Was bewegt den Onlinehandel? Zwei aktuelle Publikationen dazu!

Die zunehmende Bedeutung des E-Commerce wurde in den vergangenen Monaten auch den letzten Zweiflern vor Augen geführt.

Wie die EU-Kommission jedoch selbst am 15.07.2020 erläutert hat – mehr dazu in Kürze in einem Blogpost – stellt der Bereich Umsatzsteuer-Compliance für viele kleine und große innovative Unternehmen in diesem Segment eine erhebliche Hürde dar.

Zwei konkrete Hürden haben wir in den aktuellen Ausgaben der folgenden Steuerzeitschriften ausführlich diskutiert.

- beck.digitax – Der One-Stop-Shop (OSS): Kommt er? Wenn ja, wann? Was bringt er? …

- IWW BBP – Finanzämter entdecken den Onlinehandel: Was sind die Prüfungsschwerpunkte? Wo liegen die Schwachstellen aufseiten der HändlerInnen?, …

beck.digitax: One-Stop-Shop

IWW: Betriebsprüfungen im Onlinehandel

Fazit

Beide Artikel verdeutlichen: Das Umsatzsteuerrecht läuft den technologischen Entwicklungen im E-Commerce hinterher.

- Die EU-Kommission würde den OSS und das damit einhergehende Umsatzsteuerrecht von deutlich mehr Altlasten befreien, als es ihr die Mitgliedstaaten zugestehen. Das dürfte auch in den nächsten Jahren so bleiben, sodass weiterhin auf den großen Reform-Wurf gewartet werden darf.

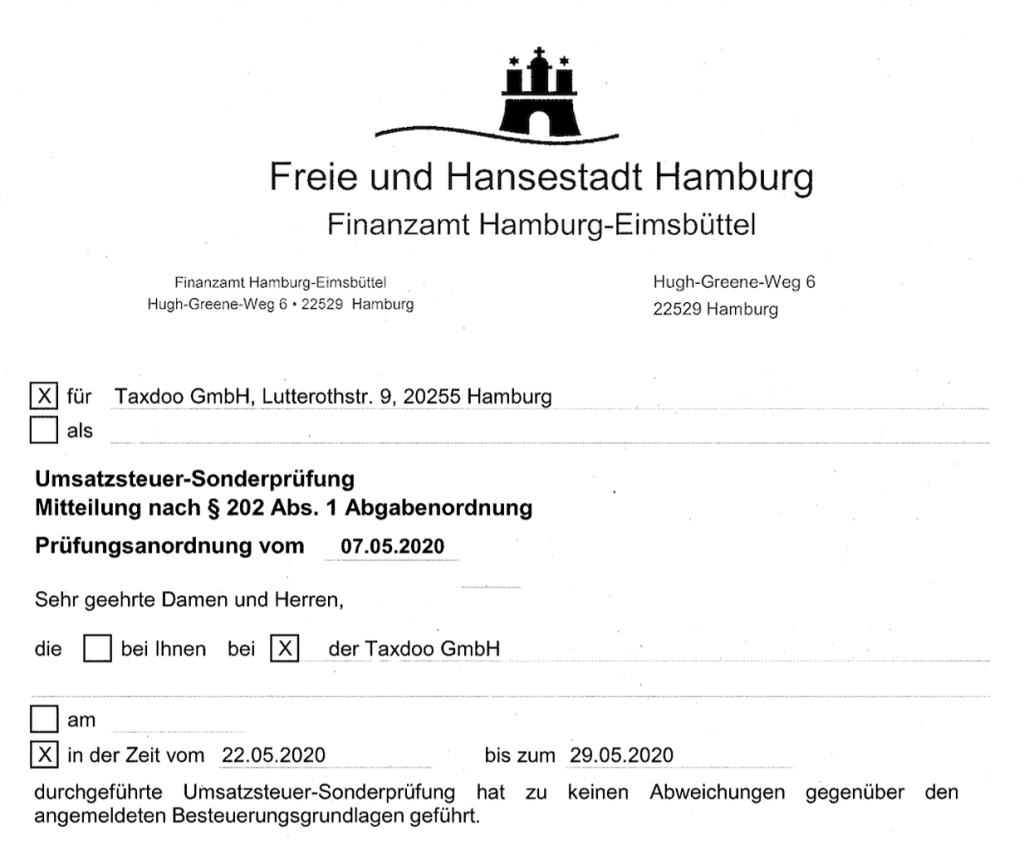

- Zunehmend mehr Finanzämter führen Betriebsprüfungen bzw. Umsatzsteuer-Sonderprüfungen im Onlinehandel durch – das Ergebnis wird dabei nicht immer wie in der folgenden Grafik aussehen, denn nicht selten fehlt beiden Seiten (Finanzämtern und OnlinehändlerInnen) das grundlegende Verständnis füreinander.

Die Compliance-Plattform für die digitale Ökonomie

… und bildet für die führenden Onlinehändler in Europa neben der Abwicklung der laufenden Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung (Taxdoo ist Partner der DATEV) noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

P.S.: Taxdoo ist seit Anfang 2020 nun auch offiziell Partner der DATEV im Onlinehandel.