Brexit: Der Deal am Heiligabend – keine Zölle, aber …

Am Heiligabend 2020 konnten die Europäische Union (EU) und Großbritannien (GB) nach zähen Verhandlungen einen harten Brexit abwenden.

Dieser hätte den (Online)Handel und den Austausch auf allen Ebenen zwischen der EU und GB aufgrund von umfassenden Grenzkontrollen, Zöllen, … deutlich komplexer gestaltet und hätte somit zu erheblichen volkswirtschaftlichen Einbußen auf beiden Seiten geführt.

Die aktuelle Pressemitteilung vom heutigen Tag findet ihr hier.

Eine von drei Säulen des Abkommens zwischen der EU und GB, welches noch endgültig durch das britische Parlament am 30.12.2020 verabschiedet werden muss, wird ein Freihandelsabkommen sein.

Freihandelsabkommen

Diese Abkommen beinhaltet u.a. (siehe Pressemitteilung vom 24.12.2020) einen weiterhin freien Warentransfer.

Das bedeutet, dass für viele Güter im Onlinehandel vorerst keine Zölle und keine Quoten greifen werden.

Hinweis: Der Zoll-Teufel steckt aber auch hier im Detail. Es handelt sich bei dem Abkommen nicht um eine generelle Zollfreiheit. Diese wird nur Waren betreffen, welche den sogenannten Ursprungsregeln genügen. Solltet ihr bei euren Produkten nicht sicher sein, kontaktiert auf jeden Fall eine Zollexpertin.

Das bedeutet aber nicht, dass sich nichts grundlegend ändert.

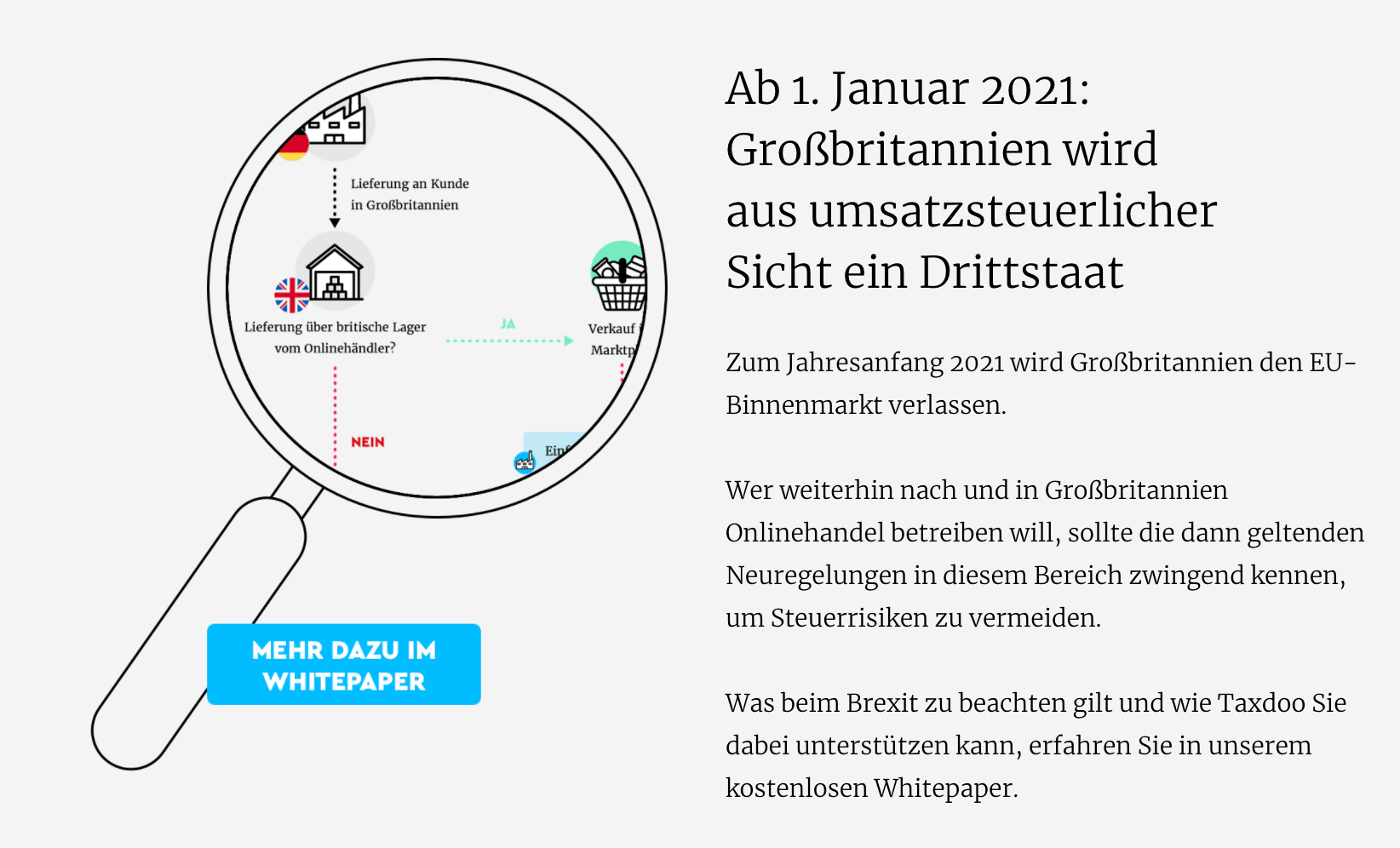

Keine Zölle aber neues Umsatzsteuer-Regime

Ab dem 1.1.2021 wird ein vollständig neues Umsatzsteuer-Regime für Lieferungen nach und in Großbritannien greifen. Das war jedoch schon vor den finalen Verhandlungen am 24.12.2020 klar.

Zusammengefasst bedeutet das, dass für fast jede Lieferung nach und in Großbritannien ab 2021 britische Umsatzsteuer anfallen wird – unabhängig von bisherigen Freigrenzen und Schwellenwerten.

Eine umfassende Darstellung der neuen Regelungen findet ihr in unserem Brexit-Whitepaper, welches ihr kostenlos hier herunterladen könnt.

Taxdoo ist die Plattform für automatisierte und sichere Compliance-Prozesse

… und bildet für die führenden Onlinehändler in Europa neben der Abwicklung der laufenden Umsatzsteuer-Compliance in der EU, GB und CH noch zahlreiche zusätzliche Services an, welche HändlerInnen und deren SteuerberaterInnen das Leben deutlich vereinfachen.

Wenn ihr mehr darüber wissen wollt, wie ihr all das effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

Weitere Beiträge

Großbritannien & Zoll – Die wichtigsten Bestimmungen für Lieferungen nach UK seit 2022

Großbritannien und die EU: Grundsätzliche Einigung im Streit um Nordirland