Onlinehandel in die Schweiz: Umsatzsteuer und Zoll einfach erklärt

Die Schweiz ist ein verhältnismäßig kleiner Markt – allerdings mit einer hohen Kaufkraft.

Wer sich die Schweiz erschließen will, wird schnell auf zwei Hürden stoßen:

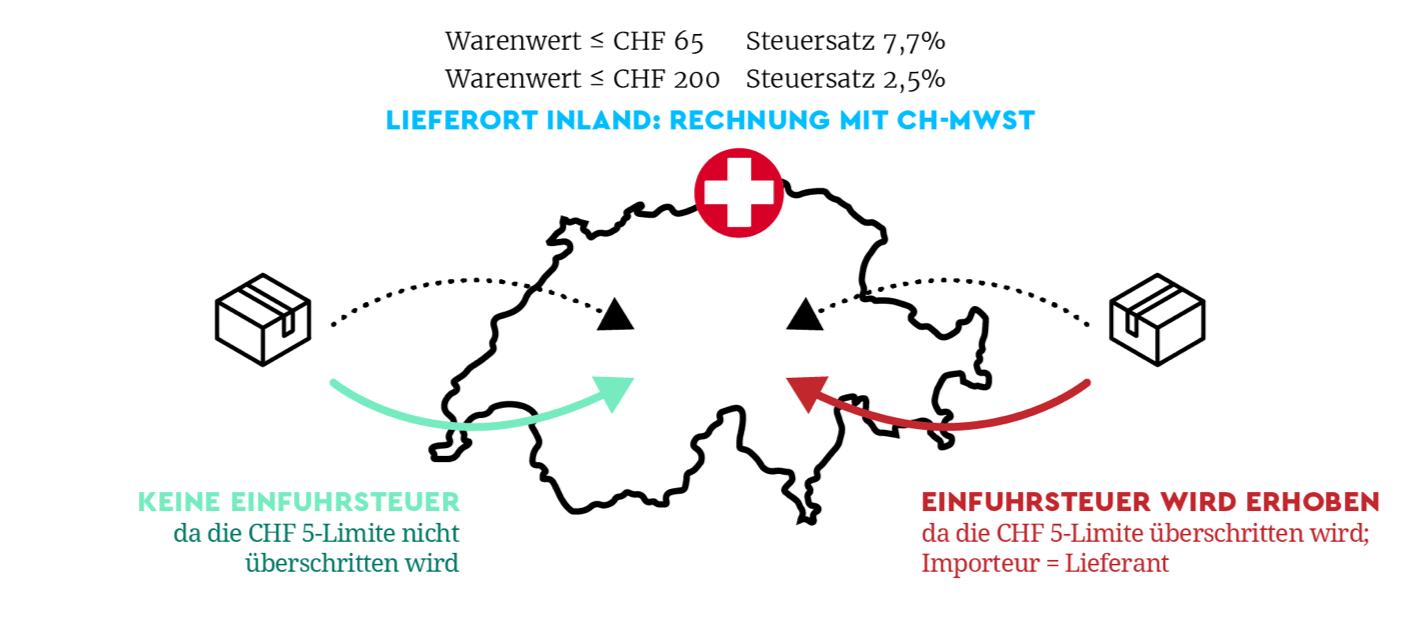

- Umsatzsteuer und

- Zoll.

Vorab: GJS Fiscal und Taxdoo bieten in Kooperation eine Lösung für Umsatzsteuer und Zoll bei Lieferungen in die Schweiz an. Bei Fragen dazu, wendet euch direkt an support@taxdoo.com.

Da die Schweiz nicht Mitglied der Europäischen Union ist, müssen dabei immer die Sichtweisen beider Länder betrachtet werden.

Die entsprechenden Stolpersteine und zugehörigen rechtlichen und technologischen Lösungen waren Gegenstand eines gemeinsamen Webinars von GJS Fiscal und Taxdoo.

Aufzeichnung Webinar: Onlinehandel in die Schweiz – Umsatzsteuer & Zoll

Taxdoo ist die Compliance-Plattform für die digitale Ökonomie

… und bildet für die führenden Online-Händler in Europa neben der Abwicklung der laufenden EU-weiten Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung – Taxdoo ist Partner der DATEV – noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

Weitere Beiträge

Update: Steuerpflicht für Online-Händler in der Schweiz ab 2019?

Gastartikel: Amazon schaltet die Schweiz wieder live – Das Warten hat sich gelohnt!