Die Haftung der Marktplätze für Umsatzsteuer kommt – und noch viel mehr!

(Hinweis: Hier gibt es ein Update zu den folgenden Informationen.)

Allein auf Amazon und eBay werden durch Händler aus dem Drittland—insbesondere China—nach Schätzungen Umsatzsteuern in Höhe von bis zu 1 Mrd. Euro pro Jahr in Deutschland hinterzogen.

Nun liegt ein Gesetzesentwurf vor, der dieses Problem ab 2019 beheben soll und noch deutlich darüber hinaus geht.

- Marktplätze können unter bestimmten Voraussetzungen für die nicht abgeführten Umsatzsteuern aller Marktplatzhändler haftbar gemacht werden.

- Die deutsche Finanzverwaltung—bislang überrumpelt von den Herausforderungen der digitalen Ökonomie—überträgt das Problem der Ermittlung der Besteuerungsgrundlagen teilweise auf die Marktplätze.

- Unternehmen, die ihren steuerlichen Pflichten nicht vollumfänglich nachkommen, laufen Gefahr, zukünftig vom Marktplatzhandel ausgeschlossen zu werden.

In welchem Umfang haften Amazon, eBay und Co. ab dem kommenden Jahr?

Die Regelung ist einfach und klar formuliert und geht weit über die Problematik der China-Händler hinaus.

Der Entwurf des § 25e Absatz 1 UStG lautet wie folgt:

Der Betreiber eines elektronischen Marktplatzes (Betreiber) haftet für die nicht entrichtete Steuer aus der Lieferung eines Unternehmers, die auf dem von ihm bereitgestellten Marktplatz rechtlich begründet worden ist.

Somit haften die Marktplätze nicht nur für die Umsatzsteuer von Händlern aus dem Drittland (insbesondere China), sondern für die Umsatzsteuer aller Lieferungen, welche über den Marktplatz vermittelt werden.

Das bedeutet, dass die Marktplätze für jeden Euro Umsatzsteuer haftbar gemacht werden können, welcher von einem Marktplatzhändler nicht abgeführt wird.

Dabei sind viele Konstellationen denkbar.

- In erster Linie zielt das Gesetz auf Händler aus China ab, welche ihre Umsatzsteuer nicht abführen.

- Aber auch Händler aus Deutschland oder der EU, die z.B. in die Insolvenz gerutscht sind und ihre Steuerrückstände nicht mehr begleichen können, können die Haftung auslösen.

- Auch Privatpersonen stehen im Fokus, welche wissentlich oder unwissentlich gewerblich handeln.

==Damit das Haftungsrisiko für die Marktplätze nicht unberechenbar groß wird, sieht der § 25e UStG auch Ausnahmen für die Haftung vor. ==

Ausnahmen von der Marktplatzhaftung

Die Haftung tritt u.a. in den folgenden Fällen nicht ein.

- Der Marktplatz kann nachweisen, dass er keine Kenntnis über die Nichtzahlung der Umsatzsteuer hatte bzw. nach den Sorgfaltspflichten eines ordentlichen Kaufmanns haben konnte.

- Bei Händlern, welche sich nicht als Unternehmer auf dem Marktplatz registrieren aber dennoch gewerblich handeln, tritt die Haftung nicht ein, wenn anhand der Art, Menge und Höhe der Umsätze nicht von einem gewerblichen Handel auszugehen war.

Wie können die Marktplätze die genannten Kriterien erfüllen und welche Auswirkungen hat das?

Haftungsausschluss: Kaufmännische Sorgfaltspflicht der Marktplätze

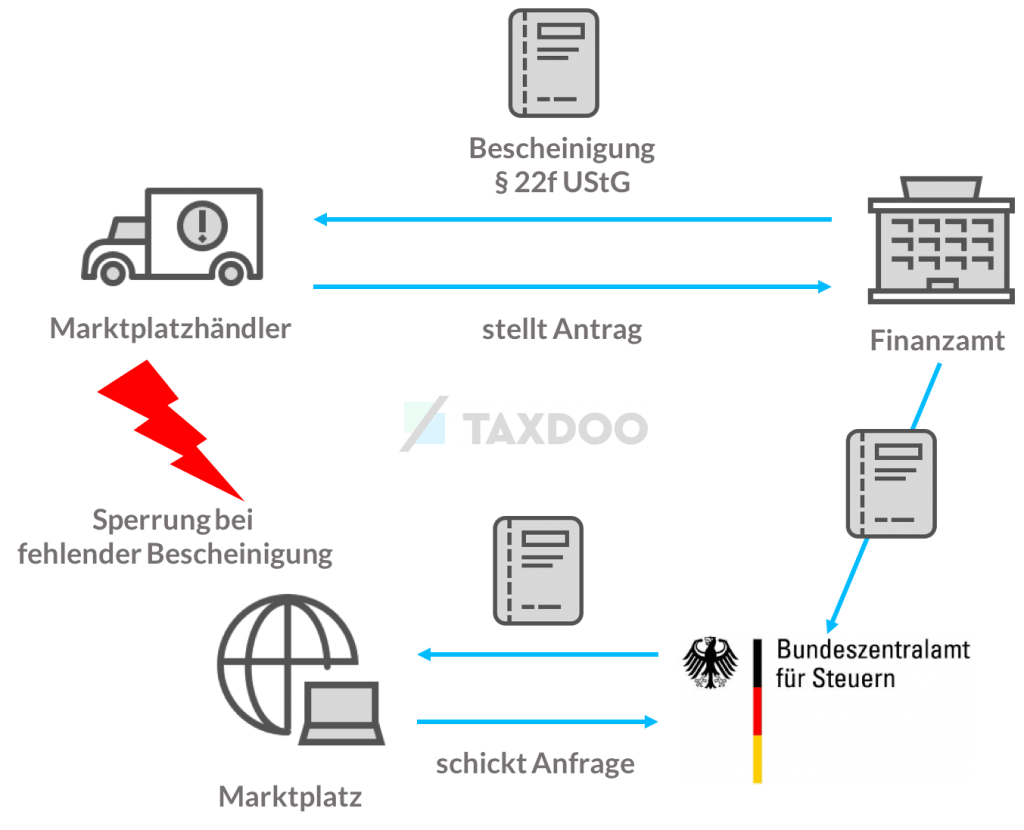

Der § 25e UStG regelt, dass die Marktplätze insbesondere dann keine Kenntnis von der fehlenden Pflichterfüllung des jeweiligen Händlers hatten, wenn ihnen eine Bescheinigung des für den Händler zuständigen Finanzamtes vorliegt.

Der ebenfalls neue § 22f UStG setzt den Inhalt und die Kriterien für diese Bescheinigung (im Folgenden Bescheinigung) fest.

Demnach bestätigt das für den Händler zuständige Finanzamt dem Händler die Gültigkeit seiner Stammdaten (z.B. die Adresse und die Steuernummer) und dass er seinen steuerlichen Pflichten bislang nachgekommen ist und auch zukünftig nachkommen wird.

Die Bescheinigung wird zeitlich befristet ausgestellt werden.

Es handelt sich damit letztendlich um eine steuerliche Unbedenklichkeitsbescheinigung, die, soweit sie nicht ausgestellt wird, den Zugang zum Marktplatzhandel versperren kann.

§ 22f Abs. 1 S. 4 UStG: Die Erteilung der Bescheinigung kann insbesondere dann abgelehnt werden, wenn der Unternehmer seinen steuerlichen Verpflichtungen nicht oder nicht in vollem Umfang nachgekommen ist und auch nicht zu erwarten ist, dass er diesen zukünftig nachkommen wird.

Das kann z.B. bedeuten, dass ein Händler, der seine Umsatzsteuer-Voranmeldungen regelmäßig verspätet abgibt und im Zweifel noch Steuerrückstände hat, diese Bescheinigung mit hoher Wahrscheinlichkeit nicht erhalten wird.

Die Konsequenz könnte sein, dass der Marktplatz diesen Händler sperrt, um nicht im Zweifel für dessen Umsatzsteuer zu haften.

Die Bescheinigung erstellt das zuständige Finanzamt dem Händler auf Antrag. Es leitet diese Information aber auch an das Bundeszentralamt für Steuern weiter. Dort dürfen die Marktplätze sich dann eine entsprechende Auskunft holen.

Haftungsausschluss: Überwachung von Art, Menge und Höhe der Umsätze

Der Ausschluss der Haftung bei sogenannten scheinprivaten Händlern—also Händlern, die sich auf einem Marktplatz als Privatperson registrieren und dennoch gewerblich handeln—ist dagegen recht schwammig formuliert.

In diesem Fall haften die Marktplätze nur dann nicht, wenn anhand der Art, Menge und Höhe der Umsätze nicht erkennbar war, dass es sich um einen gewerblichen Händler handelt.

Die Marktplätze als Außenstellen der Finanzämter

Der § 25e UStG regelt zudem, dass die Finanzämter auch sogenannte Sammelauskunftsersuchen bei den Marktplätzen einleiten dürfen. Die aktuellen gesetzlichen Hürden (z.B. dass ein hinreichender Anfangsverdacht bestehen muss) greifen in diesem Fall ausdrücklich nicht.

Insofern schafft die Neuregelung auch eine Gesetzesgrundlage für umsatzsteuerliche Rasterfahndungen auf elektronischen Marktplätzen.

Die Rasterfahndungen werden dadurch erleichtert, dass die Marktplätze verpflichtet sind, ab 2019 für jede Lieferung die folgenden Informationen aufzuzeichnen:

- Stammdaten und Steuernummer des Händlers (bei privaten Verkäufern anstelle der Steuernummer das Geburtsdatum),

- das Beginn- und Enddatum der Bescheinigung,

- den Ort des Beginns der Versendung und den Bestimmungsort sowie

- den Zeitpunkt und die Höhe des Umsatzes.

Wie genau würde die Haftung der Marktplätze ablaufen?

Bevor der Marktplatz für nicht abgeführte Umsatzsteuer haftbar gemacht werden kann, muss die entsprechende Umsatzsteuer zunächst einmal festgesetzt werden.

Das zuständige Finanzamt muss dafür die Steuerpflicht in Deutschland erkennen und anschließend die Besteuerungsgrundlagen—in diesem Fall die Höhe der Entgelte—ermitteln.

Da die Marktplätze ab dem 01.01.2019 alle Lieferungen, welche in Deutschland beginnen oder enden, dokumentieren und auf Anfrage an das Finanzamt melden müssen, wären die technischen Grundlagen dafür gelegt.

Der Marktplatz als sogenannter Haftungsschuldner der Umsatzsteuer darf letzten Endes aber nur in Anspruch genommen werden, wenn die Vollstreckung in das Vermögen des Steuerschuldners ohne Erfolg geblieben ist bzw. davon auszugehen ist, dass dies wahrscheinlich ist.

Besonderheiten bei Händlern aus dem Drittland (z.B. China)

Händler aus dem Drittland (z.B. China) erhalten die Bescheinigung nur, wenn sie einen Empfangsbevollmächtigten in Deutschland benennen.

Das Finanzamt darf bei diesen Händlern auch dann den Marktplatz als Haftungsschuldner in Anspruch nehmen, wenn eine Vollstreckung gegen den Steuerschuldner noch gar nicht eingeleitet worden ist.

Gute Ideen! Gibt es negative Effekte?

Der Gesetzesvorschlag stellt eine Zeitenwende dar. Der Gesetzgeber überträgt einen großen Teil der Verantwortung im Bereich der Erhebung der Umsatzsteuer auf die Marktplätze.

Diese müssen zudem ab dem nächsten Jahr umfangreichen Dokumentations- und Überwachungspflichten auf Transaktionsbasis nachkommen, wollen sie sich nicht hohen Haftungsrisiken aussetzen.

Dabei gibt es noch zahlreiche offene Fragen und technische Herausforderungen, die es in den kommenden Monaten zu klären gilt.

Dies wird wahrscheinlich zu höheren Kosten der Marktplatzbetreiber führen, welche dann indirekt an die Endverbraucher weitergereicht werden könnten.

Mit Taxdoo einfach und automatisiert Umsatzsteuerpflichten erfüllen

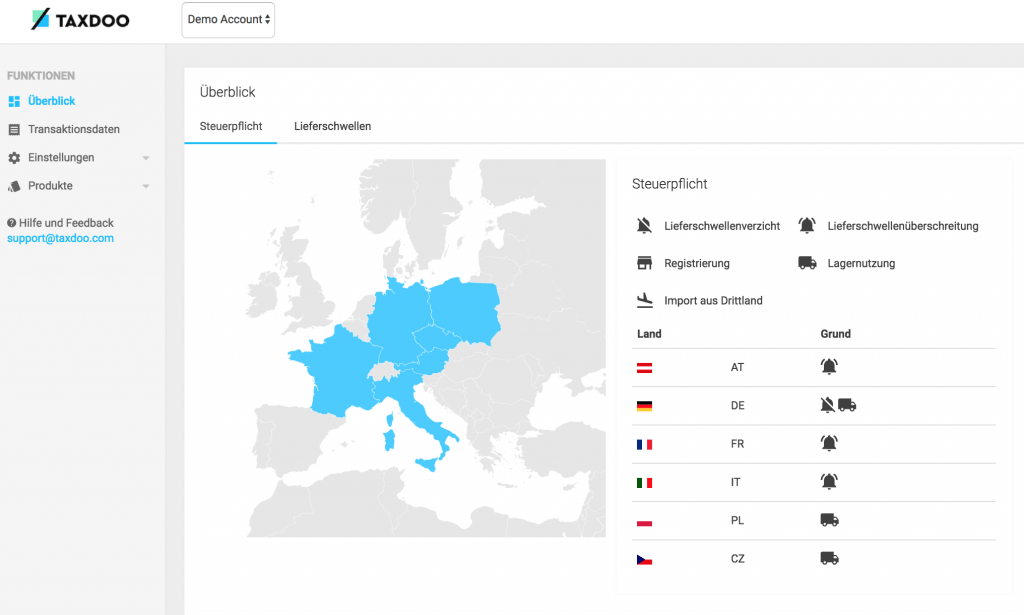

Taxdoo ist die erste cloudbasierte und vollautomatisierte VAT-Engine für den Onlinehandel und hilft dabei, umsatzsteuerlichen Pflichten frist- und formgerecht nachkommen zu können.

Taxdoo kann dazu automatisiert Rohdaten aus Marktplätzen (z.B. Amazon oder eBay) und ERP-Systemen (z.B. Plentymarkets und JTL) auslesen und

- Buchhaltungsexporte erstellen,

- eure Umsätze im Ausland melden,

- tagesaktuell Lieferschwellen überwachen,

- Verbringungen dokumentieren und

- vieles mehr.

Darüber hinaus haben wir die Taxdoo-API für unsere Kunden und externe Entwickler geöffnet. Damit können Transaktionen aus allen Shopsystemen und ERPs ohne großen Aufwand in Taxdoo importiert werden.

Klickt einfach hier oder auf den Button unten und bucht eine Live-Demo, in der wir euch und/oder eurem Steuerberater per Bildschirmübertragung persönlich die Vorteile unserer automatisierten Umsatzsteuer-Compliance erklären.