Kosten der Umsatzsteuersenkung in Deutschland: 239 Mio Euro

Nach dem Einbruch durch Covid19 soll eine temporäre Senkung der Umsatzsteuer den Konsum in Deutschland wieder beleben.

Inwieweit dieser Effekt eingetreten ist bzw. noch wird, lässt sich seriös erst zum Ende des Jahres sagen. Jetzt liegen allerdings Zahlen vor, welche einen Überblick zu den Umstellungskosten für die Wirtschaft offenbaren.

Kosten in Höhe von 1,25 Prozent des erwarteten Volumens

Die Bundesregierung bzw. das Statistische Bundesamt schätzen die Kosten im Rahmen einer aktuellen Mitteilung auf aktuell 239 Millionen Euro.

Hinweis: Die Kosten betreffen sowohl die Senkung zum 1. Juli 2020 als auch die Wiederanhebung zum 1. Januar 2021.

Das beinhaltet insbesondere die Anpassung der Steuereinstellungen in SAP, DATEV & Co. sowie weitere Prozesse, welche weitgehend in der Finanzbuchhaltung verankert sind.

Führt man sich vor Augen, dass die Bundesregierung in ihrer Prognose von einer Entlastung durch die niedrigere Umsatzsteuer in Höhe von knapp 19 Milliarden Euro ausging, hat diese Entlastung 1,25 Prozent gekostet – auf Unternehmensseite.

Wer profitiert und wer nicht?

Das ist pauschal schwer zu sagen. Schauen wir uns einmal den Bereich der Lebensmitteldiscounter an, um die Systematik besser zu verstehen.

Lebensmitteldiscounter: Aufgrund des starken Wettbewerbs haben die Lebensmitteldiscounter die Umsatzsteuersenkung fast vollständig an die Endverbraucher durchgereicht. Das bedeutet, ihnen sind die o.g. anteiligen Kosten der Umstellung entstanden; den Nutzen hatten voerst nur die Kunden. Insbesondere untere Einkommenssegmente, die einen Großteil ihres Einkommens konsumieren, profitieren. Diese Einkommensgruppen zahlen teilweise auch keine oder nur geringe Ertragsteuern, sodass eine Senkung der Einkommensteuer sie nicht erreicht hätte.

Haben die Discounter also gar nicht profitiert? Doch! – und zwar dann, wenn aufgrund der Steuersenkung die Nachfrage steigt.

Für andere Segmente sind die Resultate sehr heterogen und hängen oft stark vom Grad des Wettbewerbs ab: Je geringer der Wettbewerb, desto größer die Wahrscheinlichkeit, dass der Unternehmer unmittelbar von der Steuersatzsenkung profitiert.

Verkäufer von Handyhüllen dürften daher im Durchschnitt die Verlierer im Bereich Onlinehandel sein, da sie aufgrund des immens hohen Wettbewerbs die Steuersenkung auch fast vollständig durchreichen müssen und die Kosten der Umstellung tragen müssen.

Darüber hinaus zeigten sich in den vergangenen Wochen zahlreiche Schwachstellen.

Automatisierung: Wunsch und Wirklichkeit

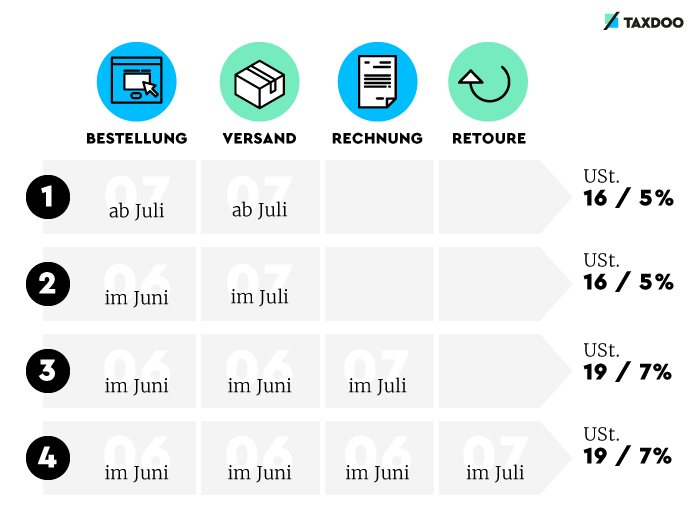

Ein Großteil der Kosten entsteht aufgrund der Komplexität der meisten Prozesse in der Finanzbuchhaltung und Umsatzsteuer-Compliance. Viele Unternehmen hadern dabei mit einer sauberen Abgrenzung der temporären Steuersatzsenkung – siehe folgende Grafik.

Insbesondere im E-Commerce ist das umsatzsteuerlich relevante Leistungsdatum – regelmäßig der Zeitpunkt der Versand der Ware – häufig nicht implementiert.

Das führte bei vielen zu großen Herausforderungen im Rahmen der Umstellung.

Warum Befristung auf sechs Monate?

Eine Frage, welche die Bundesregierung in diesem Zusammenhang ebenfalls beantwortete.

Warum erfolgte die Senkung der Umsatzsteuer nicht länger – z.B. mindestens für ein Jahr?

Die Antwort ist aus ökonomischer Sicht nachvollziehbar und deutet an, dass auch die Bundesregierung mit einem Nachfrageschub rechnet, der sich stetig bis zum Ende des Jahres aufbauen wird.

Die unmittelbare Nachfragewirkung soll durch Vorzieheffekte der Verbraucher verstärkt werden. Diese sind nur zu erwarten, wenn eine klare Befristung der Maßnahme von vornherein festgelegt wird. Mit einer Beschränkung der Umsatzsteuersatzsenkungen auf sechs Monate agiert die Bundesregierung zielgerichtet und nutzt die Verstärkerwirkung von Vorzieheffekten.

Taxdoo ist die Plattform für automatisierte und sichere Umsatzsteuer-Prozesse

… und bildet für die führenden Onlinehändler in Europa neben der Abwicklung der laufenden EU-weiten Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.