Amazon in Schweden, Lagerung, Versand: Umsatzsteuerpflicht für FBA Händler?

Das Kapitel Amazon Schweden begann bereits im Herbst 2020, als für internationale Seller der Versand nach Schweden freigeschaltet wurde. Damals beschränkte sich das noch auf Lieferungen aus anderen Lagern in der EU, ohne Lagerung vor Ort in Schweden selbst.

Bekanntermaßen verlief der Start von Amazon Schweden in mehrfacher Hinsicht etwas holprig. So waren viele Produkttexte suboptimal ins Schwedische übersetzt, und bei einigen Sellern war ohne vorherige Benachrichtigung seitens Amazon der Versand nach Schweden automatisch aktiviert worden. Letzteres hatte auch umsatzsteuerliche Konsequenzen.

Umso wichtiger, dass Ihr als (FBA-) Seller auch jetzt, mit der neu hinzugekommen Lagerung in Schweden und dem Versand aus Schweden, die umsatzsteuerlichen Konsequenzen rechtzeitig in Eure Planung einbeziehen könnt.

Steuerpflicht in Schweden für Amazon Seller?

Wie in den übrigen EU-Ländern könnt Ihr als Onlinehändler aus 2 Gründen in Schweden umsatzsteuerpflichtig werden:

- Entweder überschreitet Ihr durch Eure Verkäufe an private Kunden im EU-Ausland den seit dem 01.07.2021 gültigen EU-weiten Schwellenwert in Höhe von 10.000 EUR pro Jahr und müsst Eure Verkäufe an schwedische Privatpersonen dann in Schweden zu den dort gültigen Umsatzsteuersätzen versteuernund/oder

- Ihr lagert Eure Waren in einem schwedischen Warenlager ein.

Zu Grund 1: Sofern Ihr den EU-weiten Schwellenwert in Höhe von 10.000 EUR überschritten habt und an schwedische Privatkunden verkauft, könnt Ihr die umsatzsteuerlichen Meldungen hierfür seit dem 01.07.2021 über den „One-Stop-Shop“ (OSS) in Eurem Sitzland abwickeln.

Habt Ihr Euren Unternehmenssitz in Deutschland, erledigt Ihr die Meldungen für Schweden also im Rahmen der quartalsweisen OSS-Meldung an das Bundeszentralamt für Steuern. Hierfür benötigt Ihr keine umsatzsteuerliche Registrierung in Schweden.

Zur Klarstellung: Ihr habt den Schwellenwert auch bereits dann überschritten, wenn Ihr pro Kalenderjahr Nettoumsätze in Höhe von 10.000 EUR an Privatkunden in anderen EU-Länder als Schweden tätigt. Seit dem 01.07.2021 gibt es die länderspezifischen Lieferschwellen nicht mehr und der neue EU-weite Schwellenwert gilt in Summe (!) über alle EU-Länder hinweg.

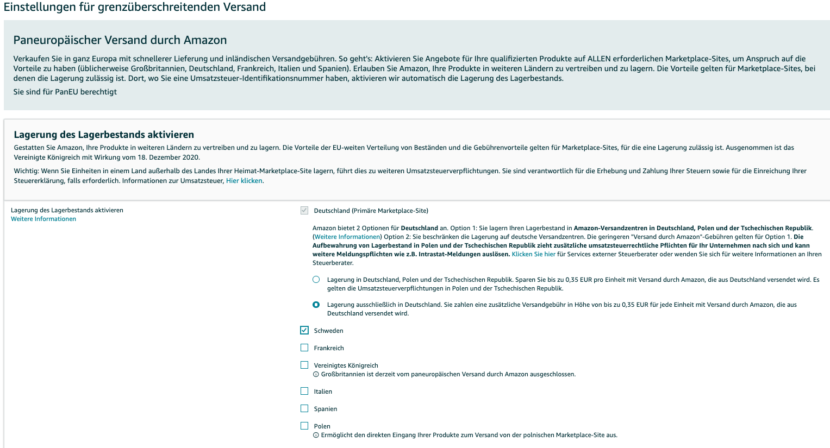

Zu Grund 2: Inzwischen lässt sich im Amazon Seller Central Dashboard die Nutzung eines schwedischen FBA-Lagers aktivieren, unter Einstellungen für den grenzüberschreitenden Versand

Wie bei allen (FBA-)Warenlagern im EU-Ausland gilt auch im Fall Schweden:

Nutzt Ihr ein solches Lager in einem EU-Land, benötigt Ihr zwingend eine umsatzsteuerliche Registrierung in diesem Land – und zwar vor Beginn der Einlagerung.

Denn mit der Einlagerung wird unmittelbar eine Steuerpflicht im Lagerland begründet.

Mehrere mit der Lagerung in Schweden zusammenhängende Transaktionsarten lassen sich nicht (!) über den OSS in Eurem Sitzland abwickeln, sondern müssen über eine Umsatzsteuer-Identifikationsnummer im Lagerland nach den dort gültigen Meldeanforderungen abgewickelt werden.

Das sind insbesondere die folgenden Transaktionen:

- Lokale Verkäufe in Schweden – also Verkäufe aus dem schwedischen FBA-Lager an schwedische Endverbraucher oder Unternehmen

- Die Verbringung der Waren nach Schweden – dieser Vorgang zieht immer sogenannte innergemeinschaftliche Verbringungen im Ursprungsland und innergemeinschaftliche Erwerbe im Bestimmungsland mit sich. Näheres dazu findet Ihr in unserem Leitfaden Verbringungen

Schwedische Umsatzsteuersätze verwenden

Wichtig: Sowohl lokale Verkäufe in Schweden, als auch grenzüberschreitende Verkäufe aus anderen EU-Ländern (nach Überschreiten des EU-Schwellenwertes von 10.000 Euro bzw. bei Verzicht darauf) müsst Ihr mit den schwedischen Steuersätzen versteuern.

Die Höhe der Umsatzsteuer in Schweden beträgt:

- Standard-Steuersatz Schweden: 25%

- Ermäßigte Steuersätze Schweden: 6% und 12%

Wann benötigt Ihr eine schwedische Umsatzsteuer-Registrierung (USt-ID)?

Zusammengefasst: Verkauft Ihr an schwedische Privatkunden und lagert nicht in Schweden ein, könnt Ihr alle umsatzsteuerlichen Meldungen für Schweden bequem über den OSS Eures Sitzlandes abwickeln und müsst in Schweden nicht umsatzsteuerlich registriert sein.

Sobald Ihr aber Waren in Schweden einlagert – etwa über das dortige FBA-Warenlager – benötigt Ihr eine umsatzsteuerliche Registrierung in Schweden.

In nur zwei Schritten zur schwedischen USt-ID

Mit Taxdoo könnt Ihr in 2 einfachen Schritten eine schwedische USt-ID beantragen:

Schritt 1

Über die Taxdoo-Website könnt Ihr in weniger als 5 Minuten die Beantragung einer schwedischen USt-ID in Auftrag geben.

Schritt 2

Im Anschluss fragen wir bei Euch diejenigen Informationen ab, die für eine umsatzsteuerliche Registrierung in Schweden erforderlich sind, und setzen den Prozess mit diesen Informationen fort.

Der umsatzsteuerliche Registrierungsprozess in Schweden dauert üblicherweise mehrere Wochen. Ist der Registrierungsprozess angestoßen, stellen wir Euch bei Bedarf eine Bescheinigung über den Start des umsatzsteuerlichen Registrierungsprozesses aus, die beim jeweiligen Marktplatz vorläufig eingereicht werden kann; damit wird bestätigt, dass Ihr Euch derzeit um eine USt-ID in Schweden bemüht.

Wenn Ihr mehr über dieses Thema wissen wollt,

… dann vereinbart über diesen Link Euer individuelles und kostenloses Erstgespräch mit den Umsatzsteuer- und E-Commerce-Experten von Taxdoo!

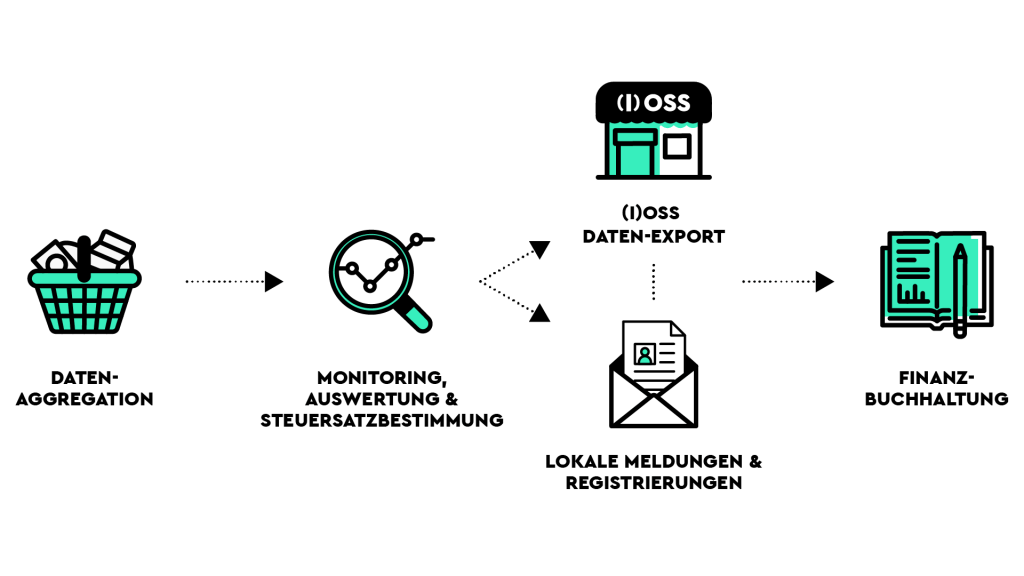

Die Erledigung der umsatzsteuerlichen Pflichten in Schweden übernimmt Taxdoo automatisiert für Euch – sowohl die Meldung an den OSS in Deutschland als auch die im Falle der FBA-Lagerung in Schweden und/oder der lokalen Verkäufe erforderlichen umsatzsteuerlichen Meldungen in Schweden. Natürlich mit den korrekten schwedischen Steuersätzen.

Ihr erhaltet in unserem intuitiv bedienbaren Dashboard alle abgegebenen Erklärungen sowie eine monatliche Zahlungsaufforderung zur Begleichung der Umsatzsteuerschuld in Schweden.

Ihr müsst keinerlei Fristen mehr selbst überwachen, könnt Euch darauf verlassen, dass korrekte Steuerdaten bei den richtigen Stellen eingereicht werden, und habt mit Taxdoo einen zentralen Ansprechpartner bei Fragen.

Ihr benötigt Pro-Forma-Rechnungen, die Eure Verbringungen in das Warenlager nach Schweden für die Finanzbehörden dokumentieren? Kein Problem: Auch Pro-Forma-Rechnungen erzeugt Taxdoo automatisch!

Bei Bedarf bieten wir unsere Services auch für weitere EU-Staaten an, z.B. im Rahmen des Amazon Pan EU Programms.

Klickt einfach hier und vereinbart eine unverbindliche Live-Demo, in der wir Euch und/oder Eurem Steuerberater per Bildschirmübertragung persönlich die Vorteile unserer automatisierten Umsatzsteuer-Lösung zeigen und Eure Fragen beantworten.

Weitere Beiträge

OSS-Meldungen für Q1-2024 abgelehnt, weil Steuersätze beim BZSt nicht up to date sind.

OSS-Mahnungen aus Spanien für Q3 und Q4 2021: BZSt dieses Mal nicht Schuld