OSS Anmeldung / Registrierung: Schritt für Schritt Anleitung, Tipps & Besonderheiten

Inhaltsverzeichnis:

Inhaltsverzeichnis

Auf den ersten Blick wirkt die Anmeldung zum OSS Verfahren recht einfach. Die One Stop Shop Registrierung in Deutschland erfolgt komplett online und in wenigen Schritten im “Mein BOP” Portal des BZSt (Bundeszentralamt für Steuern):

- “Mein BOP” Seite aufrufen

- Einloggen über den von der USt-VA bekannten “Elster” Zugang mitsamt Zertifikatsdatei

- Registrierungs-Anzeige für die Teilnahme an der OSS EU-Regelung aufrufen

- Stammdaten zu Eurem Unternehmen ausfüllen

- Frage zu elektronischen Schnittstellen korrekt beantworten (als Händler → “Nein”)

- Bei der Frage nach den festen Niederlassungen und anderen Einrichtungen im EU-Ausland genau eine Lager-Adresse je genutztes EU-Land eintragen (wir haben alle bekannten Amazon FBA Lageradressen als Liste für Euch, siehe Link weiter unten)

- Angaben prüfen und absenden

- Anschließend erhaltet Ihr vom BZSt eine Bestätigung der OSS-Registrierung in Euer Elster-Postfach.

- Fertig!

Die Erfahrung zeigt allerdings auch: Veraltete Elster-Zertifikate und insbesondere die Fragen nach der elektronischen Schnittstelle und den “ausländischen festen Niederlassungen und anderen Einrichtungen zur Lieferung von Waren” sorgen bei vielen Händlern für Unsicherheiten während der OSS Anmeldung.

Hintergrund:

Verwirrung rund um die OSS Registrierung existiert auch deshalb, weil während der ersten Monate nach Einführung des One Stop Shop Verfahrens im Jahr 2021 die Registrierungslogik beim BZSt leider fehlerhaft war.

Die damals häufig vom BZSt versandten ungerechtfertigten Fehlermeldungen, nach eigentlich korrekt durchgeführten OSS-Registrierungen, sind inzwischen zwar ausgemerzt, aber z.B. in Händlerforen sind noch viele Einträge darüber zu finden.

Damit Eure OSS Anmeldung reibungslos und ohne offene Fragen gelingt, zeigen und erklären wir nachfolgend noch einmal detailliert die einzelnen Schritte.

Dabei gehen wir insbesondere auf den zentralen Knackpunkt in Form der geforderten “Angaben zu ausländischen festen Niederlassungen und sonstigen Einrichtungen” ein.

One Stop Shop Registrierung / OSS Anmeldung in Deutschland: Schritt für Schritt Anleitung

Beim OSS-Verfahren handelt es sich, im Behördendeutsch, um ein “gesondertes Meldeverfahren”. Daher muss auch eine gesonderte Registrierung hierfür erfolgen.

Dafür könnt Ihr das Online Portal “MeinBOP” des BZSt nutzen.

1. Start der OSS Registrierung: Aufruf “Mein BOP” Portal des BZSt

Die Registrierung zum One Stop Shop erfolgt nicht unmittelbar über die Website des BZSt, sondern seit 01.04.2021 online über ein Portal namens “Mein BOP”, über das Ihr mit dem BZSt Daten austauschen könnt. Hier der direkte Link: Mein BOP.

2. Einloggen mit Elster Zertifikatsdatei

Zum Einloggen wird eine Zertifikatsdatei verlangt. Über diese solltet Ihr bereits verfügen, wenn ihr Nutzer des ELSTER-Portals seid, über das Ihr z.B. die (Umsatz-) Steuererklärungen für Euer Unternehmen ausfüllen und abgeben könnt.

Die Datei verfügt über die Endung .pfx, sodass Ihr diese leicht auf Eurem Rechner oder in der Cloud suchen könnt, falls Ihr diese einmal verlegt habt.

Gut zu wissen:

Wenn Euer Elster-Zertifikat schon etwas älter sein sollte, ist damit die OSS-Registrierung ggf. nicht möglich. In diesem Fall ist es am Einfachsten, ein neues Benutzerkonto in Elster anzulegen, Ihr bekommt dann einen Freischaltungscode für ein neues Zertifikat zugeschickt. Nach Einloggen mit dem neuen Zertifikat könnt Ihr dann sowohl die OSS Registrierung als auch später die OSS-Meldungen vornehmen.

3. Aufruf der Registrierungsanzeige für die Teilnahme an der OSS EU-Regelung

Im nächsten Schritt ruft Ihr die sogenannte Registrierungsanzeige für die Teilnahme an der OSS EU-Regelung auf.

4. Ausfüllen der Stammdaten zu Eurem Unternehmen

Für die eigentliche OSS Registrierung werden nun zunächst eine Reihe an allgemeinen Informationen und Stammdaten abgefragt.

Die allermeisten hier einzutragenden Informationen sind selbsterklärend.

Auf zwei Fragen gehen wir im Folgenden gesondert ein, da diese auf den ersten Blick nicht für jeden eindeutig zu beantworten sind.

5. Fragen bei der Registrierung zum One Stop Shop: Angaben über die Unterstützung von Lieferungen durch Bereitstellen einer elektronischen Schnittstelle.

Die erste kryptische Frage bzw. Information, die bei der OSS Anmeldung abgefragt wird, sind die sogenannten “Angaben über die Unterstützung von Lieferungen durch Bereitstellen einer elektronischen Schnittstelle”.

Bin ich eine elektronische Schnittstelle?

Soweit Ihr euch als Händler registriert, könnt Ihr hier: “Nein, es trifft nicht zu” anklicken.

Warum?

Mit Bereitstellen einer elektronische Schnittstelle sind Marktplätze – also Amazon, eBay, Zalando & Co. gemeint.

Hintergrund:

Seit der der Umsatzsteuer-Reform zum 1.7.2021 können auch Online-Marktplätze – für bestimmte Umsätze – den One Stop Shop verwenden, sodass auch Amazon & Co. sich dafür registrieren können.

6. Fragen bei der Registrierung zum One Stop Shop: Feste Niederlassungen des Unternehmens und andere Einrichtungen zur Lieferung von Waren

Die Frage nach den festen Niederlassungen und anderen Einrichtungen im EU-Ausland ist etwas tricky.

Fangen wir mit festen Niederlassungen an.

Feste Niederlassung:

Der Begriff der festen Niederlassung ist EU-weit einheitlich definiert – in Art. 11 Abs. 2 MWStVO . Demnach ist eine feste Niederlassung jede Niederlassung mit Ausnahme des Sitzes der wirtschaftlichen Tätigkeit, die einen hinreichenden Grad an Beständigkeit sowie eine Struktur aufweist, die es von der personellen und technischen Ausstattung her erlaubt, Dienstleistungen zu erbringen.

Sind Fulfillment-Center von Amazon im EU-Ausland feste Niederlassungen?

Die Antwort lautet: Nein!

Schaut man sich die Definition an, dürfte es offenkundig sein, dass Ihr von einem Amazon-Lager niemals Dienstleistungen erbringen könnt.

Was ist aber mit den anderen Einrichtungen zur Lieferung von Waren? Das klingt schon eher nach einem Fulfillment-Center von Amazon, Zalando & Co.

Dazu bekommt Ihr eine entsprechende Klarstellung, wenn Ihr auf das Fragezeichen direkt hinter dem Satz klickt.

Andere Einrichtungen:

Unter anderen Einrichtungen zur Lieferung von Waren sind dem Unternehmen zuzurechnende Einrichtungen in anderen EU-Mitgliedstaaten zu verstehen, die keine festen Niederlassungen sind und von denen aus im Rahmen innergemeinschaftlicher Fernverkäufe Waren befördert oder versendet werden, wie z.B. Warenlager.

Auch wenn Amazon-Lager bzw. Fulfillment-Center von Amazon Euch nicht zuzurechnen sind, sind für die OSS Anmeldung an dieser Stelle Amazon Fulfillment-Center oder andere Warenlager anzugeben.

Laut des BZSt sind hier alle “Einrichtungen” zu erfassen, die für innergemeinschaftliche Fernverkäufe aus einem anderen Mitgliedstaat genutzt werden.

Bitte beachtet aber folgendes. Wenn Ihr in einem Land mehrere Lager nutzt, dann kann laut BZSt maximal ein Lager angegeben werden. Wenn Ihr für mehrere Lager nur eine USt-ID habt, könnt Ihr nur ein Lager pro Land melden.

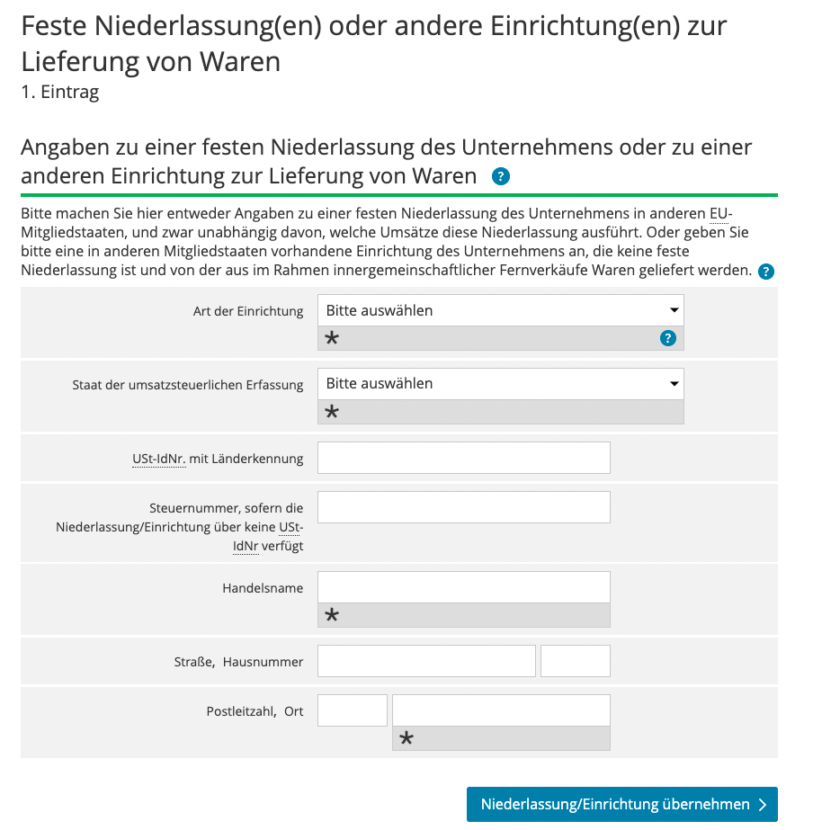

Pro Lager sind bei der OSS-Registrierung die folgenden Angaben zu machen:

- Art der Einrichtung: Lager gelten als “andere Einrichtung”

- Staat der umsatzsteuerlichen Erfassung: Staat, in dem das Lager ist, z.B. “Polen”, “Frankreich”, etc.

- USt-IdNr. mit Länderkennung: Eure ausländische UST-IdNr. für den jeweiligen Staat des Lagers, also z.B. “PL1234567890”

- Handelsname: z.B. “Amazon Fulfillment Center”

- Straße, Hausnummer, PLZ, Ort: Anschrift des ausländischen Lagers, also z.B. “ul, Okmiany 3C, 59-225 Okmiany” (beispielhaft aufgeführt für ein Amazon FBA Lager in Polen)

Wir haben für Euch eine Liste mit den Adressen aller bekannten Amazon EU Lager zusammengestellt. Die dort gelisteten Anschriften könnt Ihr, zusammen mit Eurer USt-ID für das jeweilige Land, direkt bei der OSS Registrierung einkopieren.

Wichtiger Hinweis:

Achtet unbedingt darauf, dass Ihr hier die Lager für alle Länder angebt, aus denen Ihr Waren versendet. Lest weiter unten im Abschnitt “OSS-Meldung abgelehnt bei fehlenden Angaben zu ausländischen Warenlagern”, warum das so wichtig ist.

7. Bestätigung der Registrierung für das One Stop Shop Verfahren

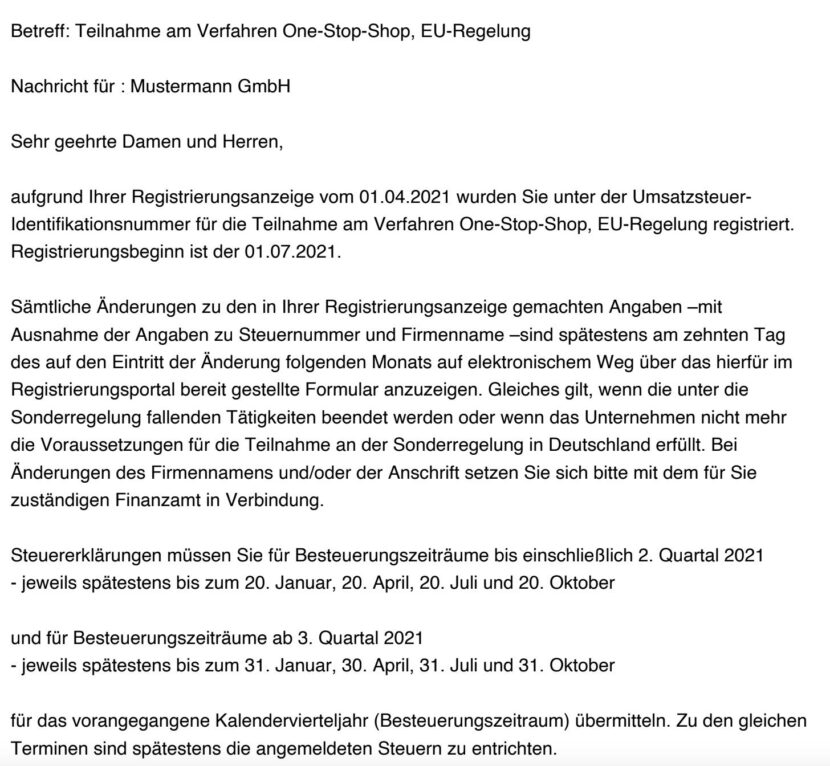

Nach Ausfüllen aller Felder des OSS Registrierungsverfahrens und Prüfung Eurer Angaben sendet Ihr das ausgefüllte Formular mit einem Klick ab. Anschließend erhaltet Ihr zunächst eine Anmeldebestätigung vom BZSt, die den folgenden Text enthält:

Sehr geehrter Herr Mustermann,

in Ihrem Mein BOP Posteingang befindet sich eine neue Nachricht für Sie.

Betreff: Bestätigung der Übermittlung Registrierungsanzeige für die Teilnahme an der OSS EU-Regelung (vormals Mini-One-Stop-Shop)

Absender: Bundeszentralamt für Steuern

Datum: 01.04.2021, 17:10

Sie können sie unter: https://www.elster.de/bportal/ abrufen.

Ihr Benutzername lautet: Muster-xx

Mit freundlichen Grüßen

Ihr Bundeszentralamt für Steuern

… Falls Sie Fragen zu Mein BOP oder zur Verwendung des ElsterAuthenticator haben, durchsuchen Sie bitte zuerst unsere FAQ (Häufig gestellte Fragen): https://www.elster.de/bportal/start?themaGlobal=help_bop oder fragen Sie unseren Info-Assistenten: https://elias.elster.de/nmIQServer/index.html

Das vervollständigte Anmeldeformular könnt Ihr jederzeit unter Meine Formulare einsehen bzw. herunterladen.

Nach der Bearbeitung der Registrierung durch das Bundeszentralamt für Steuern wird folgende Bestätigung zur Teilnahme am OSS Verfahren übermittelt:

Die Registrierungsanzeige bestätigt also Eure Teilnahme am OSS-Verfahren. Eure erste OSS-Meldung könnt Ihr dann erstmals für das nach der Registrierung folgende Quartal an das BZSt übermitteln.

Auch wenn Eure Registrierung für das OSS-Verfahren schon einige Zeit zurückliegt und Ihr die Anmeldung rechtzeitig vorgenommen habt, empfehlen wir Euch:

Prüft kurz vor Abgabe der ersten OSS-Meldung noch einmal gründlich, ob Ihr alle Angaben bei der Registrierung vorgenommen habt. Fehlende Angaben bei der Registrierung können ansonsten weitreichende Folgen haben.

OSS-Meldung wird abgelehnt bei fehlenden Angaben während der Registrierung zu ausländischen Warenlagern

Die ersten Praxiserfahrungen in 2021 mit der damals noch manuellen OSS-Meldung im Portal “Mein BOP” des BZSt zeigten, dass unvollständige Angaben bei der OSS-Registrierung sogar zur Ablehnung der Meldung führen können.

Wann kommt es dazu?

Wenn Ihr ausländische Lager im Rahmen von grenzüberschreitenden Fulfillment-Strukturen (Amazon FBA u.ä.) nutzt und Eure Waren daher auch aus dem EU-Ausland an Privatkunden versendet, dann gilt: B2C-Lieferungen aus dem EU-Ausland sind gesondert von Lieferungen aus Deutschland anzugeben.

In unserem Blogbeitrag zur manuellen OSS Meldung beschreiben wir, wie Ihr die Meldung in Deutschland befüllen müsst.

Sobald Ihr Umsätze erfasst, die Ihr aus anderen EU-Mitgliedstaaten versendet habt, wird vom OSS eine Plausibilitätsprüfung durchgeführt.

Bei dieser Plausibilitätsprüfung wird validiert, ob Ihr für die Länder, aus denen Ihr Eure Waren verschickt bzw. verschicken lasst, im Rahmen der Registrierung auch die entsprechenden Lager hinterlegt habt.

Für jedes EU Land, aus dem Ihr versendet, muss bei der OSS Registrierung ein Lager hinterlegt sein

Solltet Ihr die Lager nicht oder nicht vollständig im Rahmen der Registrierung angegeben haben, wird Eure OSS-Meldung seitens des BZSt als “nicht plausibel” abgelehnt.

Wir verdeutlichen dies nochmal an einem Beispiel:

Stellt Euch vor, Ihr nehmt am Amazon CEE Programm teil, was dazu führt, das Amazon Eure Produkte in Polen und Tschechien einlagert und von dort versendet. Bei der Registrierung für das OSS-Verfahren habt Ihr aber nur das Lager in Polen registriert. Das Amazon Lager in Tschechien habt Ihr vergessen.

Ihr gebt nun Eure Umsätze für Q3 in der manuellen OSS-Meldung im Portal “Mein BOP” ein. Hierbei erfasst Ihr beispielsweise auch Verkäufe aus Tschechien an Privatkunden in Frankreich.

Da Ihr das Lager in Tschechien aber bei der Registrierung nicht angegeben habt, sind die Verkäufe aus Tschechien aus Sicht des BZSt nicht plausibel. Ergebnis: Eure gesamte OSS-Meldung wird abgelehnt.

Damit Ihr diese Erfahrung vermeiden könnt, erläutern wir Euch nachfolgend nochmals, welche Prüfungsschritte vor Abgabe der ersten OSS-Meldung angebracht sind.

Prüfung der OSS-Registrierung vor Abgabe der ersten OSS-Meldung

Im Portal “Mein BOP” könnt Ihr Eure Registrierungsanzeige für das OSS-Verfahren aufrufen.

Hier könnt Ihr insbesondere überprüfen, ob Ihr alle ausländischen Lager angegeben habt.

Solltet Ihr im Rahmen der Überprüfung feststellen, dass Ihr noch weitere Lager erfassen müsst, könnt Ihr diese ergänzen. Dazu müsst Ihr Eure Registrierungsdaten bearbeiten. Hierzu öffnet Ihr im Portal “Mein BOP” “Alle Formulare” und wählt dann “One-Stop-Shop für in der EU ansässige Unternehmer – EU Regelung”.

Dort findet Ihr als zweiten Unterpunkt die Option “Änderung der Registrierungsdaten zur OSS EU-Regelung”. Hier könnt Ihr zusätzliche Lager hinterlegen.

Hinweis: Auch wenn sich im Laufe der Zeit Angaben ändern, seid Ihr verpflichtet, die entsprechenden Angaben in der OSS-Registrierung zu aktualisieren.

Rückblick: Fehlermeldungen Oktober 2021:

Auch wenn Ihr alle Angaben während der OSS-Registrierung, insbesondere zu ausländischen Lagern, korrekt eingegeben und ebenso das Formular für die erste OSS Meldung mit den richtigen Daten gefüllt hattet, kam es zu Fehlermeldungen und abgelehnten OSS-Meldungen.

Lest in unserem Blogpost „OSS Meldung fehlgeschlagen“ über die Hintergründe der abgelehnten Meldungen, und was in solchen Fällen für Euch zu tun ist.

Abschließend haben wir noch Antworten auf die 3 häufigsten Fragen rund um die OSS Anmeldung.

Ist die OSS Registrierung Pflicht?

Die Teilnahme am OSS-Verfahren ist freiwillig, somit ist auch die Registrierung keine Pflicht. Wer auf die Teilnahme am OSS-Verfahren verzichtet, hat weiterhin die Möglichkeit, Fernverkäufe aus anderen EU-Ländern dort jeweils lokal zu melden.

Frist zur OSS Registrierung

Die Anmeldung zum OSS Verfahren kann jederzeit erfolgen. Die Teilnahme am OSS-Verfahren ist dann jeweils zum Beginn des darauffolgenden Quartals möglich. Händler, die beim OSS vom ersten möglichen Quartal (Q3 2021) dabei sein wollten, konnten sich frühestens ab 01.04.2021 anmelden, bzw. mussten ihre Registrierung spätestens bis zum 30.06.2021 abgeschlossen haben.

Kann man auch von der Teilnahme am OSS Verfahren ausgeschlossen werden?

Folgende Gründe können dazu führen, dass eine Teilnahme am OSS Verfahren versagt wird oder ein Onlinehändler nachträglich durch die Finanzbehörde wieder ausgeschlossen wird:

- Keine oder nicht rechtzeitige Übermittlung der notwendigen Steuererklärungen beim Bundeszentralamt für Steuern

- Missachtung der Aufzeichnungspflichten im Zusammenhang mit dem OSS Verfahren; oder keine oder nicht rechtzeitige Zurverfügungstellung der aufgezeichneten Daten an die Finanzbehörden auf Nachfrage

Hinweis:

Onlinehändler können auch von der Teilnahme am OSS Verfahren ausgeschlossen werden, beispielsweise wenn die relevanten Aufzeichnungspflichten nicht erfüllt werden. Sofern ein/e Onlinehändler in der Vergangenheit vom MOSS Verfahren ausgeschlossen worden ist, ist anzunehmen, dass ebenfalls eine Teilnahme am OSS Verfahren durch die zuständige Behörde verneint wird.

Taxdoo bietet Lösungen – für OSS und mehr

Ihr wollt mehr darüber wissen, wie Ihr OSS-Meldungen, EU Umsatzsteuer-Pflichten, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt?

Wählt über diesen Link einen Termin für Euer individuelles und kostenloses Erstgespräch mit den E-Commerce- und Umsatzsteuer-Experten von Taxdoo!

Weitere Beiträge

OSS-Meldungen für Q1-2024 abgelehnt, weil Steuersätze beim BZSt nicht up to date sind.

OSS-Mahnungen aus Spanien für Q3 und Q4 2021: BZSt dieses Mal nicht Schuld