Umsatzsteuersenkung: Probleme im Übergang bei Amazons Umsatzsteuer-Berechnungsservice

Update vom 2. Juli 2020, 19:00 Uhr: Wir standen heute im konstruktiven Austausch mit der Presseabteilung von Amazon Deutschland. Diese bat uns, das folgende Statement zu veröffentlichen.

Stellungnahme der Amazon Deutschland Services GmbH (per E-Mail exklusiv an Taxdoo vom 2. Juli 2020): Amazon hat die neuen deutschen Umsatzsteuersätze (16% und 5%), die am 1. Juli 2020 in Kraft getreten sind, gemäß den Gesetzesvorgaben in den Systemen umgesetzt. Es gibt seltene Umstände, unter denen Kunden und Verkaufspartner, die den Umsatzsteuer-Berechnungsservice in Anspruch nehmen, auf Rechnungen für den 1. Juli oder kurz danach noch die vor dem 1. Juli 2020 gültigen deutschen Umsatzsteuersätze sehen. Diese Konstellation kann vorkommen, wenn die Bearbeitung einer Bestellung vor dem 1. Juli beginnt, aber erst am 1. Juli oder kurz danach mit dem Versand abgeschlossen wird. Wenn dies geschieht, sollten Business-Kunden weiterhin in der Lage sein, die volle Umsatzsteuer zum alten Umsatzsteuersatz gemäß der Rechnung abzuziehen, da aufgrund der Übergangsregelungen aus demBMF Schreiben vom 30. Juni 2020 unter der Textziffer 46 in diesen Fällen weiterhin der volle Vorsteuerabzug im Juli 2020 erlaubt wird.

Unsere (Taxdoo) Einschätzung dazu lautet.

Rein rechtlich betrachtet, gibt es nur einen Leistungszeitpunkt.

Ja, es gibt auch die genannte Übergangsregelung (Tz. 46 des o.g. BMF-Schreibens) von einem Monat (1. bis 31. Juli 2020). Diese kommt aber nur zum Tragen, wenn der Käufer nachweisen kann, dass der Verkäufer die zu hohe Umsatzsteuer auch tatsächlich abgeführt hat, da ansonsten dem Fiskus ein Schaden entsteht. Das funktioniert vlt. noch auf Ebene zweier Bauunternehmen. Im Massengeschäft E-Commerce, in dem die Plattformen die Kommunikation zwischen Käufer und Verkäufer weitgehend unterbinden, ist das faktisch unmöglich.

Zudem gibt es auch zahlreiche Unternehmen, welche über Amazon-Business einkaufen, die keinen Anspruch auf Vorsteuerabzug haben, weil sie steuerfreie und vorsteuerschädliche Ausgangsumsätze erbringen – z.B. Ärzte, Versicherungsmakler, Vermieter…

Update vom 1. Juli 2020, 11:15 Uhr: Mittlerweile haben zahllreiche FBA-Händler die folgende Problematik bestätigt. Bei Händlern – das ist die Minderheit – die den Berechnungsservice in Kombination mit Eigenversand (FBM bzw. MFN) verwenden, scheint das Problem nicht aufzutreten.

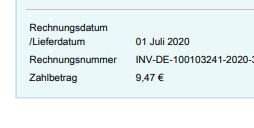

Update vom 1. Juli 2020, 14:40 Uhr: Die folgende vom Berechnungsservice erzeugte Rechnung für eine Lieferung mit Versandmeldung von heute 13:57 Uhr zeigt, dass das Problem fortbesteht.

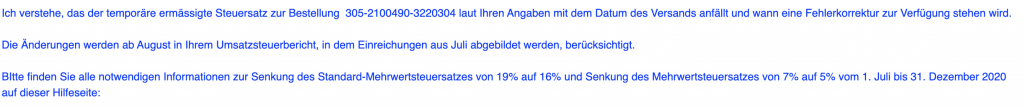

Update vom 1. Juli 2020, 16:00 Uhr: Offenbar verwendet Amazon intern den Bestelleingang als maßgebliches Datum. Die folgende Antwort eines Support-Mitarbeiters verdeutlicht das – auch die hemdsärmlige Lösung, diesen Fehler Anfang August im Rahmen des Umsatzsteuerberichtes zu korrigieren.

Das erscheint schon mehr als ignorant! Warum? Weil die Rechnungen in der Welt sind und es wohl auch bleiben. Also wird diese zu hohe Steuer durch die Händler geschuldet (§14c Abs. 1 UStG).

Was ist nun das Problem?

Der von einem externen Anbieter für Amazon konzipierte Umsatzsteuer-Berechnungsservice hat die befristete Senkung der Umsatzsteuersätze zum 1. Juli 2020 vorerst nicht umsetzen können – Stand heute.

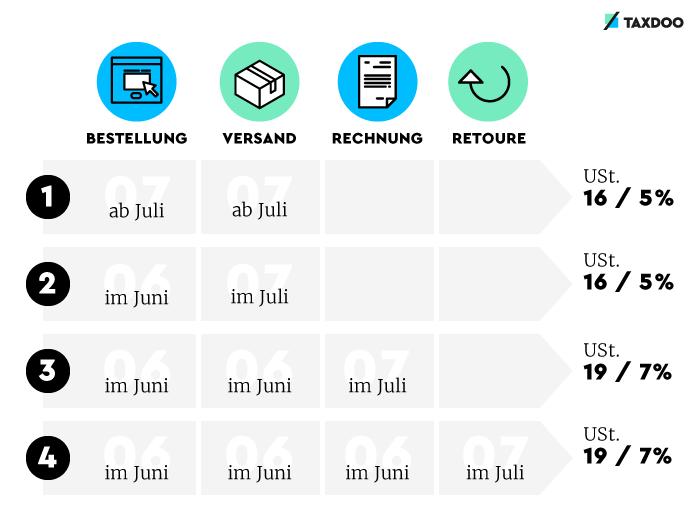

Hier nochmals zur Erinnerung die umsatzsteuerliche Systematik.

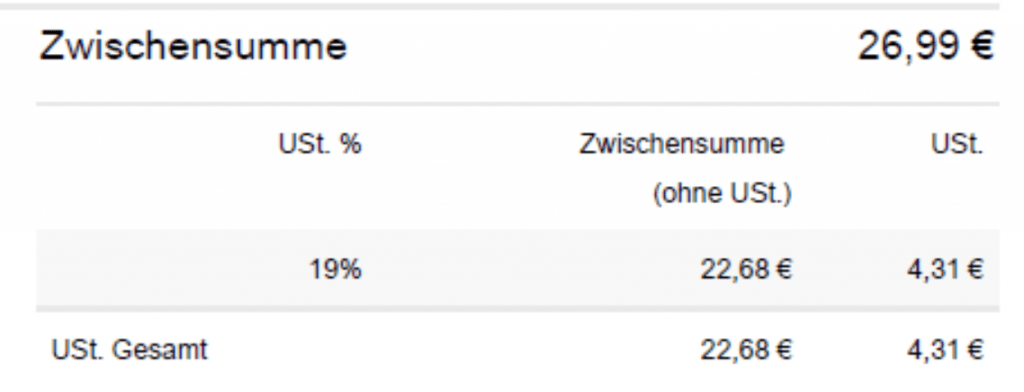

Hier seht ihr eine Rechnung, welche der Berechnungsservice für eine Lieferung mit Versanddatum vom 1. Juli 2020 ausgestellt hat. Das umsatzsteuerliche Resultat ist falsch.

Was sind die Konsequenzen?

Die Konsequenzen für euch als Händler bzw. eure Mandanten sind, dass ihr diese zu hohe Umsatzsteuer an das Finanzamt abführen müsst. Das besagt in Deutschland § 14c Abs. 1 UStG.

Wie sieht es für Käufer auf Amazon-Business aus?

Amazon-Business

Zunehmend mehr Unternehmen kaufen ihre Produkte auf der B2B-Plattform Amazon-Business ein.

Dort ist die Verwendung des Umsatzsteuer-Berechnungsservice faktisch – auch wenn Amazon es anders framed – obligatorisch. Eine umfassende Darstellung der Schwächen dieser Methodik findet ihr hier.

Dürfen Käufer diese zu hohe Umsatzsteuer als Vorsteuer abziehen?

Grundsätzlich, nein!

Allerdings hat sich die Finanzverwaltung auf eine Übergangsregelung von einem Monat eingelassen.

Was bedeutet das?

Wird im Zeitraum 01.07.2020 bis 31.07.2020 fälschlicherweise 19 bzw. 7 Prozent Umsatzsteuer ausgewiesen, darf der Käufer diese Steuer als Vorsteuer abziehen, wenn der Verkäufer diese an das Finanzamt abgeführt hat.

Das hört sich fair an, dürfte in der Praxis jedoch dazu führen, dass der Käufer nachweisen muss, dass der Verkäufer 19 bzw. 7 Prozent auch tatsächlich an das Finanzamt abgeführt hat.

Das ist jedoch nicht die einzige Schwachstelle des Umsatzsteuer-Berechnungsservice.

Nicht die einzige Schwachstelle des Umsatzsteuer-Berechnungsservice

Wir bei Taxdoo weisen schon lange darauf hin, dass die Resultate, welche der Berechnungsservice erzeugt, in absehbarer Zeit ein reichhaltiger Fundus für Betriebsprüfungen sein werden.

So sind z.B. nach unseren Auswertungen 5 bis 8 Prozent der dort erfassten USt-IDs ungültig. Bei grenzüberschreitenden B2B-Lieferungen – grds. steuerfreie innergemeinschaftliche Lieferungen – müsste der Berechnungsservice daher Umsatzsteuer berechnen.

In der Praxis werden diese Lieferungen durch den Berechnungsservice jedoch weiterhin als steuerfrei bewertet – ein Verstoß gegen geltendes Recht.

Mit Taxdoo auf der sicheren Seite

Wir bei Taxdoo folgen dem Mantra, dass wir jede Transaktion im E-Commerce – egal über welchen Kanal – vollkommen autark umsatzsteuerlich bewerten.

Das ist mittlerweile ein hoher zweistelliger Millionenbetrag pro Monat und damit bieten wir euch bzw. euren Mandanten die zusätzliche Rechtssicherheit.

Die Compliance-Plattform für die digitale Ökonomie

… und bildet für die führenden Onlinehändler in Europa neben der Abwicklung der laufenden Umsatzsteuer-Compliance, Intrastat und Finanzbuchhaltung (Taxdoo ist Partner der DATEV) noch zahlreiche weitere Compliance-Services über eine einzigartige Plattform ab.

Wenn ihr mehr darüber wissen wollt, wie ihr Umsatzsteuer-Compliance, Finanzbuchhaltung und noch viel mehr effizient und sicher über eine Plattform abbilden könnt, dann bucht über diesen Link euer individuelles und kostenloses Erstgespräch mit den Compliance-Experten von Taxdoo!

Gerne könnt ihr euch auch für unser regelmäßig stattfindendes Demo-Webinar anmelden, in dem wir euch Taxdoo und unsere Compliance-Services vorstellen und eure Fragen persönlich beantworten.

P.S.: Taxdoo ist seit Anfang 2020 nun auch offiziell Partner der DATEV im Onlinehandel.