Lieferungen nach Großbritannien – was Ihr aus umsatzsteuerlicher Sicht auch 2022 beachten müsst!

Mit Ablauf des 31.12.2020 ist die Übergangsphase beendet, in der für Lieferungen nach und in Großbritannien übergangsweise die bisherigen Umsatzsteuer-Regeln galten. Erfahrt hier, wie Ihr die – seit dem nunmehr voll wirksamen Brexit – aktuell geltenden Regelungen für Steuern und Zoll beim Versand nach Großbritannien am besten umsetzen könnt.

Inhaltsverzeichnis

Wie Ihr die Umsatzsteuer beim Handel mit Großbritannien nach dem Brexit in den Griff bekommt!

Das Thema Brexit ist in den letzten Monaten medial ein wenig in den Hintergrund getreten. Doch weniger Aufmerksamkeit heißt leider nicht, dass sich das Thema in Wohlgefallen aufgelöst hat. Im Gegenteil: Viele Händler suchen für ihre Lieferungen nach Großbritannien nach wie vor nach Wegen durch das Brexit-Chaos.

Wir möchten aus Anlass von über einem Jahr Brexit Bilanz ziehen. Und Euch als Händler sagen: Handelt mit UK! Denn trotz der Umstände gibt es Möglichkeiten, den Aufwand einzugrenzen.

Schauen wir zunächst auf die Entwicklungen: Laut Statistischem Bundesamt sind im Januar 2021 die deutschen Exporte nach UK um 30 Prozent gegenüber dem Vorjahresmonat zurückgegangen. Die Importe aus UK nach Deutschland brachen im selben Zeitraum sogar um 56 Prozent ein.

Sicherlich dürfte auch die Pandemie eine Rolle beim Rückgang gespielt haben. Doch viele Händler benennen ganz klar den Brexit als wesentliches Hindernis, warum sie nicht mehr oder kaum noch nach UK verkaufen.

Für Händler in der EU ist Großbritannien seit 01.01.2021 ein “Drittland”

Faktisch ist Großbritannien seit 1. Januar 2021 aus EU-Sicht ein „Drittland“. Für Euch als Händler rücken in diesem Zusammenhang zwei wesentliche Themen in den Fokus: Zollbestimmungen sowie steuerliche Aspekte, also insbesondere die Umsatzsteuer.

Hinweis:

In einem separaten Artikel erfahrt Ihr die wichtigsten Fakten zum Thema Zoll in Großbritannien nach dem Brexit.

Die wesentlichen steuerlichen Folgen des Brexits für Onlinehändler in der EU behandeln wir nachfolgend, und haben sie auch in einem 4-Minuten-Video für Euch zusammengefasst:

Welche Änderungen für Lieferungen nach und in Großbritannien gibt es seit dem 1.1.2021 aus umsatzsteuerlicher Sicht?

Das Wichtigste vorab: Zukünftig müsst Ihr bei Lieferungen an britische Abnehmer immer die deutsche und die britische Sichtweise gleichzeitig betrachten.

Abhängig davon, welchen Vertriebskanal Ihr nutzt und/oder wie hoch der Wert der Ware ist, ist es seit dem 1.1.2021 weiterhin erforderlich, sich in Großbritannien steuerlich zu registrieren oder eben nicht mehr.

Fangen wir mit der deutschen bzw. der EU-Sichtweise an.

Die deutsche bzw. EU-Sicht für Lieferungen nach Großbritannien

Aus deutscher bzw. EU-Sicht sind zwei relevante Fälle (Transaktionsarten) denkbar. Im Folgenden erklären wir Euch daher, wie ihr diese beiden Transaktionsarten umsatzsteuerlich und buchhalterisch bewertet und abbildet.

Fall 1: Ihr liefert direkt nach Großbritannien

Dieser Fall ist aus umsatzsteuerlicher Sicht als sogenannte Ausfuhrlieferung zu beurteilen. Ausfuhrlieferungen sind immer steuerfrei – egal ob der Abnehmer ein Endverbraucher oder ein Unternehmer ist.

Wichtig ist jedoch, dass Ihr Ausfuhrlieferungen umfassend dokumentieren und belegen müsst. Was das bedeutet, haben wir in diesem Blogpost erklärt.

Fall 2: Ihr bzw. ein Logistiker bringt die Ware in ein Fulfillment-Center nach Großbritannien

Dieser Fall ist aus umsatzsteuerlicher Sicht – zumindest aus der deutschen bzw. EU-Sichtweise – ein nicht steuerbarer Vorgang und somit umsatzsteuerlich nicht zu erfassen.

Wichtig: Auch wenn beim Verbringen der Ware nach Großbritannien kein umsatzsteuerbarer Vorgang aus deutscher Sicht vorliegt, solltet ihr unbedingt darauf achten, die sogenannten Ausgangsvermerke, welche den Export nach Großbritannien belegen, aufzubewahren und mit der Transaktion zu verknüpfen. In diesem Webinar haben wir das umfassend erklärt.

Führt man sich diese beiden Fälle vor Augen, scheint es seit dem 1.1.2021 auf den ersten Blick eher einfacher als komplexer geworden zu sein.

Das Gegenteil ist jedoch der Fall – wie zu erwarten war – denn ihr müsst nun auch simultan zwingend die britische Sichtweise betrachten.

Die britische Sicht für Lieferungen nach Großbritannien

Zoll: mehr Papierkram, mehr Sorgfaltspflicht

Wenn Ihr Ware nach Großbritannien ausführen möchtet, müsst Ihr Euch seit 1. Januar 2021 beim Zoll für den Warenverkehr mit UK registrieren lassen. Ihr erhaltet dann eine sogenannte EORI-Nummer, das steht für „Economic Operators’ Registration and Identification“ und ist die Zollnummer auf europäischer Ebene.

Zudem muss für das Produkt, das Ihr nach Großbritannien ausführt, eine Zolltarifnummer ermittelt werden. Über sogenannte Ausfuhranmeldungen müssen Ausfuhren stets angemeldet und Zollwerte angegeben werden. Das ist ganz wichtig, denn wenn die Papiere nicht korrekt sind, kommt die Ware womöglich umgehend an Euch zurück.

Vorsicht ist übrigens geboten, wenn Ware aus einem anderen Produktionsland zunächst nach Deutschland eingeführt und dann nach UK weiterverschickt wird – denn dann fällt nicht nur an der EU-Grenze Zoll an, sondern auch nochmal beim Eintritt nach UK.

In diesem Zusammenhang kann es sinnvoll sein, zu analysieren, welche zollrechtlichen Verfahren möglicherweise eine Vereinfachung in diesem Szenario darstellen könnten und ebenfalls zu einer Verringerung der Abgabenlast führen könnten.

Ab 1. Januar 2022 sind die Zollanmeldungen dann sofort zu erledigen und Einfuhrabgaben sofort zu leisten. Diesen Freiraum gewährt die EU nicht, d.h. wer aus UK in die EU einführt, muss unverzüglich alle Zollformalitäten erfüllen und die Zollabgaben entrichten.

Umsatzsteuer für den Verkauf nach Großbritannien: Warenwert und Verkaufsplattform relevant

Auch aus umsatzsteuerlicher Sicht gibt es bei Lieferungen nach UK einiges zu beachten. Zwei Fragen sind dabei entscheidend: Verkauft Ihr über einen eigenen Webshop oder einen Marktplatz (z.B. Amazon oder ebay)? Liegt der Gesamtwert der Warensendung nach Großbritannien bei über 135 Pfund (aktuell ca. 155 Euro)? Wir zeigen Euch im nachfolgenden Abschnitt, worauf es je nach Verkaufsweg bei Umsatzsteuer und auch Zoll ankommt.

Dabei stellen wir einen Grundsatz voran.

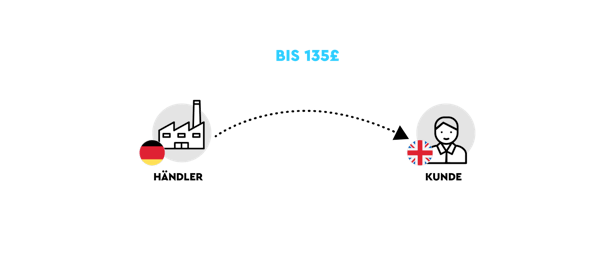

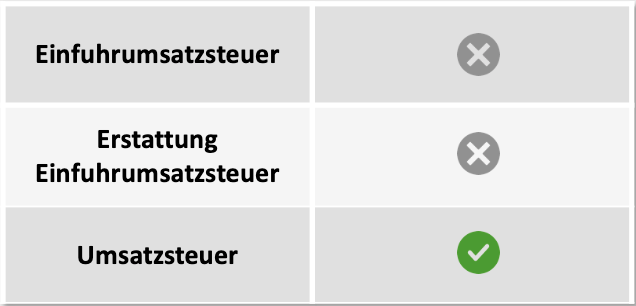

Grundsatz: Lieferungen bzw. Importe, die einen Wert von 135 Pfund (netto und exklusive Transportkosten) nicht überschreiten, sind in Großbritannien von der Einfuhr(!)umsatzsteuer befreit. Dennoch unterliegt jede Lieferung unabhängig von der Höhe des Warenwertes in Großbritannien letztendlich der Umsatzsteuer.

Schauen wir uns die Fälle im B2C-Bereich nacheinander an.

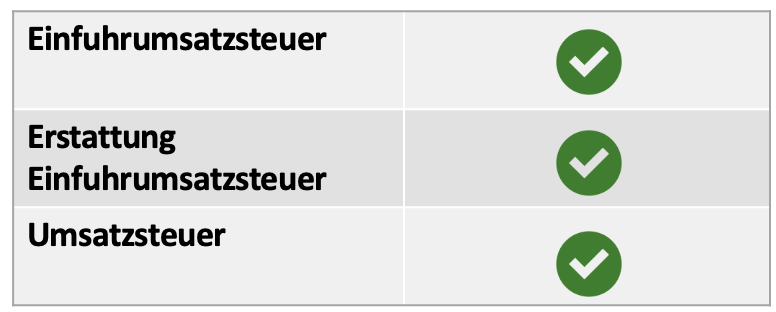

Fall 1: Ihr liefert über Euren Webshop Ware aus der EU (z.B. Deutschland) nach Großbritannien – Warenwert bis 135 Pfund

Direkte Lieferungen aus Deutschland bzw. der EU nach Großbritannien über den Webshop sind von Zoll und Einfuhrumsatzsteuer befreit.

Die Umsatzsteuer entsteht in diesen Fällen in Großbritannien am Point-of-Sale.

Was bedeutet das? Führt ihr ab dem 1.1.2021 auch nur eine solche Lieferung durch, müsst Ihr euch in Großbritannien steuerlich registrieren und quartalsweise Eure Umsatzsteuer deklarieren und abführen, da Ihr in Großbritannien steuerbare Lieferungen tätigt.

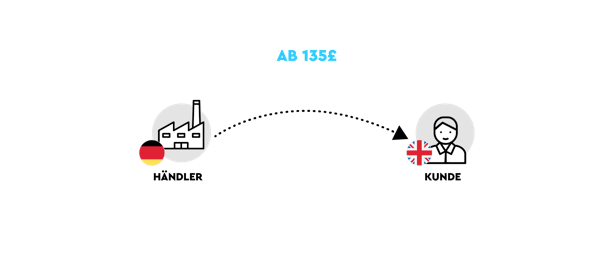

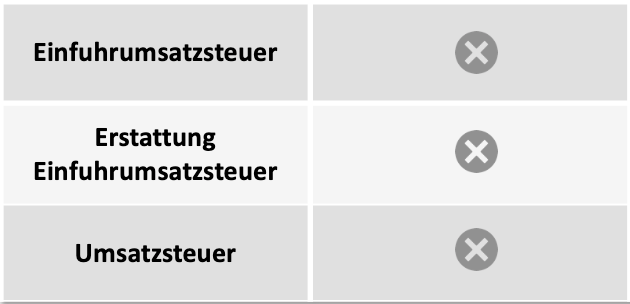

Fall 2: Ihr liefert über Euren Webshop Ware aus der EU (z.B. Deutschland) nach Großbritannien – Warenwert über 135 Pfund

Dieser Fall ist eine Abwandlung von Fall 1. Beim Import der Waren nach UK entsteht Einfuhrumsatzsteuer. Diese Einfuhrumsatzsteuer kann grundsätzlich im Rahmen der quartalsweisen Meldungen in Großbritannien als Vorsteuer abgezogen werden. Damit ist die Besteuerung allerdings noch nicht abgeschlossen. Nach der Einfuhr der Ware nach Großbritannien entsteht ebenfalls Umsatzsteuer am Point of Sale.

Was bedeutet das? Neben der Einfuhrumsatzsteuer fällt auch Umsatzsteuer in Großbritannien für diese Lieferungen an. Ihr müsst daher für diese Fälle auch umsatzsteuerlich registriert sein.

Hinweis:

Umsatzsteuersätze in Großbritannien (UK, also England, Schottland, Wales)

In Großbritannien gelten seit 01.01.2021 folgende Steuersätze (gültig für Umsatzsteuer / VAT / Mehrwertsteuer):

– Standard Umsatzsteuersatz (= Regelsatz): 20%

– Reduzierter Umsatzsteuersatz: 5%

– Nullsatz: 0%

Der reduzierte bzw. Null-Steuersatz gilt insbesondere für viele Dienstleistungen in GB.

Für Onlinehändler relevant ist insbesondere der Nullsatz für Kinderkleidung und -schuhe, Bücher, Grundnahrungsmittel und Haustier-Nahrung.

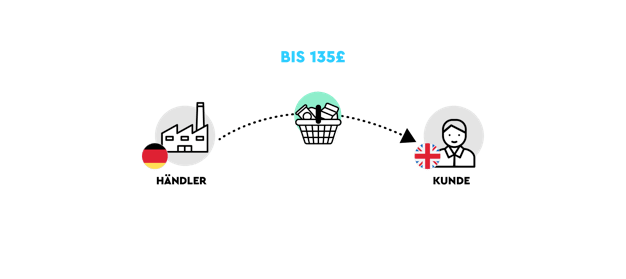

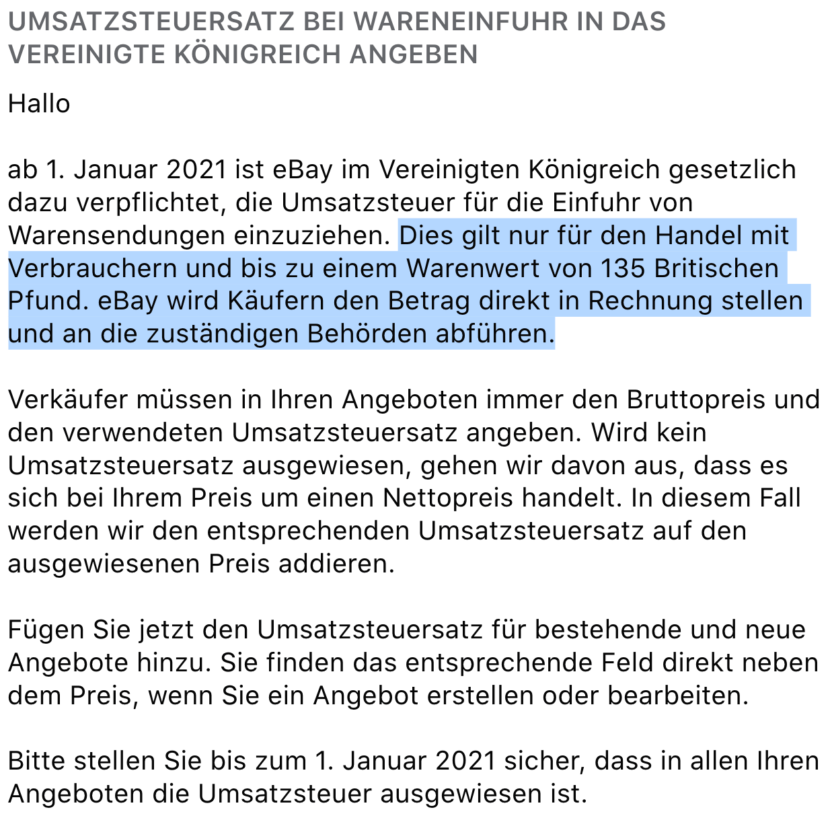

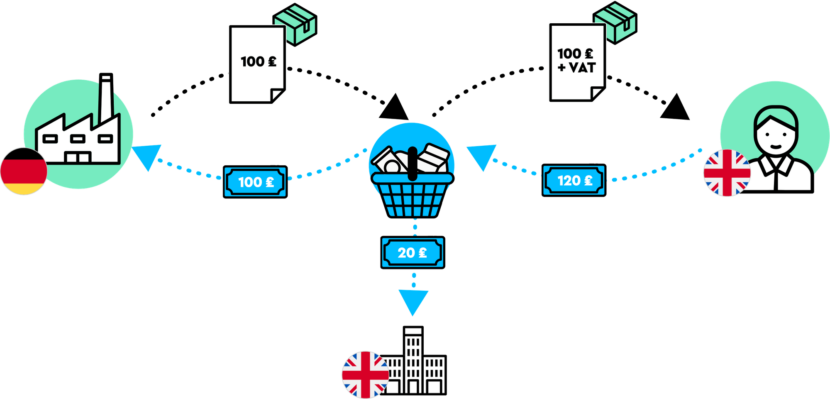

Fall 3: Lieferung über Amazon, ebay oder andere Marktplätze aus der EU (z.B. Deutschland) nach Großbritannien – Warenwert bis 135 Pfund

In diesem Fall gelangt die Ware auch wieder aus Deutschland oder einem anderen EU-Staat nach Großbritannien – allerdings erfolgt der Verkauf und die unmittelbare Abrechnung mit dem Kunden über einen Marktplatz, z.B. Amazon.

Das britische Umsatzsteuerrecht fingiert in diesen Fällen eine – in der Regel – steuerpflichtige Lieferung des Marktplatzes an den Endverbraucher, wie es die folgende Grafik illustriert. Eine Registrierungspflicht in Großbritannien besteht für den Händler somit nicht, soweit er nur diese Art von Transaktionen ausführt.

Hier seht ihr am Beispiel eBay, wie die Marktplätze diesen Fall praktisch abwickeln werden. Die Erstellung der Rechnung erfolgt durch die Marktplätze.

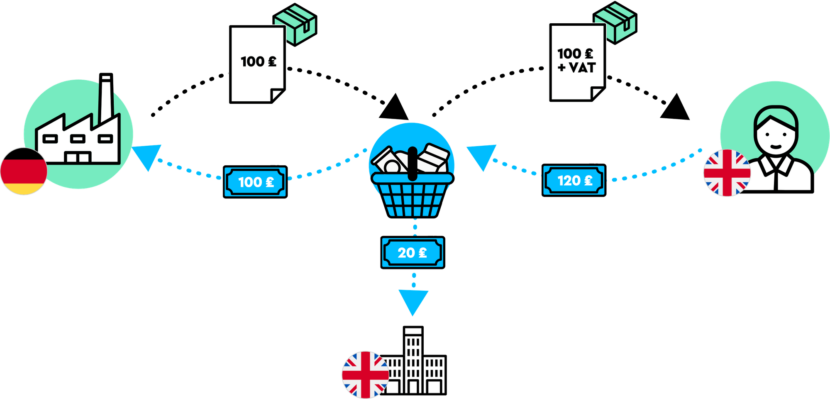

Fall 4: Lieferung über Amazon, ebay oder andere Marktplätze aus der EU (z.B. Deutschland) nach Großbritannien – Warenwert über 135 Pfund

Dieser Fall wird wie Fall 2 abgebildet. Das bedeutet auch, dass die in Fall 3 genannte Fiktion in diesen Fällen nicht greift.

Fall 5: Verkauf aus einem Fulfillment-Center in Großbritannien heraus – Warenwert egal

Wollt Ihr nach dem 1.1.2021 weiterhin das Fulfillment by Amazon (FbA) in Großbritannien nutzen, müsst Ihr eure Produkte zukünftig selbst auf die Insel bringen (lassen). Amazon hatte bereits angekündigt, dass Großbritannien aus dem Pan EU Programm zumindest zeitweise herausfallen wird. Wie ihr das machen könnt, erklärt Euch eine Zollexpertin in diesem Webinar.

Aus deutscher Sicht liegt dann kein steuerbarer Vorgang vor, da die Lieferung in Großbritannien stattfindet.

In Großbritannien greift wieder die folgende Systematik, die ihr bereits kennt – mit einer wichtigen Ausnahme/Ergänzung …

… Amazon schuldet die Umsatzsteuer und führt diese auch ab. Zusätzlich fingiert das neue britische Umsatzsteuerrecht, dass ihr im Zeitpunkt der Lieferung von Amazon an den Endverbraucher eine steuerfreie Lieferung an Amazon durchführt.

Was bedeutet das? Viele haben sicher erkannt, dass dieser Fall dann sehr relevant ist, wenn ihr unter den neuen Gegebenheiten das Pan EU Programm inkl. Großbritannien fortführen wollt. Durch die o.g. steuerfreie Lieferung an Amazon seid ihr weiterhin auf der Insel steuerpflichtig und müsst weiterhin quartalsweise Umsatzsteuer-Erklärungen abgeben.

Schauen wir uns nun noch die möglichen Fälle im B2B-Bereich an:

Fall 1: Ihr liefert über Euren Webshop oder einen Marktplatz Ware aus der EU (z.B. Deutschland) nach Großbritannien an einen britischen Händler – Warenwert bis 135 Pfund

Direkte Lieferungen aus Deutschland bzw. der EU nach Großbritannien über den Webshop sind aufgrund der Unterschreitung der 135 Pfund Grenze von Zoll und Einfuhrumsatzsteuer befreit. Die Umsatzsteuer entsteht in diesen Fällen in Großbritannien am Point-of-Sale. Allerdings gilt hier die Besonderheit des Reverse Charge Verfahrens. Das bedeutet, dass Ihr nicht als Händler die Umsatzsteuer abführen müsst, sondern Euer Kunde die Umsatzsteuerschuld trägt.

Fall 2: Ihr liefert über Euren Webshop oder einen Marktplatz Ware aus der EU (z.B. Deutschland) nach Großbritannien an einen britischen Händler – Warenwert über 135 Pfund

Ihr als Händler seid Einführer der Ware in Großbritannien:

Beim Import der Waren nach UK entsteht Einfuhrumsatzsteuer. Diese Einfuhrumsatzsteuer kann grundsätzlich im Rahmen der quartalsweisen Meldungen in Großbritannien als Vorsteuer abgezogen werden. Damit ist die Besteuerung allerdings noch nicht abgeschlossen. Nach der Einfuhr der Ware nach Großbritannien entsteht ebenfalls Umsatzsteuer am Point of Sale.

Der Kunde ist Einführer der Ware in Großbritannien:

Laut den vereinbarten Lieferbedingungen kann allerdings auch der B2B-Kunde als Einführer der Ware auftreten, sodass für Euch als EU-Händler weder Einfuhrumsatzsteuer noch Umsatzsteuer anfällt, da diese Euer Kunde trägt.

Fall 3: Verkauf aus einem Fulfillment-Center oder eigenem Warenlager in Großbritannien an einen britischen Händler – Warenwert egal

Aus deutscher Sicht liegt in diesem Fall kein steuerbarer Vorgang vor, da es sich um eine lokale Lieferung in Großbritannien handelt. Die Umsatzsteuer entsteht lokal in Großbritannien und ist von Euch als Händler zu tragen

Lieferungen nach Nordirland seit 2021

Nordirland gehört aus umsatzsteuerlicher Sicht weiterhin zur EU, zumindest was Transaktionen zwischen der EU und Nordirland betrifft.

Für Lieferungen aus der EU nach Nordirland gelten daher die europäischen Regelungen fort. Dies bedeutet auch, dass für grenzüberschreitende Verkäufe aus der EU an nordirische Endkunden das One-Stop-Shop-Verfahren genutzt werden kann.

In einem eigenen Artikel erfahrt Ihr alles zu den Umsatzsteuer- und Zoll-Regelungen für den Handel mit Nordirland.

Fazit: Komplexe Umsatzsteuer Regelungen für Lieferungen nach und in Großbritannien

Die Komplexität der steuerlichen Neuregelungen in Großbritannien führt vor Augen, was für eine wertvolle Institution ein friktionsfreier EU-Binnenmarkt war und ist.

Man mag sich nicht vorstellen, dass wir wieder in eine Zeit zurückfallen, in der jeder Staat in Europa ähnliche oder gar andere Regeln nach eigenem Ermessen etablieren kann.

Ja, die Europäische Union ist auch ein riesiges Bürokratiemonster und in Brüssel oder Straßburg getroffene Entscheidungen sind oft ein Minimalkonsens; nicht selten werden sie teilweise auch von intransparenter Lobbyarbeit beeinflusst.

Wir bei Taxdoo sind aber absolut überzeugt davon, dass diese Gemeinschaft von nunmehr noch 27 Nationalstaaten in der langen und konfliktreichen Geschichte Europas gemeinsam so viel mehr erreicht hat, als es diese Staaten einzeln in Summe geschafft hätten.

Auch wenn durch den Brexit die Komplexität für den Onlinehandel mit Großbritabnnien gestiegen ist – keine Sorge, es lässt sich bewältigen! Was Registrierungspflichten für Zollanmeldungen angeht, findet Ihr viele Checklisten und Hinweise im Internet, etwa bei der Generalzolldirektion oder auch bei den Industrie- und Handelskammern.

Taxdoo bietet Lösungen für die Umsatzsteuer beim Handel mit UK

Beim Thema Umsatzsteuer für Lieferungen nach und in Großbritannien habt Ihr mit Hilfe unserer Taxdoo-Plattform die Möglichkeit, die Abwicklung vollständig zu automatisieren. Und das nicht nur für UK, sondern auch für andere Länder. Das macht die Sache nicht nur weniger fehleranfällig, sondern es spart Euch viel Zeit und Energie.

Und schon mal nach vorne geblickt: Wir arbeiten daran, auch beim Thema Zoll einige Abläufe für Euch zu vereinfachen.

Taxdoo ist die Plattform für automatisierte und sichere Compliance-Prozesse

… und bildet für die führenden Onlinehändler in Europa neben der Abwicklung der laufenden EU- und GB-weiten Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

Weitere Beiträge

OSS-Mahnungen aus Spanien für Q3 und Q4 2021: BZSt dieses Mal nicht Schuld

Reverse-Charge: Wann zahlt Ihr die Umsatzsteuer für Amazon, TikTok und Co.? Ein aktuelles BFH-Urteil!