Gastbeitrag: Verfahrensdokumentation – viel mehr als die Erfüllung einer Verpflichtung durch die Finanzverwaltung

Die nahtlose Dokumentation aller steuerlich relevanten Prozesse – Verfahrensdokumentation – wird in absehbarer Zeit den Ausgang jeder Betriebsprüfung bzw. Umsatzsteuer-Sonderprüfung beeinflussen.

Steuerberater Lars Rinkewitz von unserem Partner ECOVIS KSO liegt bei dieser Aussage mit uns auf einer Wellenlänge und ist darüber hinaus einer der führenden Experten in diesem Segment. Der folgende Beitrag stammt von ihm.

Verfahrensdokumentation – was heißt das eigentlich nochmal genau?

Die Grundsätze zur ordnungsmäßigen Führung und Aufbewahrung von Büchern, Aufzeichnungen und Unterlagen in elektronischer Form sowie zum Datenzugriff – kurz GoBD – sagt, dass eine Verfahrensdokumentation von allen Steuerpflichtigen mit Gewinneinkünften (Einkünfte aus Gewerbebetrieb, aus selbständiger Tätigkeit, aus Land- und Forstwirtschaft) zu erstellen und bei einer Betriebsprüfung vorzulegen ist. Dieses gilt unabhängig von Branche, Unternehmensgröße und -komplexität oder Art der eingesetzten IT-Systeme.

Taxdoo Hinweis: Zusammen mit der Betriebsprüferin Andrea Köchling (in nicht-dienstlicher Eigenschaft) haben wir am 26. Juni die Webinar-Reihe “Finanzverwaltung trifft auf Onlinehandel” gestartet. Solltet ihr die Auftaktveranstaltung verpasst haben, könnt ihr euch diese in unserem Blogpost dazu nochmal ansehen.

Eine nicht ordnungsgemäße oder gar eine nicht vorhandene Verfahrensdokumentation kann im Rahmen einer Betriebsprüfung zu erheblichen Schwierigkeiten mit der Finanzverwaltung führen. Schlimmstenfalls könnten umfangreiche Hinzuschätzungen vorgenommen werden, weil die Betriebsprüferin die Buchhaltung aufgrund von formellen Mängeln verwirft.

Kurz gesagt muss eine Verfahrensdokumentation alle Prozesse und Strukturen des Unternehmens widerspiegeln, die eine mittelbare und unmittelbare Auswirkung auf die Buchführung haben können.

Unbedingt eine revisionssichere Erfassung aller Ausgangsumsätze beachten…

Die vorhandenen Musterdokumentationen, insbesondere von den Verbänden, die im Internet zu finden sind, geben allerdings nicht die volle Bandbreite der erforderlichen Angaben wider. Zumeist beziehen sich diese Muster ausschließlich auf den Belegeingang. Aber viel spannender und interessanter für die Betriebsprüfer sind die Fragen der vollständigen und revisionssicheren Erfassung der Ausgangsumsätze.

… sowie die Beschreibung der Schnittstellen…

Darüber hinaus sind insbesondere im Onlinehandel alle Schnittstellen zu beschreiben. Werden per Schnittstelle Daten z.B. aus einem Warenwirtschaftssystem (WaWi) in das Buchhaltungssystem eingespielt, ist nicht nur der Prozess wichtig – also wie gelangen die Daten von A nach B – sondern auch die Frage: Wie gelangen die Daten einer revisionssicheren WaWi ins revisionssichere Fibu-System?

Werden Daten per csv-Datei ausgetauscht, können jederzeit aufgrund mangelnder Protokollierungsmöglichkeiten Änderungen vorgenommen werden.

Damit ist eine Manipulation der Daten jederzeit möglich. Man kann sich fragen, ob das Vorliegen einer nicht revisionssicheren Schnittstelle dann Auswirkungen auf die Revisionssicherheit des gesamten Fakura- bzw. Warenwirtschaftssystems haben kann. Die Frage nach den Schnittstellen wird in Zukunft unseres Erachtens sehr wichtig werden.

Wenn ihr eure Buchhaltung über einen Steuerberater oder einen sonstigen externen Dienstleister erstellen lasst, gehören auch die Prozesse und Strukturen des Steuerberaters oder Dienstleisters zur Verfahrensdokumentation. Fragt also euren Steuerberater oder Dienstleister, ob eine solche Dokumentation bei ihm vorliegt.

Wir bei ECOVIS KSO haben dazu eine separate Verfahrensdokumentation für unsere Geschäftsprozesse erstellt. In dieser ist dokumentiert, wie wir z.B. die Finanzbuchhaltungen oder die Lohnabrechnungen für unsere Mandanten erstellen und welche Sicherungsmaßnahmen wir zur Risikominimierung für Fehler getroffen haben. Fragt der Betriebsprüfer also danach, was denn so beim Steuerberater passiert, leiten wir unsere Dokumentation an den Prüfer weiter.

Chancen einer aussagefähigen Verfahrensdokumentation

Die positiven Aspekte der Beschäftigung mit den eigenen Prozessen und Strukturen geht über die reine Pflichterfüllung hinaus. Das ist eine aus unseren Erfahrungen gewonnene Erkenntnis.

Du beschäftigst dich als Unternehmer mit deinem Unternehmen. Viele Prozesse und Strukturen sind dir vielleicht gar nicht bekannt, insbesondere, weil vielleicht ein schnelles organisches Wachstum des Unternehmens vonstattengegangen ist und die Organisation nicht richtig Schritt halten konnte. Im Rahmen der Einschaltung eines externen Dritten, z.B. eines geeigneten Steuerberaters, können jahrelang gelebte Prozesse einmal von außen, also ohne Betriebsblindheit, unter die Lupe genommen werden. Da kommen viele Fragen, Risiken und vielleicht auch Ineffizienzen ans Licht.

Das führt dazu, dass

- ihr als Unternehmer ggf. eine Neuausrichtung der Prozesse sowie der Strukturen unter Effizienzgesichtspunkten schafft

- Standards gesetzt werden können

- einheitliche Arbeitsanweisungen zu einer Hilfestellung führen

- sich neue Mitarbeiter schneller zurechtfinden und eingearbeitet werden

- Transparenz erreicht werden kann

- und ganz wichtig: Risiken aufgedeckt und behoben werden können

Zu den Risiken gibt es im Rahmen von jungen Unternehmen sowie im E-Commerce immer zu sagen, dass die Verlagerung von Buchhaltungsdaten ins Ausland, ganz oder teilweise, genehmigungspflichtig ist. Der Begriff Buchhaltungsdaten wird da von der Finanzverwaltung weit gefasst. Werden also Daten, wie zum Beispiel Buchhaltungsdaten wie Belege, Verträge, Rechnungen, Personaldaten, im Ausland in der Cloud verarbeitet und gespeichert, ist dafür in aller Regel vom Finanzamt eine Genehmigung einzuholen. Im Rahmen einer Prozessanalyse tritt dieses Risiko häufig auf und kann durch einen Antrag behoben werden.

Fazit

Die Finanzverwaltungen werden vermehrt Verfahrensdokumentationen anfordern und tun dies bereits jetzt schon. Das ist aufgrund der fortschreitenden Digitalisierung auch absolut verständlich. Wie sollten Betriebsprüfer auch sonst ein Bild über die Abläufe und über das Zustandekommen der Buchhaltungsdaten gewinnen?

Ihr als Unternehmer solltet eine ordnungsgemäße Dokumentation demnach nicht auf die leichte Schulter nehmen.

Bei allem zusätzlichen Aufwand, der naturgemäß neben der operativen Arbeit notwendig wird, wenn man sich denn mit der Dokumentation der Prozesse und Strukturen beschäftigt, sind allerdings auch die Vorteile zu sehen. Nehmt die Chance wahr, euch als Unternehmen noch besser aufzustellen.

Über den Autor

Lars Rinkewitz Steuerberater, Diplom-Kaufmann Beratungsschwerpunkt: Verfahrensdokumentation

ECOVIS KSO Treuhand & Steuerberatung Grafenberger Allee 297, 40237 Düsseldorf Tel.: +49 211 908 67-0 Fax: +49 211 908 67-11 E-Mail: lars.rinkewitz@ecovis.com Internet: www.ecovis.com/duesseldorf-koeln/

Oder besucht einfach den Ecovis NRW-Blog, um euch über Aktuelles aus Steuerberatung, Recht und Wirtschaftsprüfung aus unternehmerischer Perspektive zu informieren.

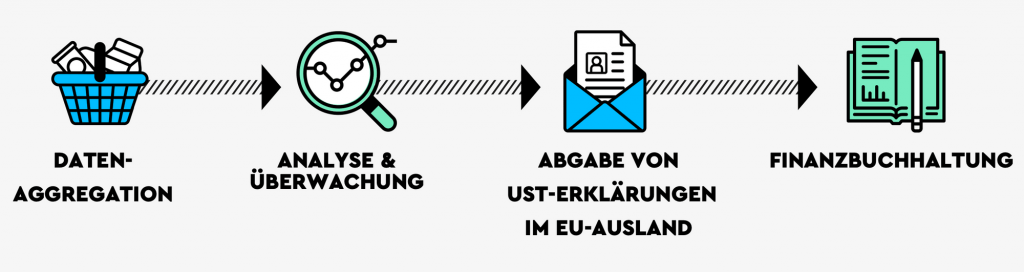

Taxdoo ist die Compliance-Plattform für die digitale Ökonomie

… und bildet für die führenden Onlinehändler in Europa die wichtigsten steuerlichen Prozesse ab. Aus diesem Grund werden wir allen Kunden in Kürze eine Verfahrensdokumention zur Verfügung stellen.

Begleitend werden wir in diesem Jahr das Thema GoBD zu einem Eckpfeiler unser Blogposts, Webinare, Seminare und Fachartikel machen.

Nichts verpassen: Tragt euch in unseren Newsletter ein und/oder besucht regelmäßig unsere Event-Seite, dann bleibt ihr jederzeit zu den Themen Umsatzsteuer, GoBD, FiBu sowie unseren Webinaren auf dem Laufenden.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

P.S.: Taxdoo ist seit Anfang 2020 nun auch offiziell Partner der DATEV im Onlinehandel.

Weitere Beiträge

GTK Kröger Steuerberater: Erste Praxiserfahrungen mit Taxdoos neuer Buchungslogik

Betriebsprüfung und Betriebsprüfer in der digitalen Welt – Teil III