwenderdokumentation beschreibt, wie die verschiedenen Softwarelösungen von den Nutzern zu verwenden sind

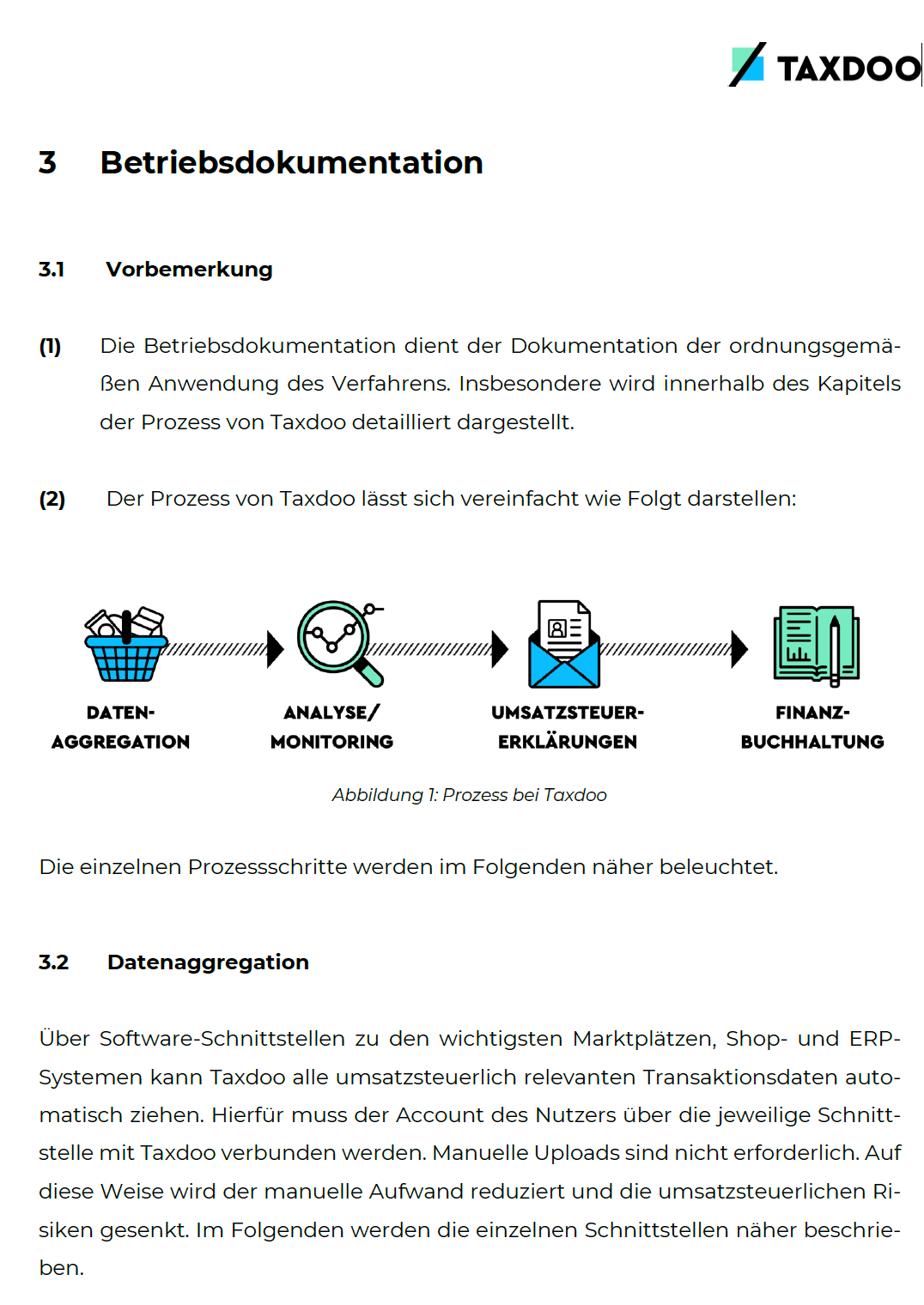

- Betriebsdokumentation: Die Betriebsdokumentation beschreibt, wie die fachlichen Prozesse auszusehen haben. Im Folgenden seht ihr dazu einen kleinen Auszug aus der Taxdoo-Verfahrensdokumentation.

- Technische Beschreibung: Die technische Beschreibung enthält alle erforderlichen Informationen zur technischen Infrastruktur des Unternehmens

Hinweis: Zusammen mit der Betriebsprüferin Andrea Köchling (in nicht-dienstlicher Eigenschaft) haben wir die Webinar-Reihe Finanzverwaltung trifft auf Onlinehandel gestartet, in welcher die GoBD den roten Faden darstellen. Solltet ihr die Auftaktveranstaltung verpasst haben, könnt ihr euch diese in unserem Blogpost dazu nochmal ansehen.

Taxdoo Verfahrensdokumentation

Taxdoo bildet für Unternehmen im Onlinehandel die wesentlichen Umsatzsteuer- und Finanzbuchhaltungsprozesse ab, sodass ein Großteil der Prozesse zur sogenannten Steuerfindung über unsere Plattform laufen.

Im Folgenden seht ihr dazu das aktuelle Feedback eines Steuerberaters mit dem Schwerpunkt Onlinehandel.

… Schön zu sehen, und das wird Sie freuen, waren die vorläufigen Prüfungsfeststellungen. Seit der Übernahme des Mandats basiert die Buchführung auf dem Taxdoo DATEV Export. Der Prüfer hat in dem Jahr des Wechsels zu uns und der damit eingehenden Buchführungsumstellung überschlägige Prüfungen vorgenommen, keine Differenzen festgestellt und das Jahr abgenickt. Für uns war das ein tolles Ergebnis, da der Prüfer schriftlich unsere Arbeit bestätigt hat. Da diese auf ihrem Export basiert, möchte ich das Lob gerne teilen und weitergeben.

In der Taxdoo Verfahrensdokumentation sind daher insbesondere die Besonderheiten des Onlinehandels abgebildet.

Abruf Taxdoo Verfahrensdokumentation

Ihr bzw. eure Steuerberater können die Verfahrensdokumentation im Taxdoo Dashboard unter dem Reiter “Themen” abrufen.

Taxdoo ist die Plattform für automatisierte und sichere Compliance-Prozesse

… und bildet für die führenden Onlinehändler in Europa neben der Abwicklung der laufenden Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

Weitere Beiträge

Finanzamt stoppt App, weil “zu unkompliziert”: Brauchen wir Mindeststandards für TaxTech?

GTK Kröger Steuerberater: Erste Praxiserfahrungen mit Taxdoos neuer Buchungslogik