Amazons Umsatzsteuer-Berechnungsservice (VCS) trotz Schwächen verwenden?

Update: 03.04.2021

Soll man als Onlinehändler*in auf Amazon den Umsatzsteuer-Berechnungsservice (VCS) nutzen oder sind die Schwächen dieses Systems zu schwerwiegend?

Was sind die bisherigen Erfahrungen mit dem Amazon VCS?

Erfahrungen mit dem Amazon Umsatzsteuer-Berechnungsservice (VCS)

Dieses Frage beantworten wir in den folgenden Abschnitten. Eines müsst ihr euch aber immer bewusst sein.

Aus der Sicht des Finanzamtes steht immer nur ihr als Unternehmer*in in der Verantwortung. Ihr solltet daher grundlegend verstehen, wie die Systematik hinter der Automatisierung eurer Unternehmensprozesse aussieht – erst recht, wenn es Prozesse zur Steuerfindung sind.

Man kann die Antwort auf die Eingangsfrage schon etwas vorwegnehmen.

Der Druck, den Umsatzsteuer-Berechnungsservice auf Amazon zu nutzen, steigt durch Amazon zunehmend. Die Schwächen dieses Systems sind je nach Setup gering bis erheblich. Wir bei Taxdoo bieten dafür Lösungen über unsere Plattform an.

Amazon Umsatzsteuer-Berechnungsservice (VCS): eine kurze Historie

Als Amazon 2017 Amazon Business als B2B-Marktplatz launchte war klar, dass dieser Marktplatz nur dann ein Erfolg wird, wenn die Käufer – zu denen mittlerweile auch die gesamte DAX-Riege gehört – von den Verkäufern rechtskonforme Rechnungen erhalten.

Aufgrund der Heterogenität im Onlinehandel, der sehr stark von Unternehmen aus dem KMU-Segment dominiert wird, wurde schnell klar, dass man die Berechnung der Umsatzsteuer und die Rechnungserstellung nicht dem/der Verkäufer*in überlassen durfte.

Jedes größere Unternehmen mit entsprechenden steuerlichen Sicherheitsmechanismen hätte der eigenen Beschaffung unmittelbar verboten, Waren über Amazon Business zu beziehen, sobald die erste via Word geschriebene Rechnung dort aufgetaucht wäre.

Wie sollte Amazon sicherstellen, dass das niemals passiert? Die Antwort ist einfach: Man nimmt den Verkäufern diese Prozesse vollständig aus der Hand.

Der Umsatzsteuer-Berechnungsservice (im Folgenden VCS für VAT Calculation Service) kalkuliert für jede Transaktion die Umsatzsteuer und erstellt eine Rechnung – für jeden Amazon Business Marktplatz in der EU. Mehr zur Funktionsweise könnt ihr in unserem ersten Artikel aus dem Jahr 2017 dazu lesen – oder im renommierten taxtech.blog.

Der VCS ist eine Entwicklung von Vertex für Amazon. Wie wir in unseren bisherigen Publikationen erläutert haben, beinhaltet diese Lösung seit Jahren einige Schwächen.

Mittlerweile wird der (sanfte) Druck auf die Händler*innen durch Amazon, den VCS zu nutzen, immer größer. Der sogenannte VCS lite, bei dem die Umsatzsteuer-Berechnung weiterhin bei Amazon liegt, die Rechnungserstellung aber beim Händler, soll mehr Akzeptanz schaffen.

Die Schwächen sind bei beiden Systemen – VCS und VCS lite – identisch und werden im Folgenden zusammengefasst.

Ungültige UStIDs auf Amazon Business und fehlende Prüfung durch den Umsatzsteuer-Berechnungsservice (VCS)

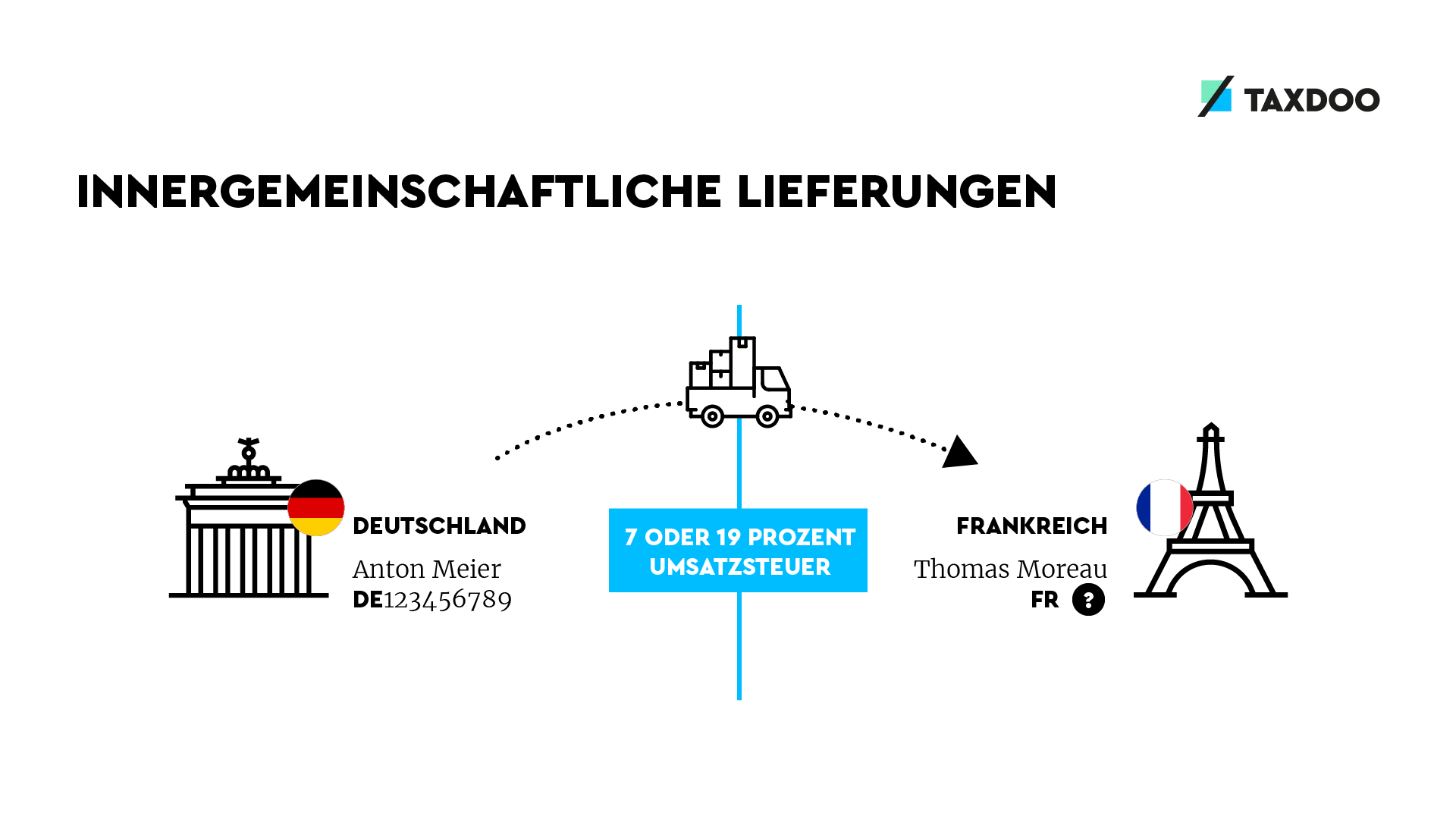

Der VCS entfaltet seine ganze Funktionalität – und man kommt dann kaum an ihm vorbei – im Rahmen von B2B-Transaktionen. Grenzüberschreitende Lieferungen an Unternehmer*innen in der EU sind als sogenannte innergemeinschaftliche Lieferungen steuerfrei.

Spätestens seit dem 1. Januar 2020 gilt das nur noch, wenn der /die Abnehmer*in zum Zeitpunkt der Lieferung eine gültige UStID im Ausland vorweisen kann.

Ist das nicht der Fall, müsst ihr diese Transaktion zwingend der Umsatzsteuer unterwerfen.

Verfügt der Abnehmer über keine gültige UStID im EU-Ausland, sind Lieferungen zu versteuern.

Taxdoo prüft daher jeden Monat eine sehr hohe sechsstellige Zahl an UStIDs. Nach unseren Ergebnissen sind zwischen fünf und acht Prozent der auf Amazon hinterlegten UStIDs ungültig.

Prüft der VCS die UStID des Käufers unmittelbar vor dem Verkauf?

Laut den Amazon-AGB kann Amazon bzw. der VCS das nicht sicherstellen.

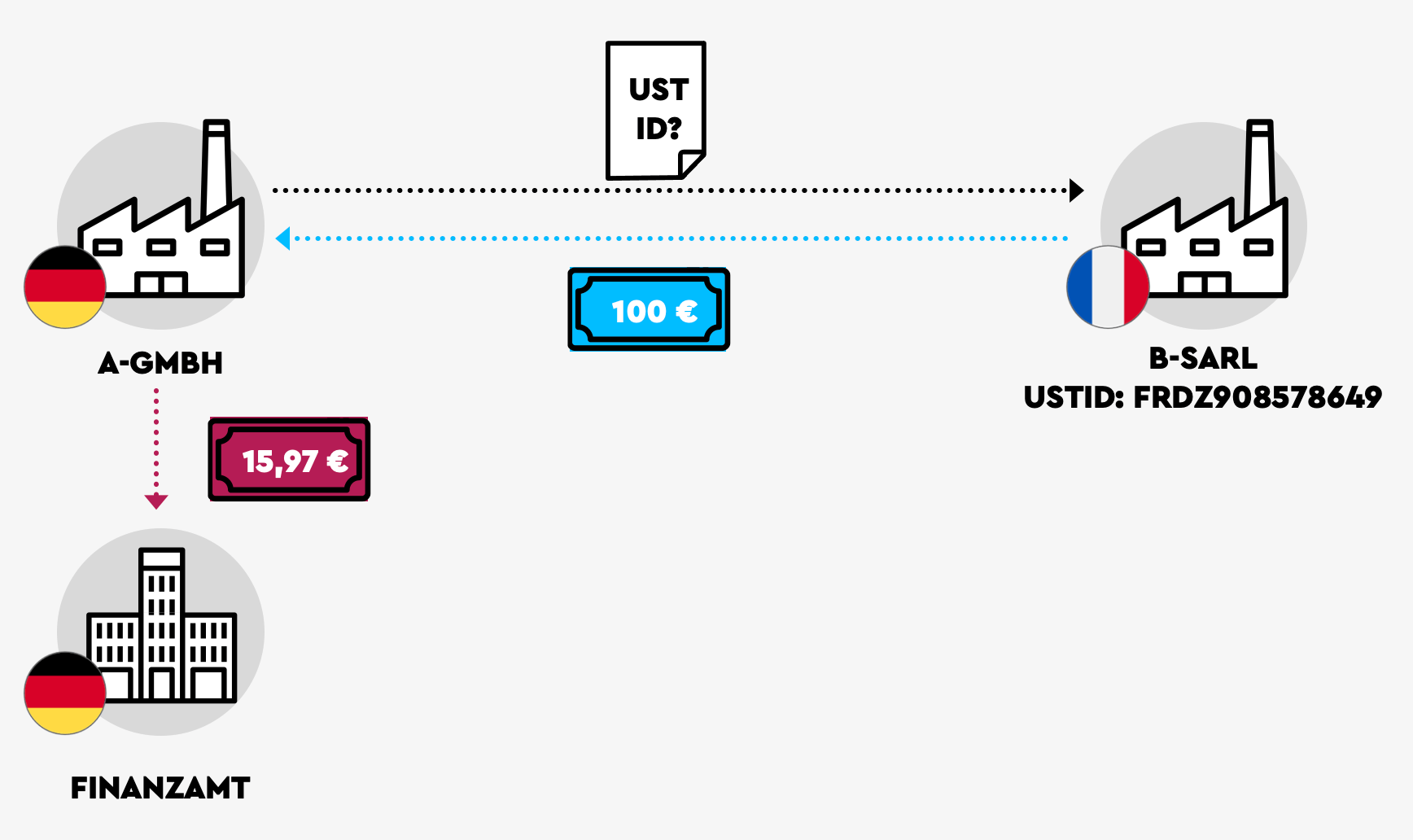

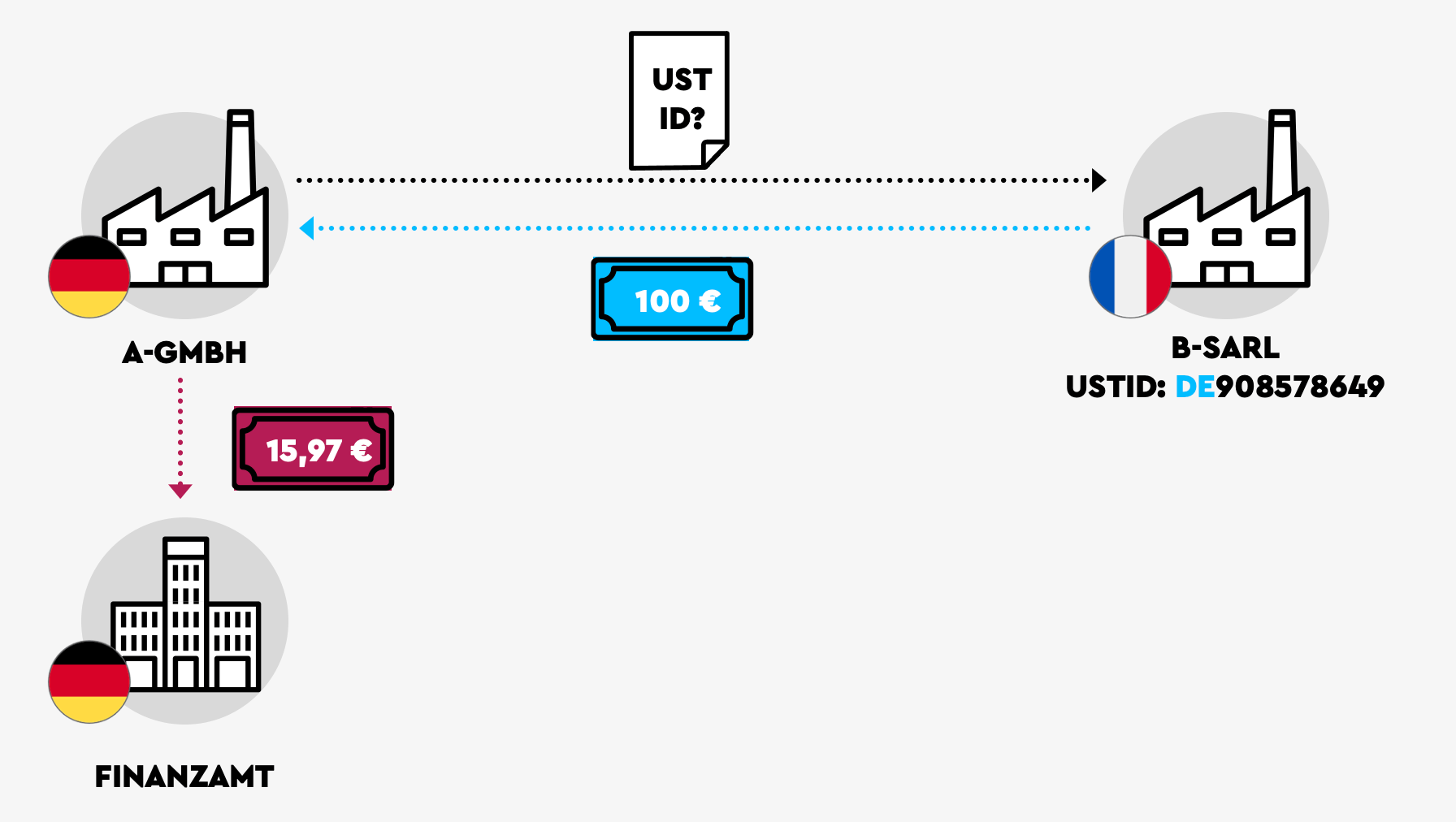

Das hat zur Folge, dass Amazon bzw. der VCS innergemeinschaftliche Lieferungen auch dann als steuerfrei bewertet, wenn die UStID des Käufers ungültig ist.

Risiko: Im Rahmen einer Prüfung durch die Finanzbehörden wird der/die PrüferIn spätestens seit dem 1. Januar 2020 rückwirkend Umsatzsteuer erheben, wenn die UStID des Käufers zum Zeitpunkt der Lieferung ungültig war. Hinzukommen bei rückwirkenden Versteuerungen die Zinsen, welche die Finanzbehörden erheben müssen. In Deutschland sind das – nach Ablauf einer kurzen Frist – 0,5 Prozent pro Monat auf die Umsatzsteuer. In anderen EU-Staaten häufig ein Vielfaches.

Aber nicht nur ungültige UStIDs stelle ein Problem für den Amazon Umsatzsteuer-Berechnungsservice dar.

Amazon Umsatzsteuer-Berechnungsservice (VCS): die fehlende Umsetzung Quick Fixes 2020?

Der VCS scheint eine wichtige Umsatzsteuerreform verschlafen zu haben – die bereits eingangs genannten Quick Fixes.

Hintergrund Quick Fixes: Die Quick Fixes bildeten zum 01.01.2020 den Auftakt zu einer umfassenden Reformierung des Umsatzsteuerrechts, welches noch immer weitgehend auf dem Stand von 1993 ist und dadurch den Anforderungen an das digitale Zeitalter und den Onlinehandel nicht mehr genügt. Die nächste Stufe werden wir am 1.7.2021 sehen – in Form des One Stop Shop bzw. der zweiten Stufe des E-Commerce Package.

Mehr zu den Quick Fixes und Amazons Problemen damit lest hier in diesem Artikel.

Was verbirgt sich hinter den Quick Fixes im Zusammenhang mit innergemeinschaftlichen Lieferungen?

Seit dem 01.01.2020 sind innergemeinschaftliche Lieferungen nur noch dann steuerfrei, wenn die/der Käufer*in eine ausländische Umsatzsteuer-Identifikationsnummer (UStID) zum Zeitpunkt der Lieferung vorweisen kann.

Weitere Voraussetzung für eine steuerfreie innergemeinschaftliche Lieferung erklären wir in diesem Video.

Diese Regelung galt grundsätzlich auch schon vor 2020. Allerdings sah der Europäische Gerichtshof (EuGH) das anders, sodass man sich regelmäßig mit den Urteilen des höchsten Gerichtes in der EU gegen eine Versteuerung von innergemeinschaftlichen Lieferungen wehren konnte, wenn das Finanzamt bei einer fehlenden oder ungültigen UStID Umsatzsteuer einziehen wollte.

Das funktioniert seit dem 01.01.2020 – dem Inkrafttreten der Quick Fixes – nicht mehr.

Konkreter Fall: Fehler im Umsatzsteuer-Berechnungsservice (VCS) und die Antwort von Amazon

Im Rahmen eines konkreten Falles, der relativ betrachtet nicht sehr häufig vorkommen dürfte, aber aufgrund der Größe von Amazon Business in absoluten Beträgen einen umfassenden fiskalischen Schaden anrichten könnte, wenn es kein Einzelfall ist, ist Folgendes aufgetreten.

Ein/e Käufer*in Frankreich kauft über Amzon Business von einer/m deutschen Händler*in. Die/der Abnehmer*in verwendet seine/ihre deutsche UStID. Der VCS stellt diese Lieferung steuerfrei und verstößt damit gegen seit 2020 (Quick Fixes) geltendes Recht.

Was sagt das Gesetz? § 6a UStG regelt klar, dass zum Zeitpunkt der Lieferung eine gültige ausländische Umsatzsteuer-Identifikationsnummer (UStID) vorliegen muss.

Mit ausländisch ist gemeint, dass diese nicht in dem EU-Staat ausgestellt worden sein darf, in dem die Lieferung startet.

In diesem Fall sollte idealerweise eine franzöische UStID vorliegen. Der/die Käuferin kann laut Gesetz grundsätzlich auch jede andere ausländische UStID verwenden – z.B. eine niederländische, italienische, … Es darf nur keine deutsche UStID sein.

Die Antwort des Amazon Supports ist daher leider nicht richtig. Es wird darauf verwiesen, dass keine Umsatzsteuer berechnet wurde, da der Käufer eine deutsche UStID hinterlegt hat.

Da die Lieferung aber aus Deutschland nach Frankreich ging, genügt das nach EU-Recht und auch nach deutschem Recht nicht.

Eine weitere Fehlerquelle ist die Hinterlegung eines falschen Lagerortes.

Falsches Ergebnis durch falschen Lagerort

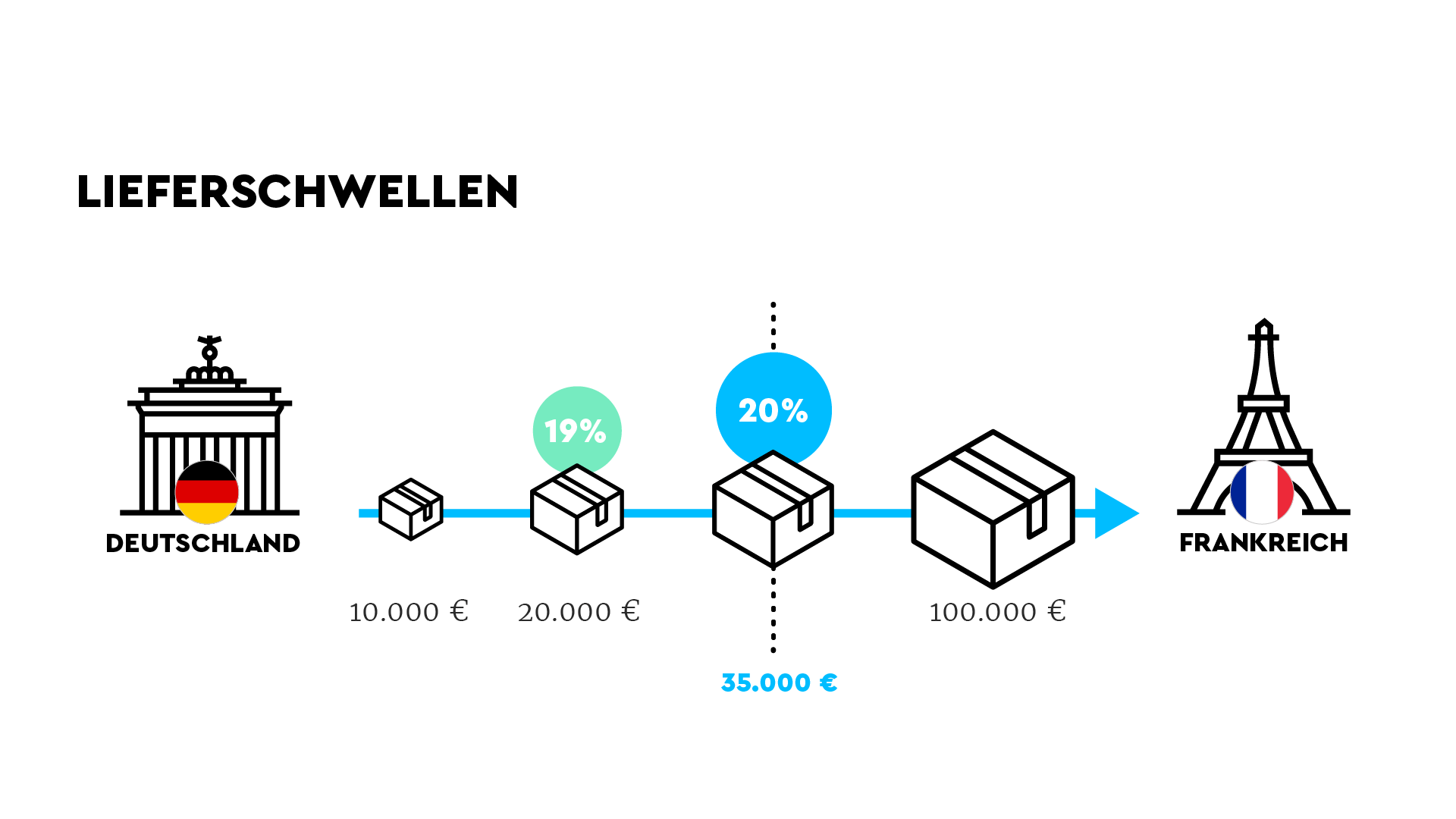

Versendet ihr eure Produkte selbst, kann der VCS nur mit einem Lagerort arbeiten. Habt ihr mehr als ein eigenes Lager, aus dem ihr die Waren an die Abnehmer versendet, kann der VCS bei B2C-Transaktionen zu falschen Ergebnissen kommen, wenn die folgende Konstellation vorliegt.

- Die Lieferung ist grenzüberschreitend UND

- euer zweites, drittes, viertes, … Lager befindet sich in einem anderen EU-Staat als das erste Lager UND

- die Lieferschwelle des Bestimmungslandes ist nicht überschritten.

Risiko: Der VCS berechnet für die o.g. Konstellation den falschen Umsatzsteuersatz für den falschen Staat. Ihr schuldet in dem Fall die Umsatzsteuer doppelt: die Steuer, welche auf der VCS-Rechnung steht und die Steuer, die tatsächlich im Lagerland angefallen ist – ggf. nebst Zinsen.

Eine weitere offene Flanke besitzt der Amazon Umsatzsteuer-Berechnungsservice (VSC) bei der Bestimmung der korrekten Steuersätze.

Bestimmung des falschen Steuersatzes

Nehmt ihr keine Einstellungen vor, wird der VCS immer den Standardsteuersatz des jeweiligen EU-Staates anwenden.

Verkauft ihr Produkte, die ermäßigt besteuert werden, müsst ihr eine Einordnung dieser Produkte anhand der von Amazon vorgegebenen Produktsteuercodes vornehmen. Das sind keine offiziellen Klassifizierungen, sodass eine Einordnung keinen rechtsverbindlichen Charakter hat.

Insbesondere im Bereich Lebensmittel und Nahrungsergänzungsmittel solltet ihr zwingend eine sogenannte Tarifierung eurer Produkte durch eine/n ZollexpertIn vornehmen lassen. Nur anhand der in diesem Rahmen ermittelten Zolltarifnummer lässt sich der Umsatzsteuersatz für eure Produkte und für jeden EU-Staat sicher bestimmen.

Risiko: Ein erhebliches Risiko besteht dann, wenn der VCS einen zu niedrigen Steuersatz kalkuliert. Beispiel: Kaffee wird in Frankreich mit 5,5 Prozent versteuert. Der VCS wendet aufgrund eurer falschen Einordnung den dritten ermäßigten Steuersatz in Frankreich in Höhe von 2,1 Prozent an. In dem Fall würdet ihr 3,4 Prozentpunkte Umsatzsteuer pro Lieferung verkürzen bzw. hinterziehen.

Wir bei Taxdoo arbeiten ausschließlich mit der Zolltarifnummer und können euch für jedes Produkt und jeden EU-Staat mittels einer automatisierten Logik einen Vorschlag unterbreiten.

Überwachung von Lieferschwellen durch den Amazon Umsatzsteuer-Berechnungsservice (VCS) nicht möglich

Der Amazon VCS kann Lieferschwellen nicht überwachen und auch nur recht schwerfällig mit ihnen umgehen. Das wird jedoch noch bis mindestens zum 30.06.2021 erforderlich sein – siehe hier.

Eine überschrittene bzw. optierte Lieferschwelle müsst ihr selbst im Amazon VCS erfassen. Das erfolgt dadurch, dass ihr euch im jeweiligen Bestimmungsland steuerlich registriert und diese ausländische UStID im VCS hinterlegt.

Risiko: Habt ihr keine Prozesse zur Überwachung eurer Lieferschwellen, wird der VCS zwangsläufig falsche Ergebnisse liefern. Ihr werdet im worst case doppelt Umsatzsteuer schulden: die Umsatzsteuer auf der Rechnung und die Umsatzsteuer, die tatsächlich angefallen ist – nebst Zinsen, wenn die Aufdeckung durch die Finanzbehörden später erfolgt.

Checkliste Amazon VCS: Welches Setup?

Zusammengefasst lässt sich Folgendes sagen.

- Du bist nur in Deutschland steuerpflichtig, verkaufst nicht grenzüberschreitend und deine Produkte unterliegen dem Standardsteuersatz: Du kannst den VCS ohne Probleme nutzen.

- Du bist nur in Deutschland steuerpflichtig und deine Produkte unterliegen dem ermäßigten Steuersatz: Du solltest vorab dafür sorgen, dass ein/e Zollexpertin die Zolltarifnummer deiner Produkte bestimmt hat. Dann ist der VCS ohne Probleme zu nutzen.

- Du verkaufst grenzüberschreitend B2C innerhalb der EU und bist in allen Staaten steuerlich registriert, in denen du die Lieferschwelle überschritten hast und kannst diese laufend überwachen: Du kannst den VCS ohne Probleme nutzen.

- Du verkaufst grenzüberschreitend auch B2B innerhalb der EU: In diesem Fall musst du dir bewusst sein, dass ein Teil der Auswertungen des VCS falsch sind und du im Zweifel Steuernachzahlungen nebst Zinsen tätigen musst.

- Du bist steuerpflichtig im EU-Ausland – z.B. wegen Lieferschwellen, Versandlagern, … – verfügst aber noch nicht über steuerliche Registrierungen in allen/einigen Staaten: In diesem Fall führt der VCS zu falschen Ergebnissen, die im worst case zu einer Doppelbesteuerung führen.

- Du bist steuerpflichtig im EU-Ausland – aufgrund der Nutzung von Versandlagern – und verfügst auch über steuerliche Registrierungen in den entsprechenden Staaten, in denen du allerdings nicht die Lieferschwelle überschritten hast: In diesem Fall führt der VCS zu falschen Ergebnissen, die ebenfalls im worst case zu einer Doppelbesteuerung führen.

Amazon Umsatzsteuer-Berechnungsservice (VCS) und der One Stop Shop

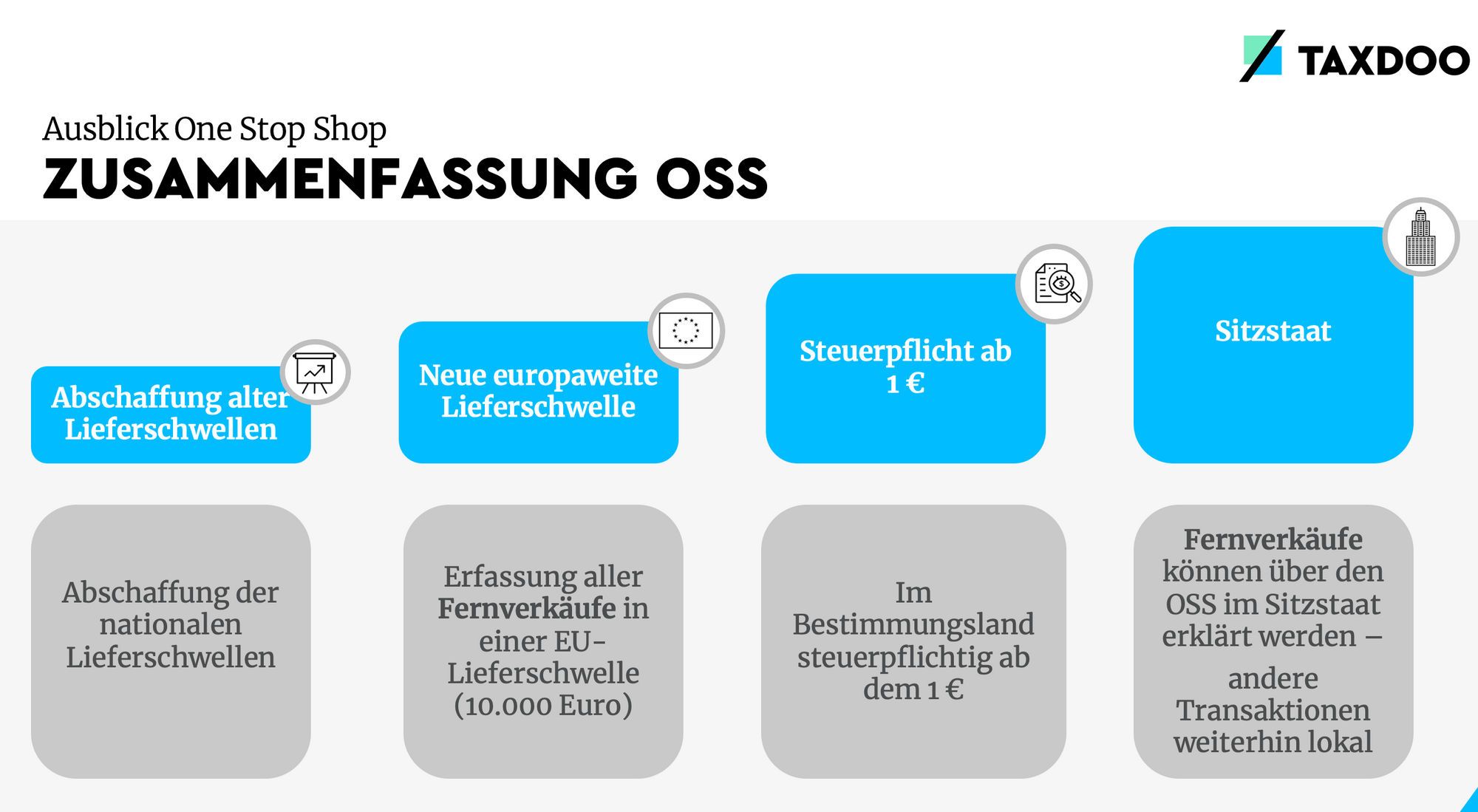

Zum 01.07.2021 werden wir die größte Umsatzsteuerreform für den Onlinehandel sehen – einhergehend mit dem One Stop Shop.

Mehr dazu erfahrt ihr in diesem Blogpost.

Die entscheidende Frage ist: Wird der Amazon Umsatzsteuer-Berechnungsservice (VCS) mit dem One Stop Shop kompatibel sein?

Die Antwort darauf kann man noch nicht geben, da Amazon bzw. der Anbieter dahinter – Vertex – sich bislang noch nicht geäußert haben.

Die folgende Grafik verdeutlicht aber, worauf ihr als Amazon-Händler*in – insbesondere, wenn ihr am Pan EU oder CEE Programm teilnehmt – achten müsst.

Ihr müsst beachten, dass:

- ihr aufgrund der EU-weiten Lieferschwelle von nur noch 10.000 Euro netto pro Jahr für alle B2C-Lieferungen ins EU-Ausland zusammen, im Bestimmungsland steuerpflichtig werdet,

- ihr diese Lieferungen über den OSS in eurem Sitzstaat melden könnt – selbst B2C-Lieferungen aus z.B. einem Amazon-Lager in Polen an einen Endverbraucher in Frankreich,

- ihr gesetzlich nicht mehr verpflichtet seid, Rechnungen für die Transaktionen zu schreiben, für die ihr den OSS nutzt,

- die Käufer und somit auch Amazon aber mit einer gewissen Wahrscheinlich weiterhin darauf bestehen werden, dass diese Rechnungen erhalten. In diesem Fall muss dann nach der obigen Logik regelmäßig der Steuersatz des Bestimmungslandes auf der Rechnung ausgewiesen sein.

- lokale Lieferungen aus einem ausländischen Amazon-Lager und sämtliche Verbringungen und Erwerbe ihr weiterhin lokal im EU-Ausland melden müsst.

Fazit zum Amazon Umsatzsteuer-Berechungsservice: Schaut genau hin!

Ohne die Automatisierung der wesentlichen Unternehmensprozesse wäre der Onlinehandel in seiner heutigen Form kaum denkbar.

Insbesondere bei den Prozessen zur Steuerfindung, wie sie z.B. Amazons Umsatzsteuer-Berechnungsservice anbietet, müsst ihr als HändlerIn bzw. SteuerberaterIn unbedingt sehr genau hinschauen.

Der VCS ist kein Meisterstück der automatisierten grenzüberschreitenden Umsatzsteuer-Compliance und kann in den gezeigten Fällen zu existenzbedrohenden Nachforderungen der Finanzbehörden führen.

Ihr werdet früher oder später aber kaum noch am VCS vorbeikommen.

Wir bei Taxdoo bieten daher Sicherheitsmechanismen über unsere Plattform, um diese Risiken aufzufangen.

Taxdoo ist die Plattform für automatisierte und sichere Umsatzsteuer-Prozesse

… und bildet für die führenden Onlinehändler in Europa neben der Abwicklung der laufenden EU-weiten Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wir verfügen über eine Datenbank von mehr als einer halben Million UStIDs, die wir regelmäßig prüfen und so Risiken signifikant senken.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

Weitere Beiträge

OSS-Mahnungen aus Spanien für Q3 und Q4 2021: BZSt dieses Mal nicht Schuld

Reverse-Charge: Wann zahlt Ihr die Umsatzsteuer für Amazon, TikTok und Co.? Ein aktuelles BFH-Urteil!