11 Prozent der 22f-Bescheinigungen auf Amazon gefälscht? Lösung erst Ende 2021 in Sicht

Die Haftung von Amazon & Co. für die nicht abgeführte Umsatzsteuer in Deutschland seit 2019 hat zu Mehreinnahmen für den Fiskus geführt.

Diese Mehreinnahmen liegen jedoch noch deutlich unter dem Soll – soweit die Finanzverwaltung entsprechende Zahlen überhaupt erhebt. Dazu gibt es widersprüchliche Informationen.

- Die Bandbreite der dem Bund, Ländern (und zu einem sehr kleinen Anteil auch den Gemeinden) vor 2019 jährlich entgangenen Umsatzsteuereinnahmen reicht von über einer Milliarde – siehe hier,

- … bis hin zum kürzlich veröffentlichten Offenbarungseid des Bundesfinanzministeriums: “Die Finanzbehörden in Deutschland erheben dbzgl. keine Daten.” – siehe hier.

Ein großes Einfallstor für Onlinehändler, die ihre geschuldete Umsatzsteuersteuer vorsätzlich nicht abführen wollen, ist die Tatsache, dass der Nachweis der steuerlichen Erfassung – die sogenannte 22f-Bescheinigung – noch immer in Papierform erfolgt.

Es ist daher nicht schwer, diese zu fälschen, was scheinbar regelmäßig vorkommt.

Betrug bei 22f-Bescheinigungen

Amazon & Co. haften zunächst nicht für nicht abgeführte Umsatzsteuer, wenn ihnen eine sogenannte 22f-Bescheinigung vorliegt.

Mit diesem Formular bestätigt das jeweilige Finanzamt, dass der/die HändlerIn steuerlich in Deutschland registriert ist.

Nur: Wie kann man sicherstellen, dass eine 22f-Bestätigung nicht gefälscht wurde?

Nach einer uns bekannten vertrauenswürdigen Quelle soll eine Forensik-Software, welche bei Amazon im Einsatz ist, festgestellt haben, dass ca. 11 Prozent der hochgeladenen 22f-Bescheinigungen sehr wahrscheinlich gefälscht wurde. Die genannten Indizien sind: exakt gleiche Unterschrift, gleicher Stempelabdruck, Steuernummer passt nicht zum Finanzamt, Zeichen der Bildbearbeitung, etc.

Es ist offenkundig, dass eine einfache Bescheinigung aus Papier alles ist – umständlich, bürokratisch, aus der Zeit gefallen – aber in keiner Weise fälschungssicher.

Das war auch der Finanzverwaltung von Anfang an bewusst. Allerdings fehlt bislang die technologische Infrastruktur.

Das soll sich ändern.

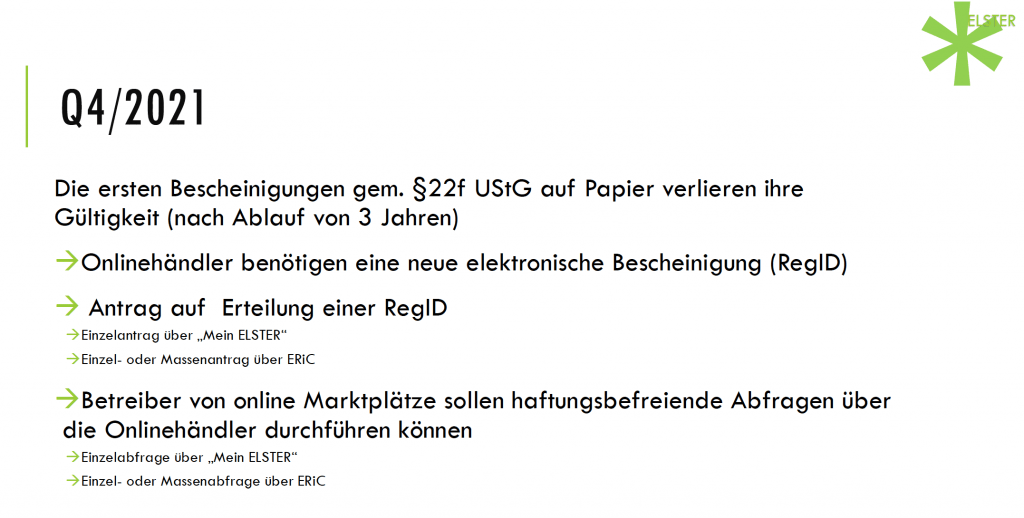

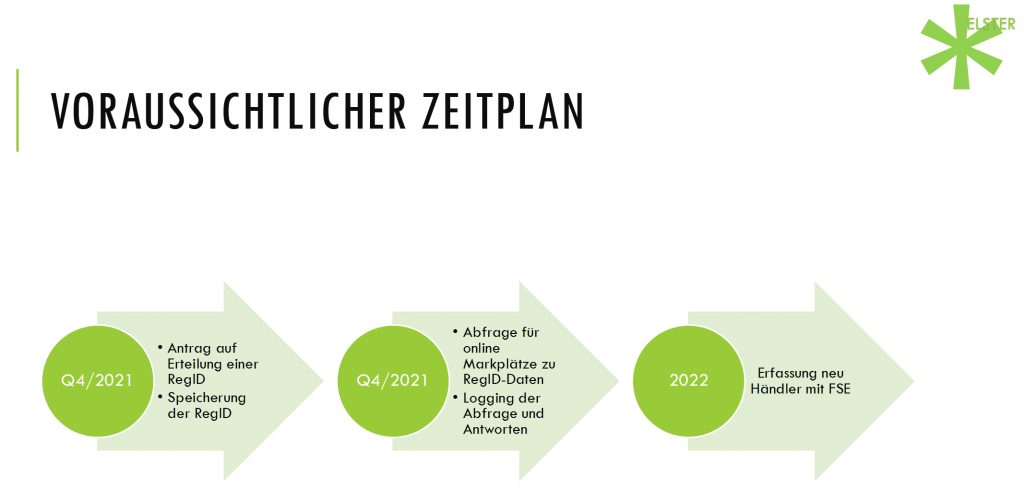

Lösung: RegID – frühestens ab Q4/2021

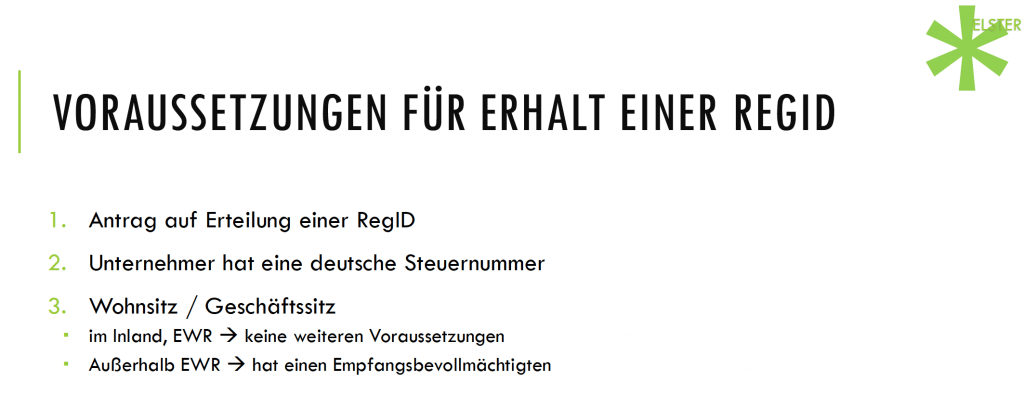

Die Marktplätze sollen zukünftig nicht mehr die 22f-Bescheinigungen prüfen müssen, sondern direkt über ELSTER eine elektronische Abfrage durchführen, um festzustellen, ob der jeweilige Händler auch tatsächlich in Deutschland registriert ist.

Der angedachte Zeitplan dafür sieht wie folgt aus.

Fazit

Die Marktplatzhaftung zeigt Wirkung. Allerdings entgeht dem Fiskus noch immer ein erheblicher Anteil des möglichen Umsatzsteueraufkommens.

Einer der fundamentalen Grundsätze unseres Steuerrechts, dass die Finanzverwaltung die Steuern gleichmäßig – über alle Sektoren und Zielgruppen – erhebt (§ 85 Abgabenordnung), scheitert im Onlinehandel an der technologischen Infrastruktur der Finanzverwaltung.

Am Ende liegt das Risiko bei Amazon & Co., die in Technologien investieren müssen, um die spiegelbildlichen Versäumnisse der Finanzverwaltung aufzufangen.

Taxdoo ist die Compliance-Plattform für die digitale Ökonomie

… und bildet für die führenden Online-Händler in Europa neben der Abwicklung der laufenden EU-weiten Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung – Taxdoo ist Partner der DATEV – noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

Weitere Beiträge

OSS-Mahnungen aus Spanien für Q3 und Q4 2021: BZSt dieses Mal nicht Schuld

Reverse-Charge: Wann zahlt Ihr die Umsatzsteuer für Amazon, TikTok und Co.? Ein aktuelles BFH-Urteil!