Gastbeitrag: Falsche Automatisierung – Risiken und Steuerhinterziehung

Bei fast keiner anderen Berufsgruppe treten die Probleme einer unbemerkten, falschen Rechnungsschreibung so oft auf wie beim Onlinehändler. Dies liegt zum einen daran, dass die Entwicklung bei Onlinehändlern oft über Nacht stark skaliert und daher unbemerkt bleibt, zum anderen werden Rechnungen automatisch geschrieben und sind aus dem Blickfeld des Mandanten.

Natürlich schützen diese beiden Begründungen den Mandanten nicht vor Strafen. Soviel vorweg.

Hinweis: Nur weil es technisch möglich ist, alle falsch geschriebenen Rechnungen automatisch zu stornieren und neu zu schreiben, so ist dies umsatzsteuerlich trotzdem mit großen Problemen verbunden.

Wie dies in der Praxis am Ende aufgedeckt wird und warum ihr dies nicht auf die leichte Schulter nehmen sollte, erklären wir im Folgenden.

Welche Varianten kann es bei einer falschen, automatisierten Rechnungsstellung geben und wie gliedern wir unseren Artikel:

- Unrichtiger oder unberechtigter Steuerausweis nach § 14c UStG

- Praxisbeispiel: Grenzüberschreitender Handel – PAN EU und CEE

- Die Praxis – wie kommt es raus?

1. Unrichtiger oder unberechtigter Steuerausweis – Steuerfalle § 14c UStG

Hat ein Unternehmer entweder zu Unrecht oder eine falsche Umsatzsteuer in seinen Rechnungen ausgewiesen, kann dies unbemerkt eklatante Folgen haben. Neben den steuerstrafrechtlichen Konsequenzen einer etwaigen Steuerhinterziehung, können Nachforderungen der Finanzämter das Unternehmen in erhebliche Schieflage bringen.

Hauptanwendungsfall für den § 14 c UStG ist der immer stärker wachsende Bereich des Onlinehandels, insbesondere, wenn Landesgrenzen überschritten werden.

Wenn sich die Konsequenzen auch ähneln, ist zwischen unrichtiger und unberechtigter Ausweisung der Umsatzsteuer zu differenzieren. Vorab sei gesagt, dass sowohl die unrichtig als auch die unberechtigt ausgewiesene Umsatzsteuer zunächst an das Finanzamt abzuführen ist. Bei grenzüberschreitenden Umsätzen ist die Umsatzsteuer nach Feststellung der fehlerhaften oder unberechtigten Ausweisung an das jeweilige ausländische Finanzamt zu leisten, ohne dass es zu einer automatischen Erstattung der bereits geleisteten Umsatzsteuer kommt. Hier droht eine immense Gefahr für die Liquidität des Unternehmens.

Zunächst einmal betrachten wir die beiden Absätze des § 14c UStG, um zu verstehen, wo das Problem liegt.

§ 14c Abs. 1 UStG: Unrichtiger Steuerausweis

Wie dem Absatz 1 zu entnehmen ist, handelt es sich hier um den Fall des gesonderten Ausweises eines höheren als des geschuldeten Umsatzsteuerbetrages.

Klassische Beispiele hierfür sind:

- die Anwendung des vollen Umsatzsteuersatzes von 19 %, obwohl der ermäßigte Satz von 7 % auszuweisen gewesen wäre

- oder das Ausweisen einer Umsatzsteuer für eine umsatzsteuerfreie Leistung

Diese Beispiele sind keine abschließende Auflistung, vielmehr sollen sie aufzeigen, was unter unrichtiger Steuerausweisung zu verstehen ist.

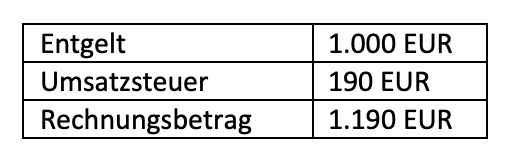

Im folgenden Rechenbeispiel machen wir die Konsequenzen deutlich:

Leistung eines Unternehmers für 1.000 EUR, die mit einer Umsatzsteuer von 7 % auszuweisen ist. Der Unternehmer weist in seiner Rechnung jedoch 19 % aus.

Der Unternehmer würde dem Finanzamt lediglich 7 % Umsatzsteuer aus einem Betrag aus 1.190 EUR schulden, sprich 77,85 EUR. Da er in der Rechnung jedoch 19 % Umsatzsteuer ausgewiesen hat, schuldet er dem Finanzamt die vollen 190 EUR an Umsatzsteuer.

Für den Unternehmer, der die Leistung empfangen hat, bleibt jedoch nur ein Vorsteuerabzug von 77,85 EUR.

Der Ausweg hieraus stellt die Rechnungskorrektur dar.

Dazu muss die ursprünglich fehlerhaft ausgestellte Rechnung entsprechend korrigiert werden, d.h. der Rechnungsbetrag auf 1.070 EUR und die USt auf 70 EUR herabgesetzt werden. Eine Anerkennung dieser Korrektur kann jedoch nur erfolgen, wenn der zu viel gezahlte Betrag von 120 EUR an den Leistungsempfänger zurück gewährt wird.

Alternativ kann die ursprünglich erstellte Rechnung dahingehend korrigiert werden, als dass das Entgelt und die USt entsprechend korrigiert werden – für unser Beispiel bedeutet dies folgendes:

Eine solche Korrektur hat aber die Folge, dass sich die erbrachte Leistung um gut 112 EUR für den Leistungsempfänger verteuert.

Hinweis: Erst bei entsprechender Korrektur und ggf. Rückabwicklung – wie es die erste Option anbietet – besteht ein Anspruch gegen das Finanzamt, die zu viel gezahlte Umsatzsteuer zurück zu erhalten.

Im Falle der zu niedrig ausgewiesenen Umsatzsteuer, schuldet der Unternehmer jedoch die gesetzlich geschuldete Umsatzsteuer. In unserem Beispiel hat der Unternehmer 7 % Umsatzsteuer ausgewiesen, obwohl er den vollen Satz von 19 % hätte ausweisen müssen. Er stellt lediglich einen Rechnungsbetrag von 1.070 EUR inkl. einer USt von 70 EUR aus.

Hier schuldet der Unternehmer eine Umsatzsteuer von 19% aus einem Betrag von 1.070 EUR, sprich 170,84 EUR.

Für den Leistungsempfänger gilt folglich, dass er nur den in der Rechnung ausgewiesenen Umsatzsteuerbetrag von 70 EUR als Vorsteuer abziehen darf. Hat der Leistungsempfänger jedoch einen höheren als die gesetzlich geschuldete Vorsteuer geltend gemacht, so hat er den Mehrbetrag an das Finanzamt zurückzuerstatten.

Fazit: Wie man sieht, führt man die überhöhte Umsatzsteuer erst einmal an das Finanzamt ab. Der Prozess einer Berichtigung ist auch nicht mit unerheblichem Aufwand verbunden und das an das Finanzamt gezahlte Geld ist vorerst einmal weg.

§ 14c Abs. 2 UStG: Unberechtigter Steuerausweis

Absatz 2 bezieht sich auf den Steuerausweis eines Unternehmers oder Nichtunternehmers, der dazu allerdings gar nicht berechtigt ist.

Klassische Beispiele hierfür sind:

- der Kleinunternehmer im Sinne von § 19 Abs. 1 UStG, wenn dieser in einer Rechnung Umsatzsteuer ausweist

- Scheinrechnungen für Leistungen, die nicht ausgeführt wurden

- ein Nichtunternehmer weist in seiner Rechnung Umsatzsteuer aus

- wenn ein Unternehmer nicht im Rahmen seines Unternehmens handelt

Auch hier ist die Auflistung nicht abschließend.

Die Rechtsfolge von Absatz 2 des § 14c UStG ist die, dass die ausgewiesene Umsatzsteuer dem Finanzamt geschuldet wird.

Um die unberechtigt ausgewiesene Vorsteuer zurückzubekommen, sind die fehlerhaften Rechnungen zu korrigieren. Voraussetzung dafür ist neben dem Berichtigungsverfahren auch, dass keine Gefährdung des Steueraufkommens vorliegt.

Eine Gefährdung des Steueraufkommens ist nicht gegeben, wenn der Empfänger der Rechnung keinen Vorsteuerabzug getätigt oder diesen bei der Finanzbehörde rückgängig gemacht hat.

Die Berichtigung des Steuerbetrags ist schriftlich beim zuständigen Finanzamt gesondert zu beantragen.

Fazit: Die Rückabwicklung beim unberechtigten Steuerausweis ist mit noch größerem Aufwand verbunden als bei unrichtigem Steuerausweis.

2. Praxisbeispiel: Grenzüberschreitender Handel – PAN EU und CEE

Richten wir den Blick auf den grenzüberschreitenden Handel. Dabei ist regelmäßig zu prüfen, in welchem Land die Umsatzsteuer abzuführen ist. Hier sind die Lieferschwellen im Auge zu behalten, die voraussichtlich erst Mitte 2021 europaweit vereinheitlicht werden.

Nehmen wir als Beispiel einen in Deutschland ansässigen Unternehmer, der seine Leistungen in den Niederlanden erbringt. Zunächst besteht eine Umsatzsteuerpflicht am Firmensitz, also in Deutschland. Die Lieferschwelle in die Niederlande liegt bei 100.000 EUR im Jahr. Überschreitet unser Unternehmer die Grenze von 100.000 EUR geht das Recht, die Umsätze zu besteuern auf die Niederlande über.

Die Rechnungen des Unternehmers müssten alle mit der niederländischen Umsatzsteuer ausgewiesen werden und entsprechend in den Niederlanden abgeführt werden. Jedoch geschieht dies in einem so automatisierten Bereich wie dem Onlinehandel in den seltensten Fällen. Ab hier nimmt das Dilemma seinen Lauf.

Nachdem man seine vermeintliche Umsatzsteuer an das deutsche Finanzamt geleistet hat, meldet sich irgendwann einmal die niederländische Finanzbehörde und fordert den Unternehmer auf, dass er seine niederländische Umsatzsteuer abführen möge. In den meisten Fällen wird diese Problematik erst nach einigen Jahren im Rahmen einer Prüfung erkannt. Die liquiden Mittel, die für die Zahlung der Umsatzsteuer in Deutschland aufgebracht wurden, sind zunächst einmal weg und schon steckt das Unternehmen in existenziellen Schwierigkeiten. Da viele Online-Händler nicht nur in ein europäisches Ausland liefern, ergibt sich das oben aufgezeigte Problem für alle weiteren Mitgliedsstaaten, in die geliefert wird, sofern die Lieferschwellen überschritten wurden.

Selbst wenn das Unternehmen die aufgezeigte Problematik überstanden hat, ist mit Blick auf den oben gezeigten Ablauf, eine Rückabwicklung und Erstattung der unberechtigt ausgewiesenen Umsatzsteuer fast ausgeschlossen.

Im Bereich des Online-Handels mit mehreren tausend oder zehntausend Rechnungen, steht man vor einer quasi nicht zu bewältigenden Aufgabe.

Zu beachten ist auch, dass für die nicht entrichtete oder zu wenig entrichtete Umsatzsteuer die Verzinsung läuft und Bußgelder drohen. Auch eine mögliche Steuerhinterziehung steht im Raume.

Neben der umsatzsteuerlichen Komponente schlägt sich diese Problematik des § 14c UStG auch auf alle Ebenen der Ertragsbesteuerung durch – Bilanzen und Abschlüsse sind in einem solchen Falle ebenfalls zu ändern.

3. Die Praxis – wie kommt es raus?

Hier gibt es verschiedene Möglichkeiten:

- Entweder wird dies – durch das inländische oder ausländische Finanzamt – im Rahmen einer Betriebsprüfung festgestellt

- oder der Mandant bemerkt seinen Fehler selbst im Laufe des Jahres und korrigiert seine Rechnungen.

Die Betriebsprüfung an sich dürfte hier der schlimmere Fall sein, da der Fehler bis dahin wahrscheinlich für beide Seiten unbemerkt geblieben ist.

Wir rechnen mit einer drastischen Zunahme von Betriebsprüfungen bei Onlinehändlern, da kaum eine andere Berufsgruppe mehr Schwierigkeiten mit dem Umsatzsteuergesetz und falschen Rechnungsschreibungen hat als eben dieser. Aufgrund der QuickFixes und der 22f-Bescheinigung rechnen wir daher mit einer Welle von Prüfungen.

Sollte der Mandant den Fehler bemerkt haben und korrigiert nun seine Rechnungen, so entstehen hohe Differenzen in der Umsatzsteuererklärung am Jahresende. Hierdurch kann bemerkt werden, dass Korrekturen vorgenommen wurden. Denn bei einer sauberen und gepflegten Buchhaltung müsste die Umsatzsteuererklärung am Jahresende mit 0 EUR ausgehen, da unterjährig alles bereits richtig gemeldet und verbucht wurde. Nur bei Korrekturen entstehen entweder korrigierte Voranmeldungen oder hohe Differenzen in den Jahreserklärungen.

Aus den genannten Gründen ist ein sauberes Setup unbezahlbar. In der Praxis ist das Aufräumen von mehreren Jahren ein aufwendiges und teures Mammut-Projekt!

Da jedoch in anderen Ländern bereits Post/Paket-Zustelldienste in die Pflicht genommen wurden, um dem Staat zu melden, wenn ausländische Firmen des Öfteren Privatpersonen beliefern und dieses Netz auch stetig engmaschiger wird (Quick Fixes; ZM Meldungen und UST ID), ist es unserer Meinung nach nur eine Frage der Zeit, wann aber nicht mehr ob ein solcher Fehler unbemerkt bleibt.

Über den Autor

Christian Deák

Steuerberater und Geschäftsführer

Master of Arts in Taxation

- Dozent für Steuerrecht an der Hochschule FOM

- Dozent für papierlose Steuerberatung beim Deubner Verlag

- Externer Autor für die DATEV eG, Themenbereich „Digitalisierung“

- Telefon: 0208 / 98 99 22 22

- Mail: deak@dhw-stb.de

Taxdoo ist die Compliance-Plattform für die digitale Ökonomie

… und bildet für die führenden Online-Händler in Europa neben der Abwicklung der laufenden EU-weiten Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung (Taxdoo ist Partner der DATEV) noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

Weitere Beiträge

Finanzamt stoppt App, weil “zu unkompliziert”: Brauchen wir Mindeststandards für TaxTech?

GTK Kröger Steuerberater: Erste Praxiserfahrungen mit Taxdoos neuer Buchungslogik