Gastbeitrag: Raus aus der Schattenwelt – straffrei und eventuell sogar mit Gewinn

Umsatzsteuerpflicht im Ausland

Die meisten Online-Händler wissen es bereits. Sobald die Versandhandelsschwelle für Lieferungen an Kunden in einem bestimmten Land gerissen wird, muss dort entsprechend die Umsatzsteuer abgeführt werden. Gleiches gilt ebenfalls, wenn ihr als Händler an Amazon-Programmen wie z.B. CEE und Pan EU teilnehmt und Kunden aus einem FBA-Warenlager beliefert. Dann wird die ausländische Umsatzsteuer in dem jeweiligen Land schon ab dem ersten Euro fällig.

In diesen Fällen wird den Kunden also nicht die deutsche, sondern die ausländische Umsatzsteuer berechnet. Das ist eine unschöne bürokratische Begleiterscheinung des Online-Handels.

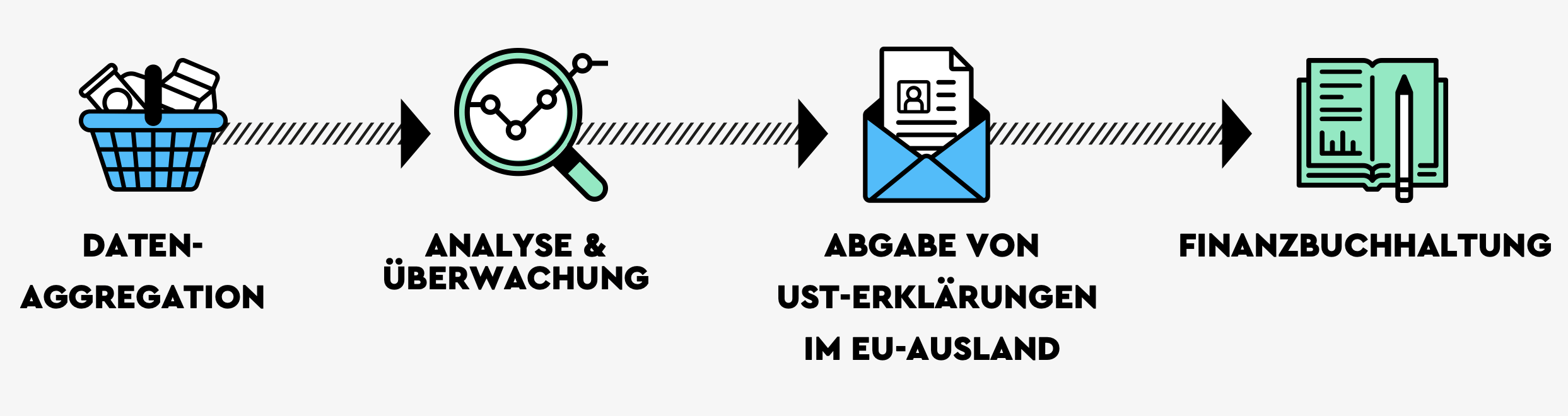

Erfreulicherweise gibt es inzwischen Compliance-Plattformen, wie Taxdoo. Hier werden nicht nur eure Steuerpflichten im Ausland überwacht, auch die regelmäßigen Meldungen für die ausländischen Steuerbehörden können automatisiert erstellt werden. So muss lediglich noch die von den Kunden eingenommene Umsatzsteuer an den Fiskus überwiesen werden.

Den richtigen Zeitpunkt verpasst

Es gibt jedoch viele Online-Händler, die bereits vor Jahren steuerpflichtig im Ausland geworden sind und dies erst später bemerkt haben. So mancher hat vielleicht auch den Aufwand der Registrierung und Abgabe von Steuererklärungen im Ausland gescheut. In den meisten Fällen haben die Umsätze jedoch von Jahr zu Jahr zugenommen und inzwischen drückt das schlechte Gewissen immer stärker. Eigentlich möchte man reinen Tisch machen. Es drohen aber Strafen und Zinsen, die den mühsam erzielten Gewinn auffressen würden. Ganz zu schweigen von dem Aufwand, die Zahlen zu ermitteln und rückwirkend Steuererklärungen abzugeben.

Strafrechtliche Konsequenzen drohen

Und dann gibt es möglicherweise auch noch ernsthaftere strafrechtliche Konsequenzen. Ihr seid schnell dem Vorwurf der Steuerhinterziehung ausgesetzt, wenn Steuern wissentlich – oder auch unwissentlich – nicht gezahlt werden.

Hinweis: Als Unternehmer seid ihr stets verpflichtet, euch vorab über eure steuerlichen Pflichten, auch im Ausland, zu informieren.

Es gibt viele Länder in Europa, die das nicht ganz so streng sehen. In einigen Ländern, allen voran Deutschland und Österreich, kann jedoch ein Strafverfahren drohen, wenn ihr als Online-Händler die Umsatzsteuer nicht korrekt abführt. In Deutschland könnt ihr sogar als deutscher Händler belangt werden, wenn ihr ausländische Steuern hinterzogen habt. Glücklicherweise ist dieser Paragraph (noch) nicht jedem deutschen Finanzbeamten bekannt oder er wird ignoriert, weil keine deutsche Steuer verloren gegangen ist.

Das Risiko, in ein Strafverfahren hineinzulaufen, besteht aber dennoch.

Hohes Aufdeckungsrisiko

Die Wahrscheinlichkeit, dass der ausländische Fiskus von den Umsätzen an die einheimischen Kunden Wind bekommt, ist nicht gering. So haben z.B. die österreichischen Steuerbehörden das Recht, bei Paketdiensten Informationen abzufragen und somit in Erfahrung zu bringen, welche Pakete ein ausländischer Händler nach Österreich verschickt hat. Durch solche Auskunftsersuchen wurde schon so manches Strafverfahren eröffnet.

Und auch der deutsche Finanzbeamte könnte mit einem Blick in die Buchhaltung bemerken, wenn Unregelmäßigkeiten auftauchen und den ausländischen Fiskus darüber informieren. Da Deutschland von der EU-Kommission schon mehrfach aufgefordert wurde, mehr Informationen mit den anderen EU-Mitgliedstaaten zu teilen, ist dies für die Zukunft auch nicht ganz unwahrscheinlich. Ähnlich ist es auch in anderen Ländern, wie z.B. bei unseren Nachbarn in Frankreich und Dänemark.

Verschweigen der Vergangenheit ist nicht ungefährlich

So mancher Online-Händler hat sich irgendwann durchgerungen und im Ausland registrieren lassen. Dabei wird aber oft der Fehler gemacht, die Vergangenheit zu verschweigen und lediglich eine Registrierung für die Zukunft zu beantragen. Was eigentlich ein Schritt in die richtige Richtung ist, kann schwer nach hinten losgehen.

In jedem Registrierungsantrag muss angegeben werden, ab wann im jeweiligen Land steuerpflichtige Umsätze gemacht wurden bzw. werden. Wenn hier wissentlich falsche Angaben gemacht werden, ist das nicht nur Steuerhinterziehung, sondern es wird auch noch schriftlich dokumentiert.

Mit viel Glück hinterfragt oder kontrolliert das niemand. Falls aber doch, ist es nicht ganz unwahrscheinlich, dass ein Strafverfahren wegen Steuerhinterziehung eröffnet wird.

Straffreiheit durch freiwillige Offenlegung

Das einzig sichere Mittel gegen strafrechtliche Konsequenzen ist die Selbstanzeige. Das klingt erstmal gefährlich. Viele denken eventuell auch: Warum sollte ich mich selbst anzeigen? Der große Vorteil ist jedoch, dass man straffrei ausgeht, wenn es richtig angestellt wird.

Dahinter steht der Gedanke: Wer freiwillig und umfassend reinen Tisch macht, soll nicht bestraft werden. Man muss nur aufpassen, dass man es richtig macht.

Die meisten kennen sicherlich die Geschichte von Uli Hoeneß. Auch er wollte eine Selbstanzeige abgeben und so zurück in die Legalität gelangen. Hierbei ist leider etwas schiefgelaufen, da bei der Selbstanzeige offenbar Fehler gemacht wurden.

Damit eine Selbstanzeige wirksam ist, müssen bestimmte Formalien beachtet werden. Dafür sollte sich also bestenfalls ein Berater gesucht werden, der die entsprechende Expertise auf diesem Gebiet mitbringt.

Finanzielle Belastung reduzieren und ggf. in zusätzliche Gewinne umkehren

Neben der strafrechtlichen Aspekte ist nicht minder wichtig, wie man die Offenlegung angeht, ohne am Ende pleite zu sein. Schließlich wird der ausländische Fiskus neben der Steuer mindestens auch Zinsen für die verspätete Umsatzsteuerzahlung haben wollen. Und für die administrative Aufarbeitung wird vermutlich ebenfalls Unterstützung benötigt, die Geld kostet.

Hinzu kommt, dass ihr darauf achten solltet, liquide zu bleiben. Dem ausländischen Fiskus muss die Steuer zunächst gezahlt werden bevor die Erstattung der deutschen Steuer beantragt wird. So könnte es vorübergehend zu finanziellen Engpässen kommen, da die Bearbeitung ebenfalls einige Monate in Anspruch nimmt. Ganz zu schweigen davon, dass bei der Erstattung in Deutschland etwas schieflaufen kann, wenn die Beantragung nicht korrekt abgewickelt wird.

Wenn man die Aufarbeitung strategisch richtig angeht und ein Gesamtkonzept entwickelt, kann man nicht nur den finanziellen Schaden im Rahmen halten, sondern z.B. Strafzahlungen und Zinsen durch die richtigen Maßnahmen und deren korrekte zeitliche Abfolge mindern oder sogar ganz vermeiden.

Man kann ebenso durch unterschiedliche verfahrensrechtliche Regelungen in den einzelnen Ländern, wie z.B. abweichende Verjährungsfristen, erreichen, dass man in Deutschland mehr Steuer erstattet bekommt, als man im Ausland zahlen muss – und das auch noch ganz legal. So hat schon der ein oder andere Online-Händler die Vergangenheitsbewältigung mit einem beträchtlichen Gewinn abgeschlossen.

Den Experten vertrauen

Was ihr jetzt tun könnt und wie ihr zurück in die Legalität kommt, ohne schwerwiegende Konsequenzen befürchten zu müssen?

Die Antwort ist einfach: Vertraut den Experten!

KMLZ ist gerne euer Experte, wenn ihr eure umsatzsteuerliche Vergangenheit aufräumen möchtet. Wir betreuen seit vielen Jahren deutsche Unternehmen dabei, ihre Steuerpflichten im Ausland zu erfüllen.

Wir haben bereits viele Offenlegungen in ganz Europa erfolgreich für Online-Händler begleitet. Dabei bekommt ihr bei uns alles aus einer Hand und müsst euch nicht mit verschiedenen Beratern aus den einzelnen Ländern herumschlagen. Wir begleiten euch bei den für die Vergangenheit notwendigen Korrekturen und zeigen euch außerdem, wie dies mit geringem Aufwand möglich ist.

Mit den passenden Gesamtumständen, der richtigen Taktik und etwas Glück schaffen wir es, Steuererstattungen für euch herauszuschlagen. Gerne binden wir dabei auch euren Steuerberater ein, der euch sonst von A bis Z betreut. Auch er ist ein Baustein in der Gesamtstrategie.

Autor dieses Beitrags und euer Ansprechpartner bei KMLZ

Ronny Langer

Dipl.-FW (FH), Steuerberater

Tel.: +49 89 217501250

ronny.langer@kmlz.de

Und wenn ihr mit der Vergangenheit im Reinen seid, hilft euch Taxdoo, die laufenden steuerlichen Verpflichtungen im Ausland sauber und effizient zu erfüllen, sodass ihr euch auf euer Kerngeschäft konzentrieren könnt.

Taxdoo ist die führende Compliance-Plattform für die digitale Ökonomie

… und bildet für die führenden Online-Händler in Europa neben der Abwicklung der laufenden Umsatzsteuer-Compliance noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

P.S.: Taxdoo ist seit Anfang 2020 nun auch offiziell Partner der DATEV im Onlinehandel.

Weitere Beiträge

Finanzamt stoppt App, weil “zu unkompliziert”: Brauchen wir Mindeststandards für TaxTech?

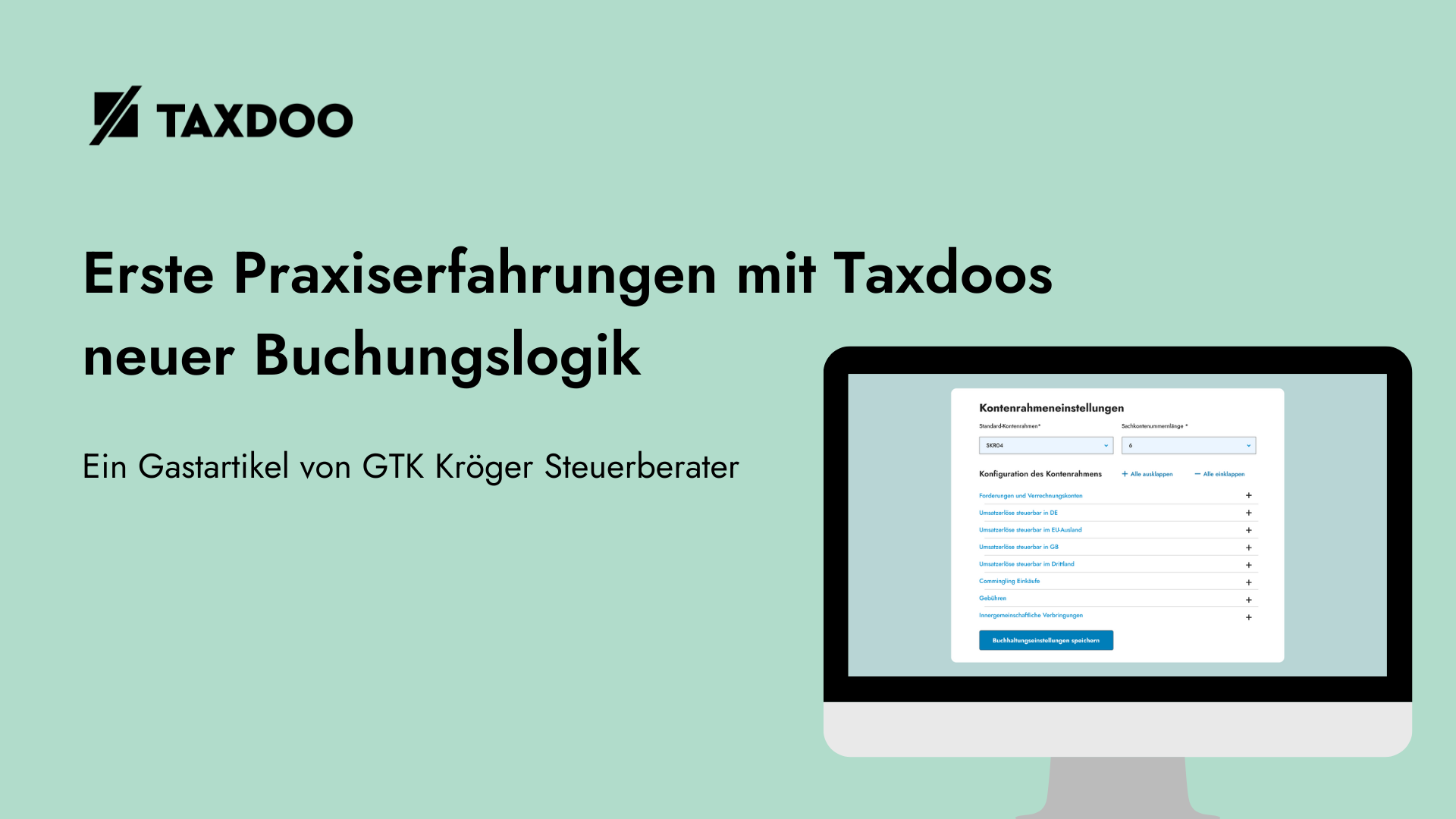

GTK Kröger Steuerberater: Erste Praxiserfahrungen mit Taxdoos neuer Buchungslogik