Taxdoo News: Regulatory issues increasingly influencing e-commerce – Taxdoo compliance platform builds RegTech Center

- Increasing regulatory requirements in e-commerce

- Acting in accordance with the law is becoming an ever greater challenge

- Taxdoo builds RegTech Center to connect regulation and technology

The regulatory requirements in e-commerce are becoming ever greater and increasingly pose challenges for online traders, marketplaces, shop providers, tax advisors, but also tax administrations. The most recent example: the introduction of the one-stop shop for the EU-wide processing of Value Added Tax – in addition to other comprehensive changes within the framework of the so-called VAT E-Commerce Package – on 1 July 2021.

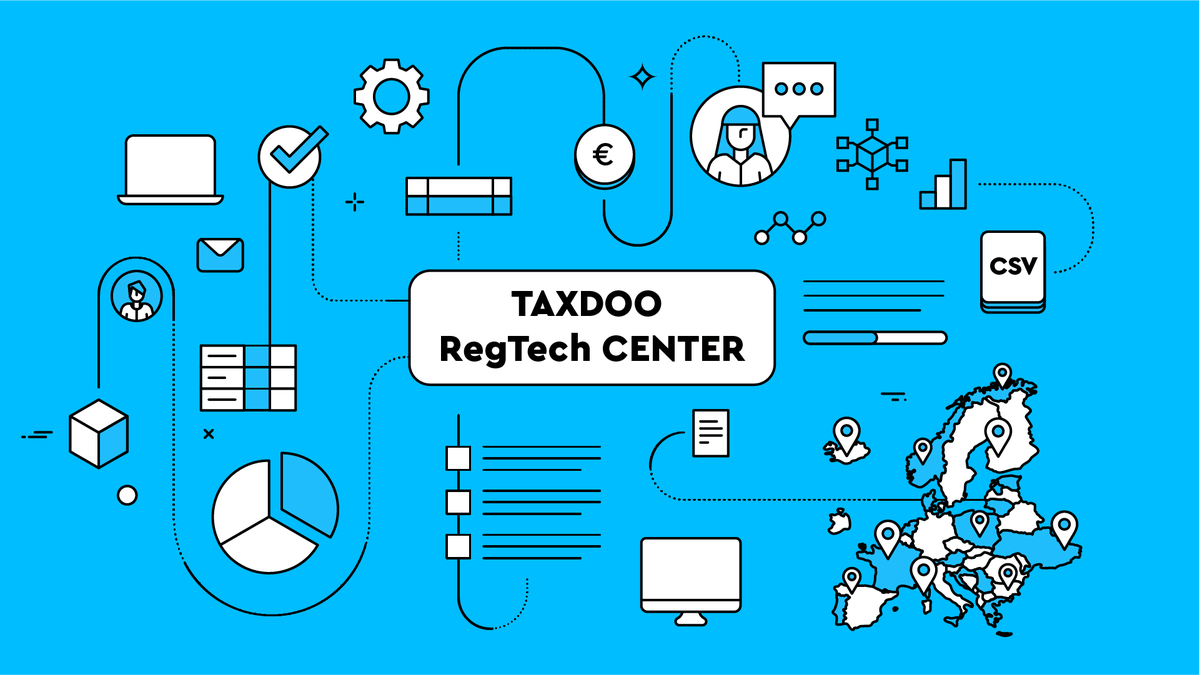

The Hamburg-based compliance platform Taxdoo is now expanding one of its two core areas consisting of Tax and Tech into a RegTech Center.

In addition to the task of transferring regulatory requirements into automated processes, a special focus in the future will be on anticipating regulatory changes at an early stage and helping to shape them.

The RegTech Center will be headed by tax advisor Anna-Katharina Heidbüchel, who has already been responsible for the transfer of regulation into technological solutions at Taxdoo in a leading position since the beginning of 2021. In addition, the RegTech Center will be strengthened by further new additions.

Example of OSS: Regulatory issues cause high complexity in e-commerce

According to Dr Roger Gothmann, co-founder and co-CEO of Taxdoo, the regulatory complexity in e-commerce will increase significantly in the coming years: “Parallel to the rapid growth of online trade, more and more fields are opening up that need to be regulated from the legislator’s point of view. However, new laws often lead to more rather than less effort on the part of e-commerce players. This can be clearly seen in the example of the most recent law reform. The assessment of the consequences of legislation according to today’s standards no longer covers the increasing dynamics in the technology sector. Laws are therefore already outdated when they are enacted.”

In his view, the One-Stop-Shop introduced on 1 July does not do justice to modern e-commerce and creates unnecessary complexity – for example, by allowing traders who rely on modern cross-border logistics structures to report only a fraction of their transactions via the OSS.

“The deep penetration, anticipation and also co-design of regulatory requirements and their technological effects in e-commerce is becoming increasingly important to ensure smooth online trade. We are tackling these tasks with our RegTech Center,” says Gothmann.

The goal is to offer all players in e-commerce an all-round carefree package so that they can always act in a legally compliant manner. “We are pleased that Anna-Katharina Heidbüchel, as a leading expert at the interface of tax and technology, will shape and drive the development and expansion of the RegTech Center. We have very consciously chosen a new generation of tax lawyers, because innovations are not created where people still profit from the status quo,” explains Gothmann.

“The Taxdoo RegTech Center combines regulatory and technological expertise at the highest level. We are thus further expanding Taxdoo into a compliance platform for the digital economy,” explains Anna-Katharina Heidbüchel. In addition to marketplaces, online retailers, tax firms and shop operators, Heidbüchel also sees the tax administration as a beneficiary: “With the help of our technology, we can help the tax administration to secure tax revenues and thus ensure more tax justice.

Due to a lack of technical control options, administrations in Germany are missing out on hundreds of millions of euros in sales tax revenue every year, Heidbüchel estimates.

Expansion of the RegTech Center with additional tax experts

From Anna-Katharina Heidbüchel’s point of view, the interface between regulation and technology offers tax advisors completely new application possibilities and professional perspectives. “Technological developments will massively change the field of traditional tax consultancy in the coming years. It is already apparent today that the connection to technology significantly increases the attractiveness as an employer,” says Heidbüchel.

This is shown, for example, by the fact that Taxdoo is becoming increasingly attractive for advisors from “Big Four” companies.

With Carolin Schmidt and Patrick Schulz, two more tax experts with a technology background joined the team of the newly created RegTech Center in September. “For me, the fusion of tax law and technology is the basis for tax processing in the future,” says Carolin Schmidt. “The automation of repetitive tasks enables the tax function to focus more on knowledge-intensive activities,” Schmidt adds.

From Patrick Schulz’s point of view, the increasing registration and reporting obligations make it difficult for both clients and tax advisors to comply with their obligations in a timely and proper manner. “Taxdoo addresses precisely this issue by combining tax expertise and technology,” says Schulz.

Weitere Beiträge

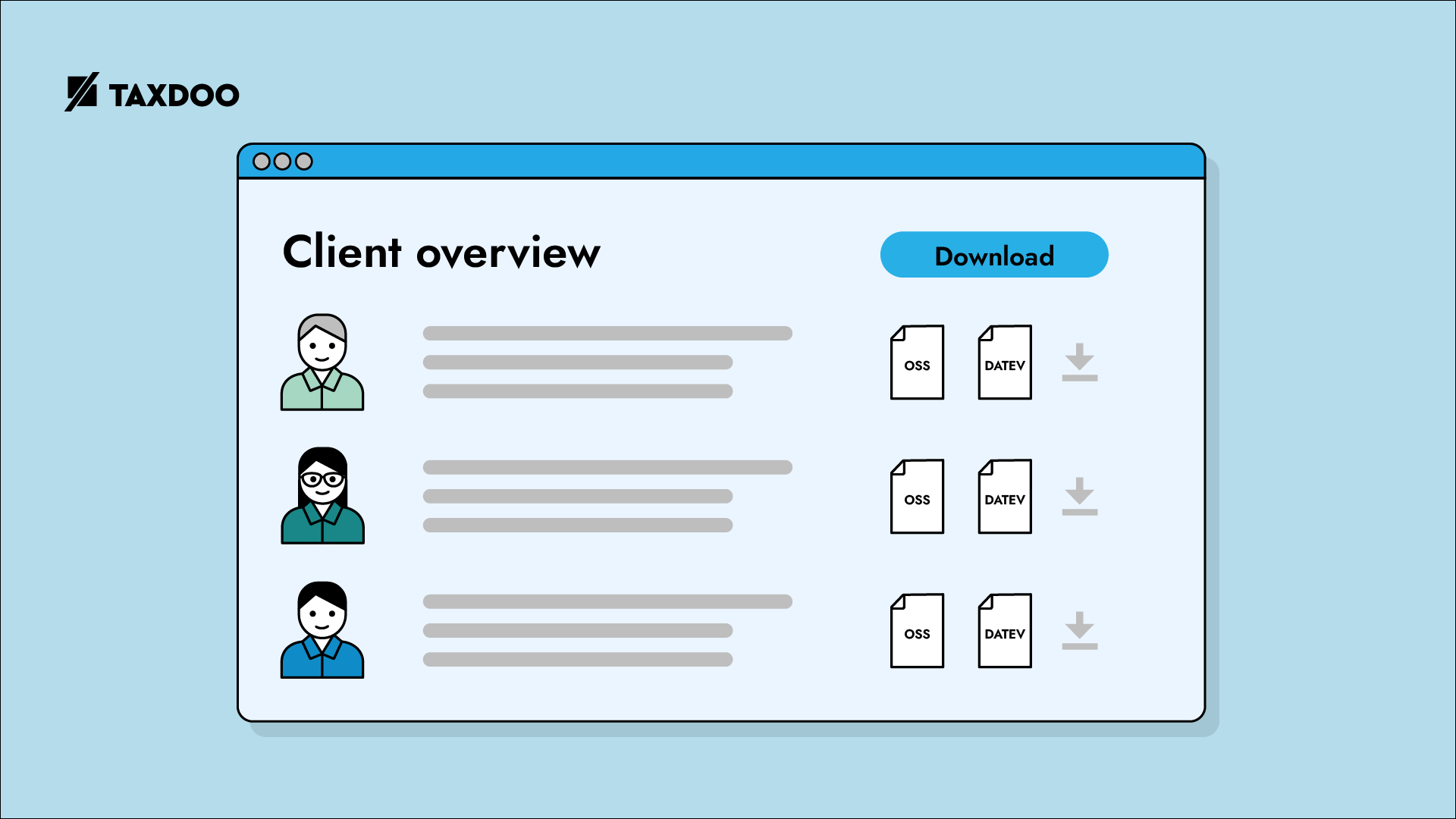

Introducing client overview! Become more efficient when working with multiple clients.

News | Cooperation Taxdoo and Prestashop – Hamburg-based compliance platform Taxdoo drives forward EU orientation