Zusammenfassung: Befristete Senkung der Umsatzsteuersätze & Onlinehandel

In diesem Blogpost fassen wir die Auswirkungen der befristeten Senkung der Umsatzsteuersätze vom 1. Juli bis 31. Dezember 2020 zusammen.

Hintergrund: Am 3. Juni hatte die Große Koalition bekanntgegeben, die Umsatzsteuersätze in Deutschland von 19 bzw. 7 Prozent ab dem 1. Juli 2020 auf 16 bzw. 5 Prozent abzusenken, um den Konsum zu stimulieren – befristet bis zum 31. Dezember 2020.

Mittlerweile gibt es auch die Sichtweise der Finanzverwaltung zur Anwendung dieses (geplanten) Gesetzes – zumindest einen Entwurf dazu.

Hinweis: Jedes neue Gesetz bringt Unsicherheit mit sich, denn es kann niemals jeden denkbaren Sachverhalt, den es betrifft, wortwörtlich abbilden. Aus diesem Grund hat es sich etabliert, dass die Finanzverwaltung, die ja letztendlich Gesetze bundesweit einheitlich auslegen und anwenden muss (§ 85 Abgabenordnung), ihre Sichtweise – oftmals auch anhand von Beispielen – darlegt. Der wichtigste Kommunikationskanal sind dabei die sogenannten BMF-Schreiben: Darin stellen der Bund und die Länder ihre Auslegung des Geseztes dar, an die u.a. die Finanzämter und Zollbehörden gebunden sind.

Viel Überraschendes gibt das Schreiben jedoch nicht her. An der Systematik, die wir unmittelbar mit der Bekanntgabe des Gesetzesvorhabens am 3. Juni erläutert hatten, ändert sich nichts.

Keine Vereinfachungen und Übergangsregelungen für den Onlinehandel

Die von Spitzenverbänden geforderten Vereinfachungen bzw. Übergangsregelungen wird es nicht geben.

Insbesondere das Risiko, dass Händler ab dem Stichtag einen falschen Steuerbetrag auf Ihrer Rechnung ausweisen und diesen dann auch an das Finanzamt abführen müssen, wird ab dem ersten Tag bestehen.

- Frage: Was hat es damit auf sich?

- Antwort: Wann immer ein Unternehmer Umsatzsteuer in einer Rechnung ausweist, muss er diese an das Finanzamt abführen – selbst dann, wenn das Rechnungstool z.B. aufgrund eines Fehlers 30 Prozent Umsatzsteuer ausweisen würde.

- Frage: Ab wann darf ich nicht mehr 19 bzw. 7 Prozent auf meinen Rechnungen ausweisen?

- Antwort: Für jedes Leistungsdatum zwischen dem 1. Juli und dem 31. Dezember 2020. Auf den wichtigen Begriff des Leistungsdatums kommen wir gleich zurück.

- Frage: Muss ich überhaupt Rechnungen erstellen?

- Antwort: Nur, wenn du an Unternehmer lieferst oder deine Produkte grenzüberschreitend (B2B und B2C) in der EU verkaufst – anderenfalls nicht.

Was hat es nun mit dem Leistungsdatum auf sich, welches für die Umstellung relevant ist?

Versanddatum, Rechnungsdatum, Retouren: Welcher Steuersatz greift wann?

So vielfältig die Systemlandschaft im Onlinehandel ist, so vielfältig erfolgt die Bestimmung des Leistungszeitpunkts, der für die befristete Senkung der Umsatzsteuersätze relevant ist.

Wir erklären schon seit Jahren, dass Workarounds, bei denen z.B. die zeitliche Erfassung einer Lieferung durch das Rechnungsdatum, Bestelleingang, Zugang beim Kunden, … erfolgt, falsch sind.

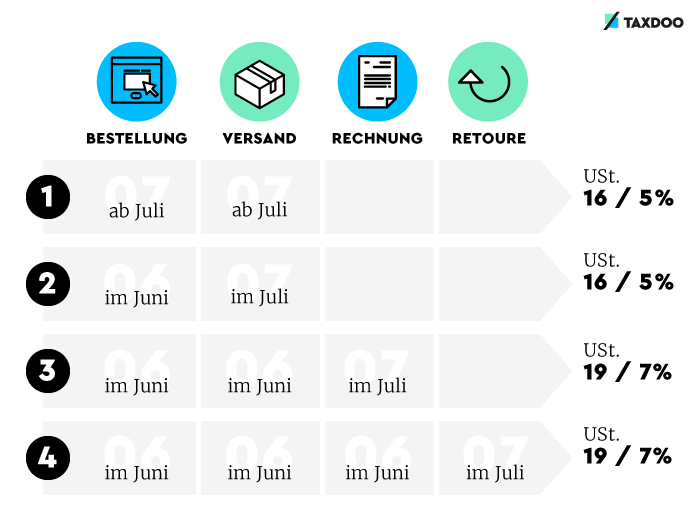

Der Zeitpunkt einer Lieferung im Onlinehandel ist der Zeitpunkt, zu dem diese beginnt – also z.B. euer Lager verlässt bzw. an den Spediteur übergeben wird.

Für Waren, welche Kunden einige Monate später retournieren, könnt ihr euch die vormals abgeführte Umsatzsteuer zurückholen.

In welcher Höhe? Selbstverständlich in Höhe der damals korrekt abgeführten Umsatzsteuer, wie es auch die Grafik verdeutlicht.

Beispiel 1: Nicht zu verwechseln mit einer Retoure (Rückgabe) ist der Umtausch im umsatzsteuerlichen Sinne (siehe Tz. 43 des Entwurfs des BMF-Schreibens). Hier sendet euch der Kunde das Produkt zurück und verlangt ein wirtschaflich neues Produkt – z.B. ein Dreirad anstelle des vormals gelieferten Kettcars. In diesem Fall führt ihr mit der Versendung des Dreirads eine neue Lieferung aus, deren Steuersatz nach dem Zeitpunkt der (neuen) Versendung zu bemessen ist.

Beispiel 2: Verlangt der Kunde im Rahmen des 1. Beispiels nur eine andere Farbe des Kettcars, ist dieser Tausch umsatzsteuerlich irrelvant. Dieser Fall dürfte im Onlinehandel wesentlich häufiger auftreten als der in Beispiel 1, was das Leben deutlich einfacher macht.

Welche Einstellungen sind nun im Rahmen der Finanzbuchhaltung vorzunehmen?

Finanzbuchhaltung und Umsatzsteuervoranmeldung

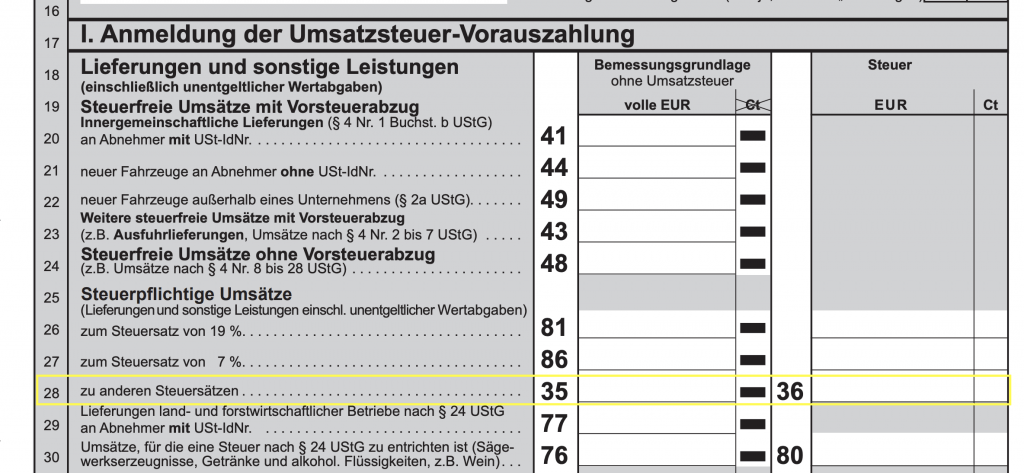

Da die Finanzverwaltung die Formulare für die Umsatzsteuervoranmeldung sowie die Umsatzsteuer-Jahreserklärung nicht auf die Schnelle umstellen kann, werden alle Transaktionen zu 16 und 5 Prozent in einem Sammelfeld erfasst. In der Umsatzsteuervoranmeldung ist das die Zeile 28 bzw. die Kennzahl 35.

Da dort Umsätze zu beiden Steuersätzen (16 und 5 Prozent) einlaufen können, tragt ihr in die Kennzahl 35 die Nettosumme ein und in Kennzahl 36 die selbst berechnete Umsatzsteuer.

Im Rahmen der laufenden Finanzbuchhaltung sieht es so aus, dass z.B. der Marktführer – die DATEV – keine neuen Konten einführt. Über die Standardkonten wird für Lieferungen mit einem Leistungsdatum ab dem 1. Juli 2020 dann automatisch 16 bzw. 5 Prozent Umsatzsteuer berechnet.

Hinweis: Aufpassen müsst ihr lediglich, wenn ihr keines der sogenannten Automatikkonten verwendet. In diesem Fall müsst ihr den korrekten Steuersatz im Rahmen der Buchung (z.B. manuell) übergeben.

Aus diesem Grund solltet ihr die Erfassung, Bewertung und Verbuchung von Lieferungen in diesem Zeitraum besonders gut dokumentieren.

Hinweis: An dieser Stelle zeigt sich, wie wichtig es ist, das korrekte Lieferdatum zu bestimmen. Workarounds wie Rechnungsdatum oder der Bestelleingang, wie es klassische to-DATEV-Konverter überiegend verwenden, werden zu einem falschen Steuersatz führen. Wir weisen schon lange auf diese Problematik hin.

Zukünftiges Prüffeld oder drückt die Finanzverwaltung beide Augen zu?

… denn wie eingangs gesagt: Die Finanzverwaltung hat im Rahmen ihrer publizierten Sichtweise keine nennenswerten sogenannten Nichtbeanstandungsregelungen kommuniziert.

Es ist daher absolut vorstellbar, dass dieser Zeitraum bzw. diese Gesetzesänderung ein zukünftiges Prüffeld im Rahmen von Betriebsprüfungen und Umsatzsteuer-Sonderprüfungen sein wird.

Die auf den ersten Blick pragmatische bis hemdsärmelige Lösung, alle Erlöse im Rahmen einer Kennzahl an das Finanzamt zu melden, wird mit einem Mehraufwand und dem damit verbunden Risiko aufseiten des Steuerpflichtigen erkauft.

Taxdoo ist die Compliance-Plattform für die digitale Ökonomie

… und bildet für die führenden Onlinehändler in Europa neben der Abwicklung der laufenden Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung (Taxdoo ist Partner der DATEV) noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

P.S.: Taxdoo ist seit Anfang 2020 nun auch offiziell Partner der DATEV im Onlinehandel.